Arthur J. Gallagher & Co. Projects Growth Ahead of Q1 Earnings Report

Arthur J. Gallagher & Co. (AJG), with a market capitalization of $83.3 billion, provides a range of services including insurance and reinsurance brokerage, consulting, and third-party property/casualty claims management. Established in 1927 and based in Rolling Meadows, Illinois, the company operates across Brokerage and Risk Management segments.

Upcoming Earnings Expectations

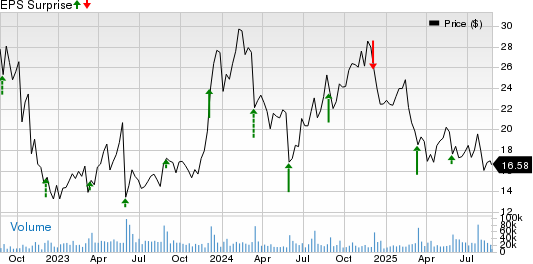

AJG is set to report its Q1 earnings on Thursday, April 24. Analysts anticipate an earnings per share (EPS) of $3.53, reflecting a 1.2% increase from the prior year’s $3.49 per share. The company has exceeded analysts’ earnings estimates in three of the last four quarters and matched the expectations in one quarter. Its adjusted EPS of $2.13 in the most recent quarter surpassed expectations by 5.5%, underpinned by strong performance in its brokerage and risk management sectors.

Fiscal Projections

For fiscal 2025, analysts project AJG to achieve an adjusted EPS of $11.21, marking an 11.1% increase from fiscal 2024’s $10.09. Looking ahead to fiscal 2026, the adjusted EPS is expected to grow by 19.5% year-over-year to reach $13.39.

Stock Performance Overview

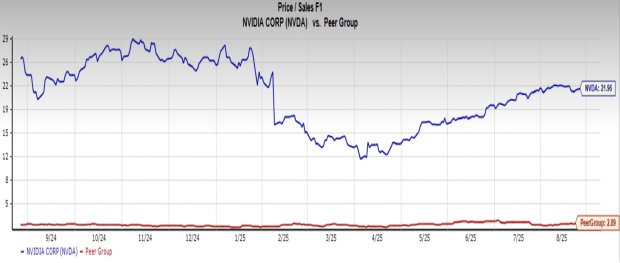

Over the last year, AJG shares have increased by 35.7%, significantly outperforming the S&P 500 Index, which gained 2.1%, and the Financial Select Sector SPDR Fund, which surged 12.3% in the same period.

Quarterly Revenue and Analyst Ratings

The stock rose 1.7% following the release of its Q4 earnings on January 30, where total revenue increased by 14% year-over-year to $11.4 billion, surpassing Wall Street’s estimates. The net earnings reached $258.2 million for the quarter, a significant improvement from a net loss of $39.6 million in the same quarter of the prior year.

The consensus on AJG stock remains cautiously optimistic, with an overall “Moderate Buy” rating. Among the 19 analysts covering the stock, nine advocate for a “Strong Buy,” one recommends a “Moderate Buy,” eight suggest a “Hold,” and one proposes a “Strong Sell.” The average price target of $335.75 suggests a 3.1% upside potential from current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For further details, please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.