NIKE vs. lululemon: Comparing Growth Potential and Market Strength

Leading brands NIKE Inc. (NKE) and lululemon athletica inc. (LULU) are competing fiercely for dominance in the sportswear and apparel sector. NIKE stands out as a global leader in athletic footwear, apparel, and equipment, boasting a significant market share and unparalleled brand recognition. In contrast, lululemon, celebrated for its yoga-inspired lifestyle offerings, has cultivated a committed customer base while rapidly diversifying beyond its traditional categories.

Both companies navigate the same industry but differ in their focus, strategies, and product offerings. Both face challenges from evolving consumer spending habits, disappointing earnings, and ongoing tariff uncertainties. This climate may present investors with opportunities to acquire shares of these high-quality brands at potentially appealing valuations.

This article will analyze which of these two athletic giants is better positioned for long-term growth and which stock presents a more attractive investment opportunity at present.

NKE’s Competitive Advantages

NIKE holds the largest share in the global athletic footwear and apparel market, establishing itself as a leader in sportswear. Its competitive edge lies in its iconic brands, extensive global distribution network, and unmatched marketing partnerships with top athletes and leagues. NIKE’s brand equity is among the highest worldwide, a position supported by its consistent innovation and strong connections with consumers across performance and lifestyle categories.

Despite facing short-term operational challenges and tariff-related issues, NIKE’s management has adopted a transparent approach. The company is implementing strategic initiatives, dubbed “Win Now” actions, aimed at reinstating momentum and achieving sustainable, profitable growth. This strategy involves enhancing wholesale partnerships, reducing dependence on aging franchises, streamlining inventory, and accelerating innovation. Management anticipates that challenges will lessen as it approaches fiscal 2026, with new products gaining traction and the market aligning more with NIKE’s premium positioning.

To boost long-term competitiveness, NIKE is refocusing on its core strength—sports. The brand is increasing the frequency of product introductions, exploring new performance categories, and launching bold marketing campaigns to reaffirm its leadership in athletic culture. NKE is also transforming the retail landscape by improving retail presentation, minimizing discounts, and enhancing storytelling to engage consumers effectively. Innovation plays a critical role in this strategy, with new offerings in categories such as running, training, and lifestyle—exemplified by the Pegasus Premium and Vomero 18.

Furthermore, NKE is adopting a new product development model with the “Speed Lane” initiative, supplementing its successful “Express Lane.” This approach allows the company to quickly respond to consumer trends with shorter lead times and localized designs. It is expected to lead to a surge of launches in the latter half of fiscal 2025, including new franchises in fitness and lifestyle.

As NIKE shifts its digital strategy towards a full-price model and reduces reliance on paid marketing traffic, it is establishing a more balanced and premium-focused brand identity. These efforts reflect NKE’s long-term commitment to creating shareholder value and reinforcing its stature as a global leader in sports.

LULU’s Growth Opportunities

Conversely, lululemon is solidifying its position as a frontrunner in the global athletic apparel market. Its innovation-driven strategy is deeply engaging consumers and fostering brand loyalty. Recent product introductions, such as the Glow Up technical franchise for women, Daydrift lifestyle trousers, and the BeCalm yoga line, have been well-received. The brand is also expanding its popular Align franchise and introducing new materials like LuluLinen, highlighting its commitment to performance and novelty in both core and emerging categories.

LULU has ample potential for increasing brand awareness internationally. While it boasts strong brand equity in North America, it faces low unaided awareness in key global markets such as Japan, Germany, and China, providing significant room for growth. The company is proactively promoting its brand through community events, partnerships with ambassadors, and unique marketing campaigns like the “Live Like You Are Alive” initiative, featuring athletes such as Lewis Hamilton and Frances Tiafoe. These efforts enhance customer retention and attract new consumers in underserved markets.

lululemon anticipates fiscal 2025 net sales between $11.15 and $11.3 billion, indicating a 7-8% year-on-year growth, excluding the impact of a 53rd week. This growth is expected to be supported by 40 to 45 new store openings and a 10% increase in square footage. The company has plans to expand its international presence, particularly in China and Europe, while maintaining disciplined financial management. With approximately $2 billion in cash, a strong product pipeline, and proven execution, lululemon presents a compelling growth opportunity based on its brand strength and operational credibility.

