Analysts Project Significant Upside for iShares MSCI USA Value Factor ETF

At ETF Channel, we have analyzed the ETFs in our coverage universe, comparing the trading price of each holding with the average analyst 12-month forward target price. This enables us to calculate the weighted average implied analyst target price for the ETFs themselves. For the iShares MSCI USA Value Factor ETF (Symbol: VLUE), the implied analyst target price based on its holdings is $123.79 per unit.

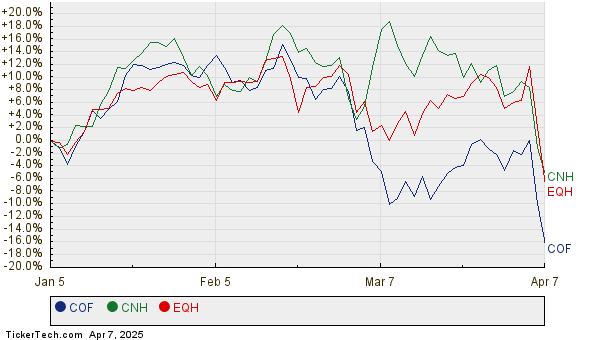

Currently, VLUE is trading at approximately $95.85 per unit, suggesting a compelling 29.15% upside potential based on the average analyst targets for its underlying holdings. Notably, three of VLUE’s holdings exhibit significant upside to their analyst target prices: Capital One Financial Corp (Symbol: COF), CNH Industrial NV (Symbol: CNH), and Equitable Holdings Inc (Symbol: EQH). Capital One’s recent price of $150.57 per share is far below the average analyst target of $214.10 per share—indicating a 42.20% upside. Likewise, CNH has a potential upside of 40.56%, as its recent trading price of $10.72 is below the average target of $15.07. Equitable Holdings also shows promise, with an expected target price of $63.33 per share, 40.43% higher than its recent price of $45.10. Below is a 12-month price performance chart comparing COF, CNH, and EQH:

Here’s a summary table of the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares MSCI USA Value Factor ETF | VLUE | $95.85 | $123.79 | 29.15% |

| Capital One Financial Corp | COF | $150.57 | $214.10 | 42.20% |

| CNH Industrial NV | CNH | $10.72 | $15.07 | 40.56% |

| Equitable Holdings Inc | EQH | $45.10 | $63.33 | 40.43% |

Are these targets reasonable, or could analysts be overly optimistic about where these stocks will trade within the next year? Examining analyst targets can reveal insights into market sentiment, but high target prices in relation to a stock’s trading price may also lead to future price adjustments if those estimates fail to reflect changing company fundamentals or market conditions. Investors should conduct further research to assess the validity of these targets.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

XHE shares outstanding history

Funds Holding EC

CLNC shares outstanding history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.