“`html

Market Volatility and Trade Deals: A Complex Landscape Ahead

Market Movement: Gains Turn to Losses Amid Trade Deal Hopes

On Tuesday morning, stocks surged as investors anticipated potential trade deals. However, by the afternoon, those gains had reversed, leaving the market in negative territory.

According to The Wall Street Journal:

Treasury Secretary Scott Bessent indicated that the Trump administration is open to negotiating deals that would reduce tariffs, and he emphasized that the recent market selloff did not change this approach.

“I would say the negotiations are a result of the massive inflow of inbound calls to come and negotiate,” he stated. “I think you’re going to see some very large countries with large trade deficits come forward very quickly,” he predicted. “If they come to the table with solid proposals, I think we can end up with some good deals.”

Assessing Trade Proposals: What Constitutes a Good Deal?

Vietnam has recently suggested lowering its tariffs to zero. Is this a “good deal”?

White House trade advisor Peter Navarro does not think so. He responded:

“When they come to us and say, ‘we’ll go to zero tariffs,’ that means nothing to us because it’s the nontariff cheating that matters.”

This raises important questions about the administration’s value assessment of tariff reductions. European Commission President Ursula von der Leyen proposed “zero-for-zero” tariffs on industrial goods with the U.S., including automobiles. Is that a “good deal”?

Apparently not. In response to a reporter’s inquiry about von der Leyen’s suggestion, Trump remarked:

“No, it’s not. The EU has been very tough over the years; I always say it was formed really to do damage to the United States in trade, that’s the reason it was formed.”

While trade discussions with Vietnam and the EU may encounter significant issues beyond just tariff reductions, shouldn’t the proposals for 0% tariffs receive some positive consideration? The lack of acknowledgment leads to speculation about alternative objectives.

Examining Trump’s Potential Economic Strategy

On Saturday, an opinion piece published by Fox News speculated on Trump’s true economic aims. Authored by Tanvi Ratna, a policy analyst with a decade of experience in statecraft, the article argues Trump’s motivations extend beyond mere tariff disputes. Instead, it suggests he may be strategizing around unsustainable national debt and pursuing extensive economic restructuring.

In 2025, the U.S. government faces the task of refinancing $9.2 trillion in maturing debt, with approximately $6.5 trillion due by June.

This looming debt crisis has substantial implications. According to the analysis, each basis point increase in interest rates could cost the government roughly $1 billion annually—an enormous incentive for keeping interest rates low.

Starting off the year at a 10-year Treasury yield of 4.80%, analysts question what could trigger a decline in rates. It’s clear that the Federal Reserve is unlikely to take initiative; as the threat of rising inflation looms, they show little urgency to cut rates. Furthermore, even if the Fed did act, historical trends indicate the bond market might not respond positively.

Ratna’s piece highlights that by imposing significant tariffs, the administration creates market uncertainty, nudging investors toward safer assets like long-term U.S. Treasuries.

“When markets are spooked, capital exits risk and equity assets (as we see with the stock market collapse) and piles into safe assets, primarily the 10-year U.S. Treasury bond. That demand pushes yields lower,” she observes, noting that this counterintuitive strategy may provide a remedy for an overheated financial system.

Responses to the Proposed Strategy from the White House

On Sunday, Kevin Hassett, director of the White House National Economic Council, dismissed the notion that this was Trump’s master plan.

“He’s not trying to tank the market. He’s trying to deliver for American workers. It is not a strategy for the markets to crash.”

Regardless of the White House’s stance, if this were indeed the plan, Wall Street would not be privy to it. The inherent ‘fear’ in the market is what could fuel the desired movement from stocks to bonds.

Future Considerations: The Broader Economic Landscape

Ratna believes Trump’s strategy of reducing the federal deficit includes plans to cut spending, targeting a trillion-dollar reduction by year-end.

The overall goal? To stimulate economic growth. Ratna explains:

“By making imports more expensive, they create space for American producers to step back in. The objective is not to punish trade partners—it is to make domestic industry viable again, even if only long enough to rebuild critical capacity.”

Moreover, tariffs could generate significant revenue, which is estimated to exceed $700 billion in the first year, potentially broadening fiscal options for tax cuts and sustaining social programs.

If Trump’s vision is indeed to reshape America’s economic landscape and reduce national debt while resetting its position in the global economy, such plans carry substantial risk. A major concern lies in avoiding stagflation, which could complicate corporate interests that may not align with his strategies.

Navigating the Risks of Inflation and Corporate Cooperation

For this ambitious plan to succeed, two critical factors must be achieved:

- Inflation must be controlled to ensure long-term bond yields decrease and remain low.

- Onshoring efforts must thrive, allowing corporate America to prosper.

Unfortunately, these outcomes are not guaranteed. Current inflation indicators present a mixed picture. For instance, alternative measures, such as Truflation, cite a U.S. inflation rate of just 1.40%.

Conversely, more traditional metrics like the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) Price Index highlight persistent inflationary pressures. As the economic landscape evolves, the unfolding narrative of trade, tariffs, and fiscal policy will merit close attention.

