U.S. Electronics Tariff Exemption Sparks Market Optimism and Economic Impact

On Wednesday of last week, President Trump announced a 90-day pause on all reciprocal tariffs imposed on our nation’s trading partners (excluding China). As a result, countries will see hefty levies reduced to a standard 10% rate. This news was celebrated by Wall Street, with the S&P 500, Dow Jones, and Nasdaq all gaining over 2% since the announcement.

This weekend, however, the White House made an even bigger, though less publicized, move.

Late Friday night, in a significant shift within the ongoing trade war, the U.S. announced a reciprocal tariff exemption for electronics exported from China, which includes computers, smartphones, and semiconductors.

While this announcement may have flown under the radar, its implications are immense: It represents the most significant development in the trade war since “Liberation Day” and surpasses even the 90-day pause.

We believe this could herald a 20% rally in the stock market.

What drives this optimism?

China exports over $100 billion worth of electronics to the U.S. annually, making it a critical component of global trade.

This means that those electronics are now shielded from the heft of the previous 145% tariffs from “Liberation Day,” dropping to a more manageable 20% (at least temporarily). The ramifications for the U.S. tariff landscape are profound.

There are four reasons this electronics exemption could invigorate the market, leading to a significant rally this summer…

The Impact of the $100 Billion Electronics Tariff Exemption

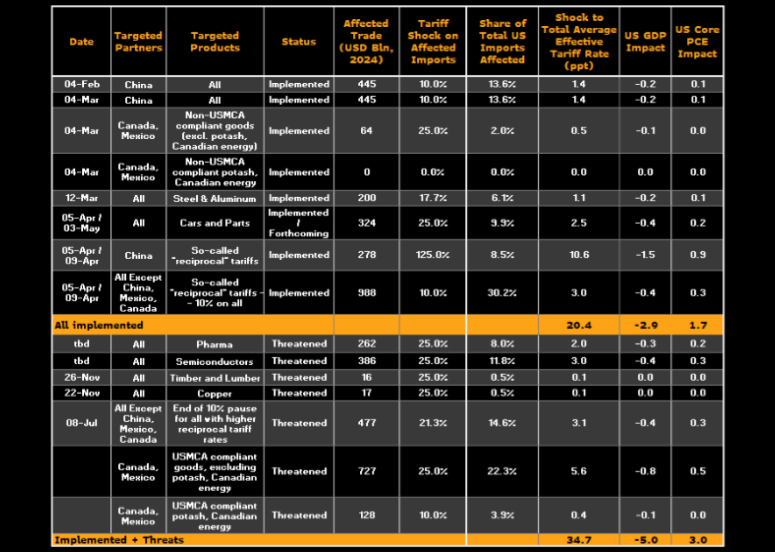

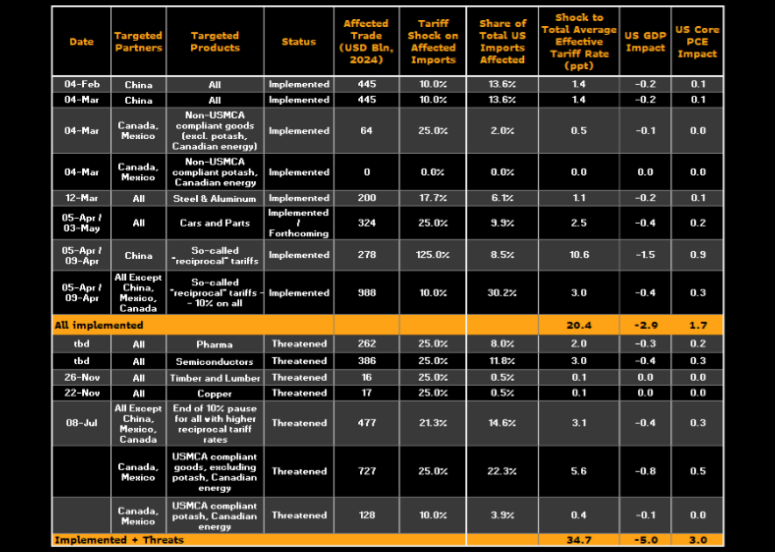

The 90-day tariff pause, which sparked last week’s relief rally, received widespread media attention. However, a closer inspection reveals it only reduced the average U.S. tariff rate by less than one percentage point, from just under 27% to slightly over 26%.

In contrast, the recent electronics exemption has cut the average U.S. tariff rate further, down to approximately 23%.

This change reflects more than three times the impact of last week’s announcement.

The volume of electronics in trade matters significantly.

