ServiceNow (NOW) Sees Notable Price Surge After Power Inflow Signal

ServiceNow, Inc. (NOW) witnessed a significant Power Inflow today, which is essential for investors who focus on institutional trading dynamics and order flow analytics.

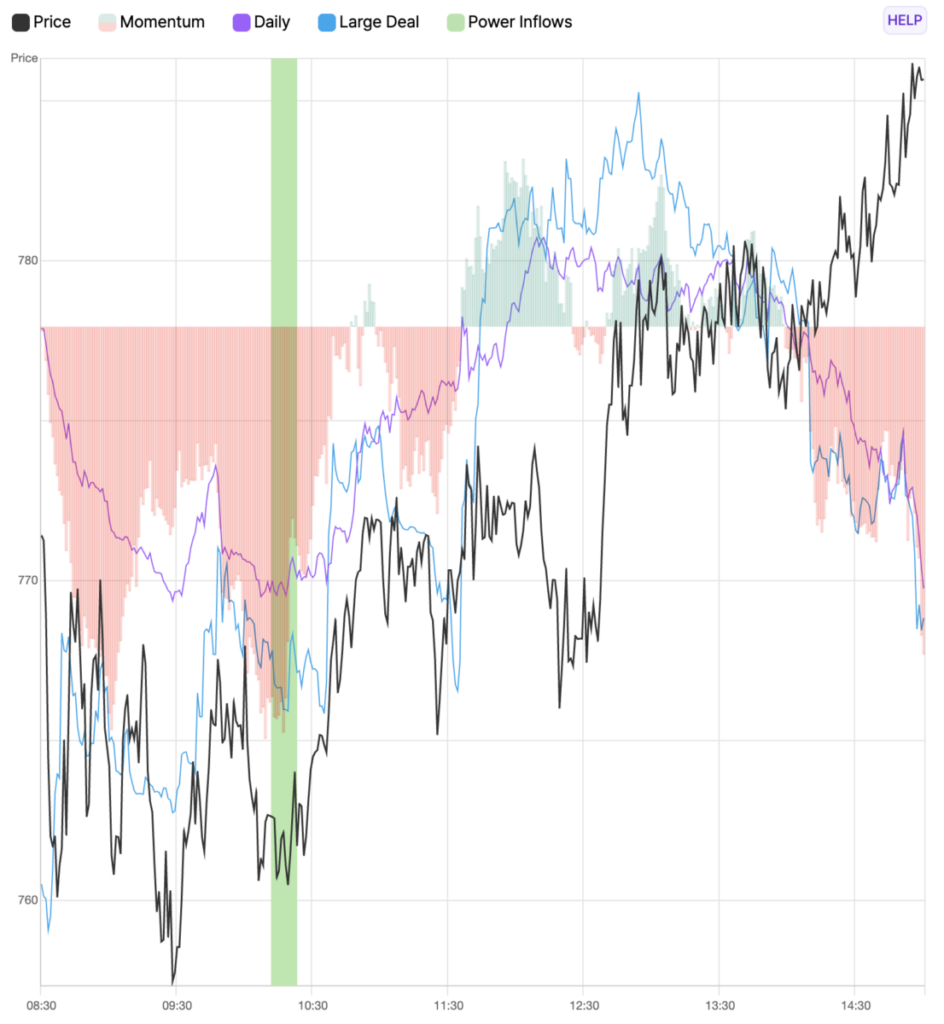

At 11:26 AM on April 11th, a critical trading signal appeared for ServiceNow, Inc. (NOW) as it recorded a Power Inflow at $762.71. This type of indicator is important for traders to understand where institutional “smart money” is moving. They recognize the advantages of order flow analytics to enhance their trading strategies. The Power Inflow suggests a potential uptrend in ServiceNow’s stock, indicating a possible entry point for traders anticipating future price increases. As this signal unfolds, traders will monitor ServiceNow’s stock price closely, interpreting the event as a positive indication of potential growth.

Understanding Power Inflow Signals

Order flow analytics, also known as transaction or market flow analysis, helps distinguish and evaluate the volume of retail versus institutional orders. This approach involves examining the dynamics of buy and sell orders, including their size, timing, and various patterns, to gain better insights and make informed trading decisions. This specific indicator is typically viewed as a bullish signal by active traders.

The emergence of a Power Inflow during the initial two hours of trading often indicates the prevailing trend for the rest of the trading day, driven primarily by institutional activity. This analysis can significantly impact how traders perceive the current market landscape.

Strategies for Effective Trading

By integrating order flow analytics into their trading strategies, market participants can effectively interpret current conditions, spot trading opportunities, and potentially enhance their overall performance. However, it remains essential to implement sound risk management strategies, aimed at protecting investments and minimizing possible losses. A comprehensive risk management approach assists traders in navigating market uncertainties more effectively while boosting the chances of achieving long-term success.

To receive ongoing updates on the latest options trades for NOW, consider using Benzinga Pro for real-time alerts.

Market News and Data is presented by Benzinga APIs, which include contributions from firms like Tradepulse, responsible for parts of the data shared in this article.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

After Market Close UPDATE

The price during the Power Inflow was recorded at $762.71. Following the Power Inflow, returns on the High price of $786.88 and Close price of $785.67 were 3.2% and 3.0%, respectively. These results highlight the necessity of a comprehensive trading plan that includes Profit Targets and Stop Losses reflective of individual risk tolerance. Today’s returns were closely aligned, but such consistency is not always guaranteed.

Past results are not indicative of future results.

Market News and Data is presented by Benzinga APIs.