Synchrony Financial Anticipates Strong Earnings Growth in Q1 2025

Based in Stamford, Connecticut, Synchrony Financial (SYF) is a prominent consumer financial services company with a market capitalization of $17 billion. The firm is recognized for its extensive digitally-driven product offerings, including credit cards, commercial financing, and installment loans. These services are provided through strategic partnerships with a diverse range of national retailers, regional chains, local merchants, and manufacturers. SYF is set to report its fiscal first-quarter earnings for 2025 on Tuesday, April 22.

As the reporting date approaches, analysts forecast that SYF will announce profits of $1.64 per share on a diluted basis. This marks a 39% increase from the $1.18 reported in the same quarter last year. Notably, the company has exceeded consensus estimates in three of the last four quarters, only missing projections once. In the most recent quarter, SYF’s earnings per share (EPS) slightly topped analyst expectations.

For the entire fiscal year, analysts predict an EPS of $7.66, representing a 16.2% increase from the previous year’s $6.59. Looking ahead, EPS is expected to rise by 13.7%, reaching $8.71 in fiscal 2026.

Over the past year, SYF shares have risen by 8.6%, outperforming the S&P 500, which has declined by 2.7%, and the Financial Select Sector SPDR Fund (XLF), which gained 6.1% during the same timeframe.

However, on April 7, shares of Synchrony Financial fell by over 1%. This decline was influenced by a broader selloff in the banking sector triggered by Morgan Stanley’s (MS) downgrade of large-cap and mid-cap banks from “Attractive” to “In-Line.” This downgrade led to widespread losses across the financial industry, affecting investor sentiment negatively.

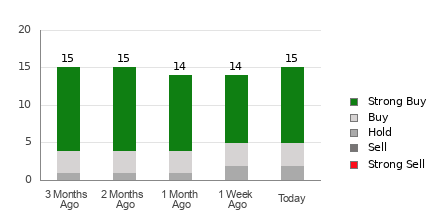

The consensus among analysts regarding SYF’s stock is relatively positive, maintaining a “Moderate Buy” rating overall. Out of 22 analysts evaluating the stock, 14 recommend a “Strong Buy,” one suggests a “Moderate Buy,” six advise a “Hold,” and one analyst rates it as a “Strong Sell.”

The average analyst price target for SYF is currently $75.48, indicating a significant potential upside of 68.4% from the stock’s current trading levels.

At the time of publication, Kritika Sarmah did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data provided is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.