Market Panic Over Tariffs: Long-Term AI Opportunities Remain Strong

With the Nasdaq Composite now in bear market territory—defined as a drop of more than 20% from its peak—market panic is palpable. Investors are concerned about how tariffs might impact consumer spending, prompting a shift toward conservative investments over riskier assets like artificial intelligence (AI) stocks. While these AI stocks have the potential for significant rewards, they also carry greater risk.

This selling pressure, however, appears short-sighted. Those who are quick to sell seem to focus on a one-year investment horizon, neglecting the more appropriate three- to five-year perspective individual investors should consider. With a longer-term view, current Stock prices transform into compelling buying opportunities.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

If you’re prepared to invest now, here are three stocks that may significantly appreciate in value over the next few years.

Concerns Over Consumer Demand and the AI Arms Race

Investment in AI has primarily focused on the development of AI infrastructure, significantly benefiting companies such as Taiwan Semiconductor Manufacturing (NYSE: TSM), Nvidia (NASDAQ: NVDA), and Broadcom (NASDAQ: AVGO). These firms provide crucial components within the AI supply chain and have also seen substantial sell-offs recently.

Broadcom has experienced the steepest decline, falling over 40% from its highs, while Nvidia and TSMC are down about 35%. However, the decline may not be justified, as the AI arms race is likely to outweigh tariff-related fears.

When President Donald Trump imposed tariffs on April 2, the high rates surprised many, especially the 32% tariff on Taiwan. Such tariffs could severely impact prices, particularly because Taiwan Semiconductor manufactures chips for companies like Nvidia and Broadcom. Fortunately, semiconductors are exempt from this high rate, suggesting that current investor concerns may be misplaced.

Nonetheless, high tariffs on other products have led to fears that consumer spending may decline. Companies such as Meta Platforms, Alphabet, and Amazon generate significant revenue from consumer-focused products via advertising or sales. A weakening consumer base could negatively impact the business operations of these firms.

This may induce cuts to historically significant capital expenditure budgets intended for AI infrastructure expansion. While this is the prevailing theory for the declines seen in stocks like Taiwan Semi, Nvidia, and Broadcom, I believe it is not entirely valid.

The AI Arms Race: A Long-Term Investment Perspective

Investors often overlook the magnitude of the AI hyperscalers’ operations. Although tariffs may negatively influence their primary businesses, the cash flows generated by these firms should remain robust enough to sustain their AI initiatives, even with business declines ranging from 10% to 20%. The AI race is too critical to forfeit, as Amazon CEO Andy Jassy highlighted during a recent fourth-quarter earnings call:

We have to procure data centers, hardware, chips, and networking gear ahead of when we’re able to monetize them. We won’t procure it unless we see significant signals of demand. When AWS expands its capex, especially for opportunities like AI, that’s a positive sign for AWS in the medium to long term.

Jassy’s comments reflect the anticipation of strong future demand. Despite current uncertainties, the need for AI infrastructure will surge in the coming years, and companies must prepare now.

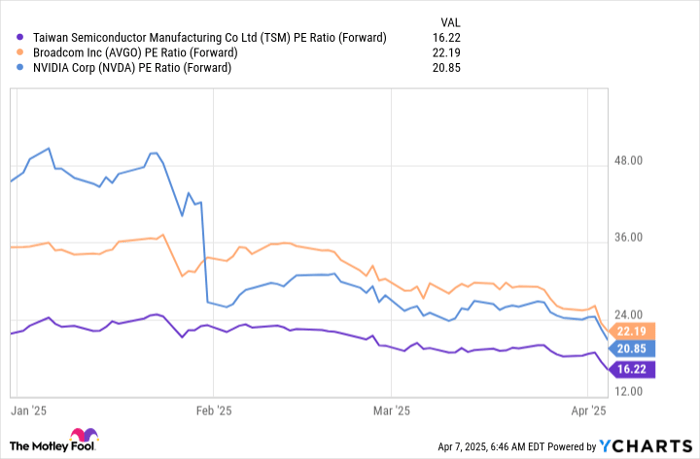

This outlook supports firms like Taiwan Semiconductor, Nvidia, and Broadcom, all essential players in the AI supply chain. While current tariffs may slightly dampen AI growth for the year, the long-term expansion trends will likely persist. Following recent sell-offs, these stocks appear undervalued based on forward price-to-earnings (P/E) ratios.

TSM PE Ratio (Forward) data by YCharts

When using forward P/E ratios, it’s important to remember they rely on analyst estimates of future earnings. Many analysts have yet to revise their earnings forecasts in light of tariff effects, likely waiting for insights from first-quarter earnings reports to gauge demand trends.

Nonetheless, the long-term momentum in the data center market makes these prices attractive. Nvidia’s CEO forecasts that data center capital expenditures could reach $1 trillion by 2028, a possibility that could significantly advantage these three companies if realized. Huang has consistently recognized the demand for AI, and current price dips represent an attractive opportunity for long-term investors.

Is Nvidia a Worthwhile Investment Right Now?

Before purchasing Stock in Nvidia, consider this:

The Motley Fool Stock Advisor team has identified what they consider the 10 best stocks for investors currently… and Nvidia was not included. The 10 selected could yield impressive returns in the coming years.

Consider that Netflix was featured on this list on December 17, 2004… had you invested $1,000 at that time, you’d be looking at $509,884!* Similarly, when Nvidia was included on April 15, 2005… if you’d invested $1,000 then, you’d have $700,739!*

Currently, the average total return of Stock Advisor is 820%—far exceeding 158% of the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

see the 10 stocks »

*Stock Advisor returns as of April 10, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet, Amazon, Broadcom, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.