Electronics constitute more than 20% of total Chinese exports to the U.S. Reducing tariffs on this key sector significantly alleviates stress on the global trade framework.

Furthermore, Federal Reserve research indicates that every one-point increase in the average U.S. tariff rate detracts 0.14 percentage points from GDP. Prior to the exemption, the anticipated drag on U.S. GDP stood at -3.3%. Now, that projection has improved to -2.9%.

This improvement is crucial, especially as efforts continue to guide a slowing economy away from recession.

A Clear Trend: Tariff Reduction

In recent weeks, we have advised stakeholders to look beyond the noise and focus on the actual numbers.

Here’s what the data illustrates:

- After the “Liberation Day” tariffs were introduced, the average U.S. tariff rate jumped from 2.5% to nearly 27%.

- The 90-day pause reduced it to 26%.

- The recent electronics exemption lowered it further to 23%.

- Reports suggest that auto parts could be the next category for exemption, potentially bringing the average tariff rate down to 20% by the end of this week.

We have witnessed a change from 27% to 20% in less than two weeks.

This is not simply a fleeting dip. It signifies a trend.

However, the administration’s messaging remains inconsistent. This past Sunday, April 13, Commerce Secretary Howard Lutnick stated that the electronics tariffs were not genuinely exempt but merely postponed. Trump also reiterated that sectoral semiconductor tariffs are still on the table.

We interpret these mixed messages as a strategic maneuver.

These backtracking statements appear to be intentional. The administration aims to project strength while negotiating behind closed doors, keeping trading partners in suspense while the tariff rates continue to decline.

We expect this trend to persist, aiming for a target of 10% or lower by early summer.

Potential for Permanent Tariff Delay

Trump’s recent 90-day pause applies to reciprocal tariffs. However, Lutnick noted that sectoral tariffs on semiconductors could be implemented within the next 30 to 60 days.

This creates a one- to two-month opportunity to finalize trade agreements with China, the EU, and other trading partners before the pause concludes and the sectoral tariffs take effect.

If successful deals are forged—which we anticipate—then the proposed electronics tariffs may ultimately be shelved.

These tariffs could become another instance of policies that failed to materialize.

Importantly, timing is crucial.

We believe the administration is utilizing this window to de-escalate quietly and secure significant trade victories, setting the stage for a favorable outcome for Trump.

Tariff Changes Could Spark a Significant Stock Market Rally

Before tariffs can inflict real economic damage, let’s examine the current situation.

Potential for a 20% Stock Market Surge Due to Tariff Rollbacks

The relationship between stocks and tariffs is straightforward. Since “Liberation Day,” stock prices have closely followed shifts in the average U.S. tariff rate. When the rate increased from 2.5% to 27%, there was a noticeable decline in stock values. However, last week, as the tariff rate decreased from 27% to 26%, stocks experienced their strongest weekly rally since 2023. Then, with the average tariff rate dropping to 23% earlier this week, stocks rallied again.

This demonstrates a clear and notable inverse correlation between tariffs and stock market performance.

If the tariff rate continues to decrease—potentially reaching 20% after auto exemptions and further down to 10% following a deal with China—we could witness stock prices surge by 20% or more.

This appears to be the plan, which the White House seems to be implementing, whether explicitly stated or not.

Implications of the 90-Day Tariff Pause for Investors

The commentary from Washington may seem muddled or even contradictory. Yet, focusing on the numbers reveals a clearer picture:

- A 90-day reciprocal tariff pause = a period of stability.

- Electronics exemptions = significant relief of $100 billion.

- Average U.S. tariff rate = down four percentage points from the previous peak.

- Stock market reactions = clearly positive and encouraging.

While we do not anticipate a flawless upward trajectory for the markets, acknowledging that volatility will remain is crucial. Reversals and threats will likely arise.

What matters most is the prevailing trend. Currently, the trend indicates that tariffs are decreasing, which suggests that stocks should follow an upward course.

Indeed, we believe a substantial rebound is on the horizon as we approach summer.

If you’re looking to capitalize on this opportunity, consider investing in AI 2.0 stocks during this recent dip.

This includes advanced AI that interacts with real-world environments—embodied intelligence that can see, hear, walk, talk, lift, carry, organize, fix, and learn.

The surge of interest in humanoid robots among tech giants emphasizes the significant potential for growth in this sector.

We believe substantial investment opportunities will emerge in this next phase of the AI Boom, and we have identified a promising pick.

Discover details about our top AI 2.0 investment opportunity.

As of the date of publication, Luke Lango held no direct or indirect positions in the securities mentioned in this article.

Have questions or comments? Reach out to us at [email protected].