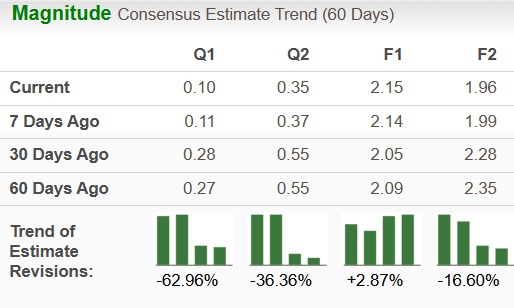

Financial Forecasts for NKE and LULU

The Zacks Consensus Estimate predicts that NIKE’s fiscal 2025 sales and earnings per share (EPS) will decline by 10.7% and 45.6%, respectively. However, EPS estimates have increased by 4.9% over the past 30 days.

Image Source: Zacks Investment Research

For lululemon, the Zacks Consensus Estimate suggests fiscal 2025 net sales and EPS will grow by 6.2% and 3.1%, respectively, although EPS estimates have slightly decreased by 1.8% in the last 30 days.

Image Source: Zacks Investment Research

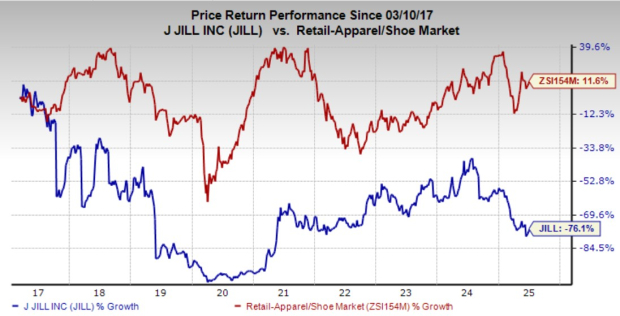

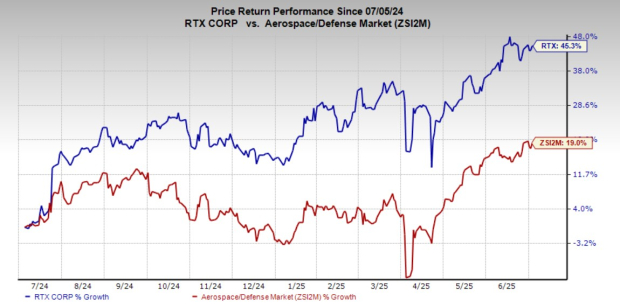

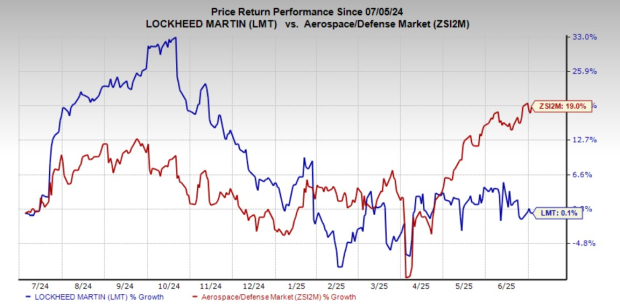

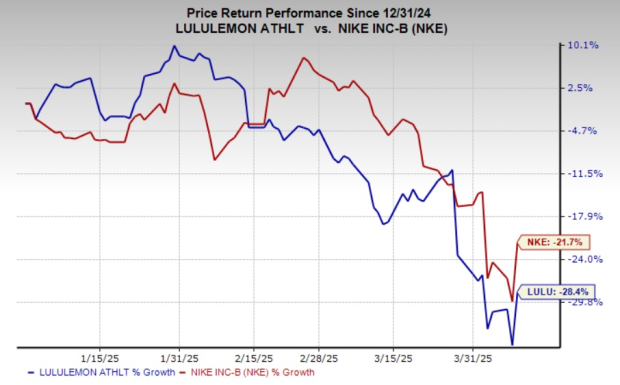

Price Performance & Valuation Analysis of NKE & LULU

This year, shares of both NIKE and lululemon have experienced a decline, driven by ongoing business challenges and rising tariff-related concerns. Year-to-date, NIKE shares have fallen by 21.7%, while lululemon’s stock has dropped by 28.4%.

