Top Tech Dividend Stocks to Hold: Meta Platforms and eBay

Investors seeking strong dividend-paying companies often gravitate toward defensive sectors like healthcare and utilities. This strategy makes sense because firms in these areas typically perform better during economic downturns, allowing for continued payouts. However, it is essential for investors to recognize that excellent dividend opportunities also exist in sectors such as technology, which often attracts growth-focused investors.

With that context in mind, let’s examine two noteworthy tech dividend stocks: Meta Platforms (NASDAQ: META) and eBay (NASDAQ: EBAY). Here’s why these companies are worth holding onto for the next decade.

Where to invest $1,000 right now? Our analyst team has disclosed what they believe are the 10 best stocks to consider purchasing now. Learn More »

1. Meta Platforms

Meta Platforms, the owner of Facebook, began its dividend payout last year and currently distributes a quarterly dividend of $0.53 per share. This yields approximately 0.4%, which falls short of the S&P 500 average yield of 1.3%. Nonetheless, Meta’s dividend program is just getting started, and the company’s strengths position it well for future growth in payouts.

As the world’s leading social media firm, Meta boasts over 3 billion daily active users (DAUs). Its significant advertising business drives steady revenue and profit. Moreover, the company is emphasizing long-term growth opportunities, investing heavily in artificial intelligence (AI) and its metaverse ambitions. While these initiatives are still in their infancy—some AI services, such as the Meta AI virtual assistant, currently operate free of charge—they are enhancing services for advertisers, likely leading to immediate positive impacts.

Meta is capitalizing on its newer offerings by working to monetize them effectively. For instance, after acquiring WhatsApp over ten years ago, it took time to transform it into a profit center. Today, Meta is exploring paid messaging and other strategies. The company’s wide moat, driven by strong network effects across its platforms, makes it difficult for competitors to lure users away.

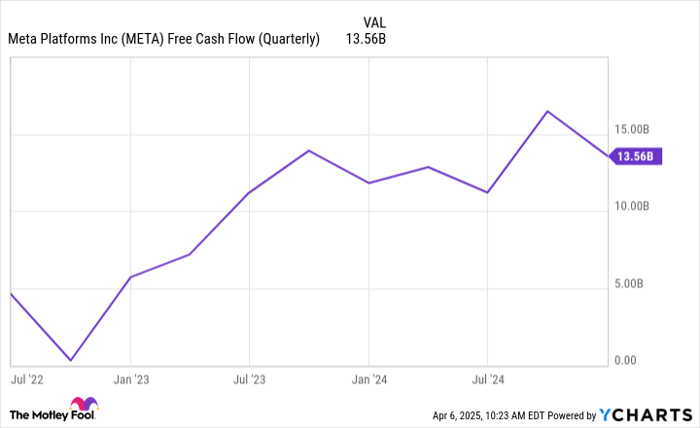

This user growth ensures ongoing advertiser interest. Additionally, Meta Platforms generates robust and increasing cash flow, suggesting that it could deliver more than just strong growth in the coming decade.

Data by YCharts.

2. eBay

Growth-focused investors may overlook eBay at present. The e-commerce company’s revenue only grew by 2%, reaching $10.3 billion in 2024. However, eBay possesses several features making it a reliable option for long-term holding. As a pioneer in e-commerce, eBay continues to compete effectively against giants like Amazon as well as smaller niche players such as Etsy. Its brand remains closely associated with the e-commerce landscape.

eBay also benefits from network effects and is taking steps to enhance its business model. Recently, it has concentrated efforts on specific categories, focusing on collectibles, luxury items, and other high-demand products. These initiatives are starting to show positive trends; eBay’s total gross merchandise volume (GMV) increased by just over 1% last year, while GMV in focus categories surged by 5%.

In addition, eBay’s advertising arm is positively influencing its financial performance. These higher-margin activities are expected to sustain profitable growth, aiding in the maintenance of its consistent dividend program for the foreseeable future. eBay currently offers a quarterly payout of $0.29 per share, yielding about 1.9%. Notably, management has increased dividends by an impressive 81.25% over the past five years, positioning eBay as a strong income stock for tech investors.

Don’t Miss This Potentially Significant Investment Opportunity

Have you ever felt you missed out on investing in top-performing stocks? If so, you will want to listen to this.

Our team of analysts occasionally issues a strong “Double Down” stock recommendation for companies they believe are positioned for imminent growth. If you think you may have already missed your chance to invest, now may be the best time to act.

- Nvidia: Investing $1,000 with our analyst team in 2009 would now be worth $244,570!*

- Apple: A $1,000 investment made when we focused on it in 2008 would translate to $35,715!*

- Netflix: A similar investment in 2004 would be valued at $461,558!*

We are currently issuing “Double Down” alerts for three exceptional companies, and this opportunity may not come again anytime soon.

Continue »

*Stock Advisor returns as of April 5, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is also a board member. Prosper Junior Bakiny holds positions in Amazon and Meta Platforms. The Motley Fool has positions in and recommends Amazon, Etsy, Meta Platforms, and eBay. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.