Investing Insights: Best Stocks Amid Tariff Concerns

President Donald Trump’s recent decision to impose extensive tariffs on imports from nearly every country has triggered one of the most challenging quarters for the U.S. Stock market in years. Market participants are increasingly concerned that this unilateral action and subsequent retaliatory measures may significantly impact the nation’s economy.

In this increasingly volatile macroeconomic environment, prospective investors may want to focus on companies less vulnerable to trade wars. Two notable examples are Netflix (NASDAQ: NFLX) and Visa (NYSE: V), both of which possess strong long-term growth potential beyond just their tariff-related resilience.

Where should you invest $1,000 today? Our analysts have revealed what they believe are the 10 best stocks to buy right now. Learn More »

1. Netflix

Netflix’s business model is somewhat insulated from tariffs because it primarily generates revenue through subscriptions rather than physical products. Although the streaming service is likely not entirely immune to the economic impacts of the trade war—especially with its rapidly growing ad-supported subscription tier—it remains better positioned than many competitors. A broader economic downturn could result in lost subscribers; nevertheless, Netflix’s substantial sales from non-advertising sources may help it weather the storm.

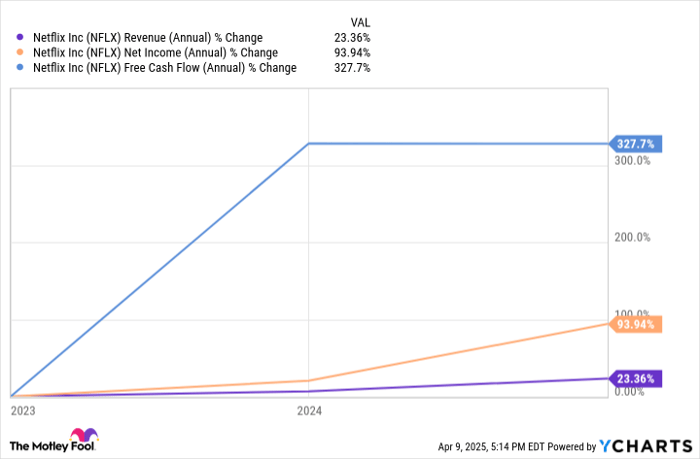

The company has adeptly leveraged its vast amount of viewer data to guide content creation, a strategy that has historically served it well. With consistent growth in revenue, earnings, and free cash flow, Netflix is expected to maintain its momentum, especially given the significant remaining market potential. Currently, Netflix serves an addressable market valued at approximately $650 billion, capturing only 6% to date. As viewing trends continue to shift decisively toward streaming, Netflix stands to gain a larger share relative to its peers.

NFLX Revenue (Annual) data by YCharts.

Investors looking to navigate the current tariff-laden environment may find Netflix a strong candidate to buy and hold long-term.

2. Visa

Visa stands as a leading financial services provider, with its iconic logo appearing on billions of credit and debit cards globally. Unlike some companies, Visa does not issue cards or provide underlying credit. Instead, it operates a network facilitating digital transactions, charging fees for each processed transaction.

This structure reduces Visa’s risk associated with borrower defaults, a concern that grows during economic downturns. Should a recession arise from current trade tensions, Visa’s exposure remains lower. Interestingly, the tariffs could lead to inflation, as noted by Federal Reserve Chair Jerome Powell, which may benefit Visa. Since its transaction fees are a small percentage of purchase amounts, increased spending on everyday items would drive higher revenue growth for Visa.

Furthermore, Visa possesses strong long-term growth potential due to the ongoing transition from cash and checks to digital transactions. The network effect plays in Visa’s favor: enhanced acceptance of its cards attracts more consumers, while increased consumer usage incentivizes more businesses to accept their services. This dynamic secures Visa’s prominent position within the financial sector.

Lastly, Visa is a reliable dividend Stock. Over the past decade, its dividends have increased by approximately 392%. Even amidst economic challenges, Visa’s dividend appears stable. Investors looking to reinvest dividends can further boost long-term returns.

Considering an Investment in Netflix?

Before purchasing Stock in Netflix, consider this:

The Motley Fool Stock Advisor analyst team has identified their picks for the 10 best stocks to buy now, and Netflix was not included. These selected stocks are projected to deliver significant returns in the upcoming years.

If you had invested $1,000 in Netflix when it first made the list on December 17, 2004, it would now be worth $495,226!* Similarly, if you invested $1,000 in Nvidia on April 15, 2005, it would be worth $679,900!*

The Stock Advisor maintains an average total return of 796% compared to 155% for the S&P 500. Don’t miss out on the latest top 10 stock list by joining Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of April 10, 2025

Prosper Junior Bakiny does not hold any positions in the stocks mentioned. The Motley Fool holds positions in and recommends Netflix and Visa. The Motley Fool has a disclosure policy.

The views and opinions expressed herein reflect those of the author and do not necessarily represent those of Nasdaq, Inc.