ServiceNow Faces Challenges with Stock Performance Amid Market Shifts

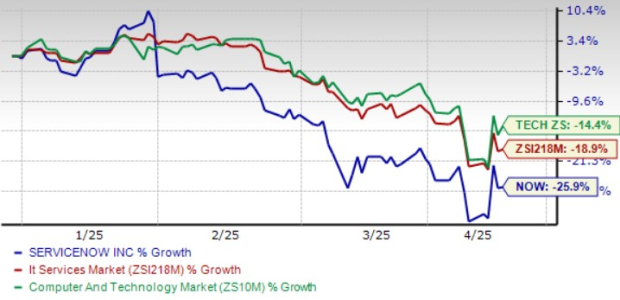

ServiceNow (NOW) shares have declined 25.9% year to date, lagging behind the Zacks Computer & Technology sector, which has dropped 14.4%, as well as the Zacks Computers – IT Services industry, down 18.9%.

The downturn in NOW shares primarily stems from a challenging macroeconomic climate following U.S. President Donald Trump’s decision to impose tariffs on trading partners, specifically China and Mexico. Additionally, the company’s federal business faces pressures related to DOGE issues. ServiceNow anticipates a negative forex impact of approximately $175 million for 2025 and expects that a back-end loaded federal business may impede growth rates.

In efforts to enhance its offerings, ServiceNow’s strategy to accelerate the adoption of its Agentic AI by sacrificing immediate revenues is likely to impact subscription revenue growth in 2025.

ServiceNow Stock Performance Overview

What should investors consider doing with NOW stock? Let’s explore the details.

ServiceNow’s Long-Term Growth Potential with a Strong Portfolio

ServiceNow is bolstering its portfolio with the introduction of its Yokohama platform. This update introduces new AI agents across various sectors such as CRM, HR, and IT, facilitating improved productivity and smarter workflows. The Yokohama platform is expected to support ServiceNow’s growth in client acquisitions. The company is significantly utilizing AI and machine learning to enhance its solutions, collaborating with notable partners including Alphabet (GOOGL), Amazon, Microsoft, and NVIDIA (NVDA).

In January, ServiceNow and Google Cloud expanded their partnership, allowing ServiceNow to provide its Now Platform and a comprehensive suite of workflows via the Google Cloud Marketplace. Furthermore, ServiceNow’s Customer Relationship Management, IT Service Management, and Security Incident Response solutions will also be available through Google Distributed Cloud.

Additionally, ServiceNow and NVIDIA partnered to develop AI agents tailored for the telecom sector, utilizing NVIDIA AI Enterprise software and the NVIDIA DGX Cloud platform. Recently, ServiceNow further deepened its collaboration with NVIDIA to bolster Agentic AI, integrating NVIDIA Llama Nemotron reasoning models and evaluation tools into its platform for optimized business transformation.

Moreover, DXC Technology (DXC) and ServiceNow have teamed up to introduce DXC Assure BPM (Business Process Management), merging DXC’s insurance expertise with ServiceNow’s unified platform and data model.

ServiceNow is also actively pursuing acquisitions this year. Earlier this month, the company revealed plans to acquire Logik.ai, an AI-powered provider of Configure, Price, Quote solutions. In late February, it announced the acquisition of Advania’s Quality 360 solution to enhance its capabilities within the manufacturing sector. Additionally, the acquisition of Moveworks strengthens NOW’s Agentic AI offerings.

NOW’s Q1 2025 Guidance Reflects Forex Challenges

For the first quarter of 2025, ServiceNow predicts subscription revenues of $2.995 to $3 billion, pointing to an 18.5% to 19% improvement year over year on a GAAP basis. On a constant currency basis, subscription revenues are projected to rise by 19.5% to 20%. The adverse forex conditions are expected to negatively impact revenues by $40 million.

These figures suggest modest sequential revenue growth, as subscription revenues for the fourth quarter of 2024 increased 21.2% year over year to $2.866 billion on a reported basis. On a constant currency basis, revenues rose by 21% to $2.859 billion.

Looking ahead to 2025, ServiceNow forecasts subscription revenues will be between $12.635 billion and $12.675 billion, reflecting an 18.5% to 19% increase from 2024 on a GAAP basis and a range of 19.5% to 20% on a non-GAAP basis.

NOW’s Earnings Estimate Revision Trends Downward

The Zacks Consensus Estimate for 2025 earnings stands at $16.23 per share, a slight decline of one cent over the last 30 days, indicating a 16.59% increase from the reported figure for 2024.

NOTABLY, NOW has surpassed the Zacks Consensus Estimate in each of the trailing four quarters, with an average earnings surprise of 7.02%.

ServiceNow, Inc. Stock Price and Consensus Analysis

ServiceNow, Inc. price-consensus-chart | ServiceNow, Inc. Quote

The consensus for 2025 revenues is projected at $13 billion, indicating growth of 18.39% compared to 2024’s reported figure.

Should You Buy or Sell ServiceNow Stock?

Currently, ServiceNow stock appears overvalued, as signified by a Value Score of F.

In terms of forward Price/Sales, NOW trades at 11.86X compared to the sector average of 5.34X.

Forward Price/Sales Ratio Analysis

Image Source: Zacks Investment Research

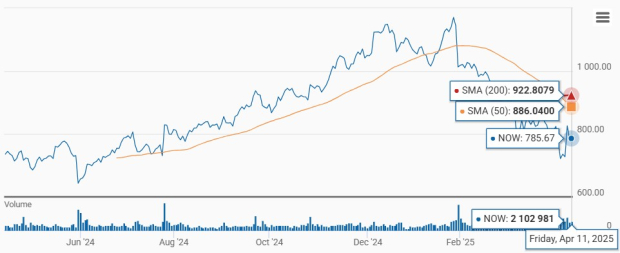

From a technical standpoint, ServiceNow stock is showing a bearish trend, currently trading below both the 200-day and 50-day moving averages.

NOW Stock Trades Below Key Moving Averages

Image Source: Zacks Investment Research

While ServiceNow’s strong GenAI portfolio and solid partner relationships are set to boost subscription revenues, adverse forex conditions and a tough macroeconomic landscape remain key concerns. With its current stretched valuation, NOW stock may not attract value investors.

ServiceNow holds a Zacks Rank #4 (Sell), indicating that investors may want to avoid acquiring the stock at this time.

You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Five Stocks with High Potential for Growth

These stocks were carefully selected by a Zacks expert as top picks expected to double (+100% or more) in 2024. While not every selection achieves success, previous recommendations have experienced companies soaring by +143.0%, +175.9%, +498.3%, and +673.0%.

Many companies featured in this report are currently off Wall Street’s radar, presenting a valuable opportunity for early investment.

Today, discover these five potential home runs >>

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days here for free.

NVIDIA Corporation (NVDA): Free Stock Analysis report

ServiceNow, Inc. (NOW): Free Stock Analysis report

Alphabet Inc. (GOOGL): Free Stock Analysis report

DXC Technology Company (DXC): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.