Image Source: Zacks Investment Research

Currently, NIKE trades at a forward price-to-earnings (P/E) ratio of 29.82X, exceeding its three-year median of 26.83X. Conversely, lululemon has a forward P/E of 17.91X, which is below its median of 28.15X over the last three years.

From a valuation standpoint, lululemon appears relatively inexpensive. Additionally, its investments in product innovation, customer experience, and market expansion—central to its Power of Three X2 growth strategy—further showcase its potential.

While NIKE may seem pricey, the company’s strategic focus on core strengths and innovation continues to justify its valuation in the eyes of some investors.

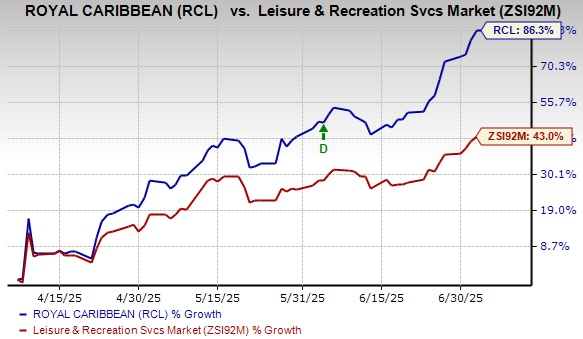

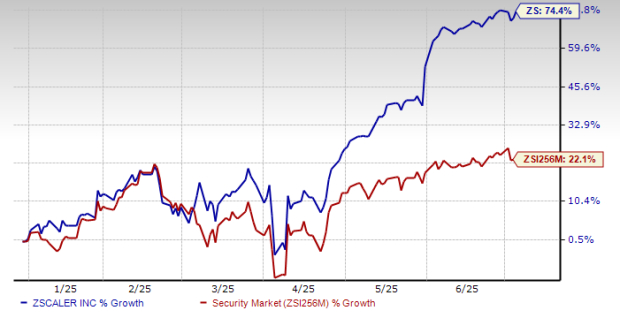

NIKE vs. lululemon: A Comparative Look at Apparel Growth Potential

Valuations for both NIKE and lululemon reflect their commitment to repositioning for increased competitiveness and sustainable long-term growth. If the companies successfully execute their strategies, the current premium valuation may be justified.

Image Source: Zacks Investment Research

Performance Outlook for Both Companies

Both NIKE and lululemon are strategically positioned to address operational challenges posed by changing consumer trends. However, lululemon shows a more promising trajectory at this time. NIKE, leveraging its vast scale and global brand recognition, has renewed its commitment to sport-driven innovation. This strategic realignment across products, wholesale distribution, and marketing indicates a solid path toward recovery and sustained market leadership.

In contrast, lululemon continues to thrive, showcasing robust financial performance and a strong capacity for innovation. Its significant potential for international expansion, along with a unique brand identity and rapid product development, fosters a devoted customer base and an optimistic long-term growth outlook.

Investment Comparisons

The discounted valuation of lululemon, coupled with its high-growth potential and expanding international presence, gives it a competitive advantage over NIKE. Given its strong fundamentals, lululemon emerges as the more attractive investment option at this juncture.

Currently, both NIKE and lululemon hold a Zacks Rank of #3 (Hold). Investors can review the complete list of Zacks’ #1 Rank (Strong Buy) stocks here.

Discover Top Stock Picks

Recently released: Experts have selected 7 top stocks from a pool of 220 Zacks Rank #1 Strong Buys, identifying them as “Most Likely for Early Price Gains.”

Since 1988, this full list has outperformed the market by more than double, achieving an average annual return of +23.9%. It’s worthwhile to consider these carefully chosen stocks immediately.

NIKE, Inc. (NKE): Free Stock Analysis Report

lululemon athletica inc. (LULU): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.