“`

Surging Treasury Yields Signal Rising Inflation Concerns Amid Trade War

Recent economic indicators suggest a complex financial landscape as inflation remains steadfast. The latest core Consumer Price Index (CPI) inflation data reveals a year-over-year increase of 3.1%. Meanwhile, the most recent core Personal Consumption Expenditures (PCE) figure shows a rise of 2.8% from a previous reading of 2.6%. This uptick in inflation expectations, especially amid ongoing trade tensions, complicates the Federal Reserve’s ability to cut interest rates, potentially leading to a natural increase in the bond market.

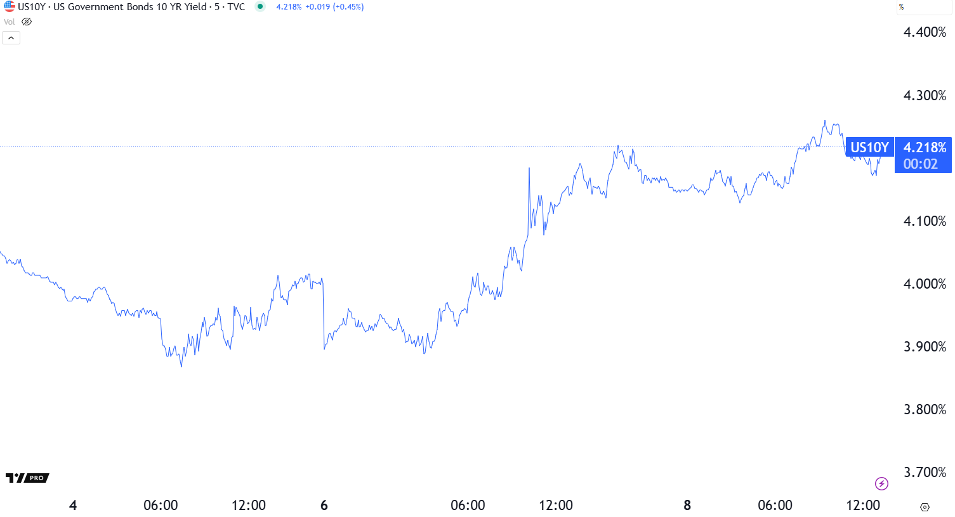

The bond market has responded noticeably, with the 10-year Treasury yield soaring approximately 32 basis points in just two days, jumping from 3.90% to 4.22% at the time this report was prepared.

Source: TradingView

This surge could result in an additional $32 billion in federal interest expenses, leading to concerns about fiscal stability.

Onshoring and Economic Resilience Are Not Assured

Surveys indicate concerning trends for the global economy. A recent Bank of America survey revealed that 71% of global fund managers anticipate stagflation within the next year. Moreover, Citibank echoed similar concerns, stating, “Looking out, large tariffs would move us closer to the stagflationary risks we have downplayed this past year.”

This economic transition is often prompted by tightening financial conditions, which can also lead to negative returns in fixed-income markets. In a modeling scenario of 10% tariffs, Citi suggested a possible onset of stagflation within approximately six months. More drastic 20% tariffs could trigger an added “growth shock,” especially given the current tariffs from the Trump administration that exceed this threshold.

This prediction is not isolated, as major financial institutions like Goldman Sachs, Stifel, and UBS are also revising their stagflation forecasts upward. Notably, JPMorgan Chase CEO Jamie Dimon remarked in his annual letter to shareholders about the turbulence faced by the economy due to geopolitical factors, stating, “We are likely to see inflationary outcomes … it will slow down growth.”

Contradictory Messaging An Obstacle for Market Confidence

To manage the bond market effectively, President Trump needs to project a message of unwavering resolve: “I don’t care about economic pain. I’m going to do whatever I want.” This approach necessitates a sense of fear among market participants to push long-term yields down.

Conversely, for corporate America, a message of optimism is vital. Trump must reassure businesses with statements like, “This is temporary and for the greater economic good. Continue your investments and hiring; you’ll be fine.” Confidence is crucial for supporting economic activity. Yet, the mixed signals from the administration complicate matters.

In a recent interaction, when asked about the permanence of the tariffs, Trump replied, “They can both be true.” This reflects an ongoing struggle to balance two opposing messages, with the result that the first is being successfully delivered while the second falters.

Bill Ackman Highlights the Impact of Economic Uncertainty

Billionaire hedge fund manager Bill Ackman articulated the effects of this uncertainty on corporate America. He stated via X: “Business is a confidence game, and confidence depends on trust.” He warned against the repercussions of imposing steep tariffs globally, which could deter investment and undermine the U.S.’s reputation as a business partner. He urges a need for negotiation to restore trust and encourage investment.

Looking ahead, if an aggressive tariff policy is enacted, it may lead to significant economic fallout, severely impacting consumer spending and business investment.

Navigating Today’s Market with Caution

As the economic landscape remains unpredictable, it is essential to maintain a composed and informed perspective. Financial experts, including Louis Navellier, Eric Fry, and Luke Lango, recently discussed market volatility with our Editor-in-Chief, Luis Hernandez. They provided insights into potential investment strategies during this tumultuous period.

To explore their discussion on market opportunities and decisions, click here to watch the interview. We will continue to monitor the ongoing tariff situation and what it means for investors in our Digest.

Have a good evening,

Jeff Remsburg