Understanding Alibaba’s Strong Buy Ratings from Wall Street Analysts

Investors frequently look to Wall Street analysts for recommendations before deciding to Buy, Sell, or Hold a Stock. Although media coverage of rating changes by brokerage-firm analysts can influence a Stock‘s price, the real question is: how reliable are these recommendations?

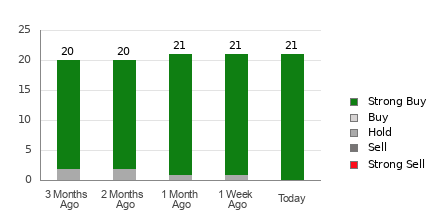

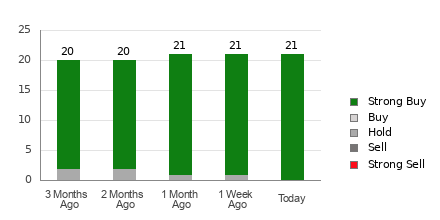

Before diving into the trustworthiness of brokerage recommendations, let’s examine what Wall Street experts say about Alibaba (BABA). Currently, Alibaba has an average brokerage recommendation (ABR) of 1.00, on a scale from 1 to 5 (where 1 represents Strong Buy and 5 equals Strong Sell). This ABR reflects the opinions of 21 brokerage firms and signifies a Strong Buy sentiment.

All 21 of these recommendations are categorized as Strong Buy, indicating unanimous support for Alibaba’s potential among analysts.

Analyzing Brokerage Recommendation Trends for BABA

Check price target & Stock forecast for Alibaba here>>>

Despite the ABR’s strong buy outlook, investors should reconsider making decisions based solely on this metric. Studies indicate that brokerage recommendations often fail to effectively identify stocks with the most significant price increase potential.

This discrepancy arises because brokerage firms often have vested interests in the Stocks they cover. Consequently, analysts may exhibit a strong positive bias in their ratings. Research shows that firms typically issue five “Strong Buy” recommendations for every “Strong Sell.” Therefore, the interests of brokerage firms do not always align with those of retail investors, providing limited insight into a Stock‘s future price trajectory. It may be more prudent to leverage this information to support your analysis or use a more reliable tool for predicting Stock price movements.

Zacks Rank, our proprietary Stock rating system with a strong externally audited record, categorizes stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This model serves as an effective prompt for assessing a Stock‘s price performance in the near term. Thus, employing the ABR alongside the Zacks Rank may lead to more informed investment decisions.

Distinguishing ABR from Zacks Rank

While both Zacks Rank and ABR are displayed on a scale of 1 to 5, they represent different evaluations.

The ABR is based solely on brokerage recommendations and can feature decimals (for instance, 1.28). Conversely, the Zacks Rank functions as a quantitative model, enabling investors to utilize earnings estimate revisions, with whole numbers ranging from 1 to 5.

Brokerage analysts tend to be overly optimistic due to their employers’ vested interests, often issuing favorable ratings beyond what their research supports. In contrast, Zacks Rank is driven by earnings estimate revisions. Historical data shows that near-term Stock price movements correlate closely with earnings estimate trends.

Furthermore, the various Zacks Rank grades are proportionately assigned across all stocks covered by analysts for current-year earnings projections, maintaining a balance within its rating system.

Timeliness is another critical distinction between ABR and Zacks Rank. The ABR may lag behind current data, while brokerage analysts consistently revise their earnings estimates to reflect market conditions, with these updates impacting the Zacks Rank promptly, keeping it current and relevant for predicting Stock prices.

Should You Invest in BABA?

Examining earnings estimate revisions for Alibaba, the Zacks Consensus Estimate for the current fiscal year has risen by 1.2% in the past month to $8.80.

This adjustment reflects analysts’ increasing optimism about the company’s earnings potential, as indicated by the consensus among them to revise EPS estimates upward. This trend paints a positive outlook for the Stock in the near term.

The magnitude of the change in the consensus estimate, combined with three additional factors linked to earnings estimates, has garnered Alibaba a Zacks Rank #1 (Strong Buy). You can view the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here >>>>

Consequently, the Buy-equivalent ABR for Alibaba could effectively guide investors in their decision-making process.

7 Best Stocks for the Next 30 Days

Recently released: Experts identify 7 elite stocks from the existing pool of 220 Zacks Rank #1 Strong Buys. They are considered “Most Likely for Early Price Pops.”

Since 1988, this curated list has outperformed the market more than twofold, averaging a gain of +23.9% annually. Therefore, give these carefully selected stocks your immediate attention.

See them now >>

Are you interested in the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days now. Click to access this report.

Alibaba Group Holding Limited (BABA): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.