Netflix’s Strong Performance and Earnings Expectations Ahead of Q1 2024

Netflix (NFLX) is set to announce its first-quarter 2024 results on April 17 after the market closes. With this imminent release, a closer examination of the fundamentals governing the leading video-streaming service is appropriate.

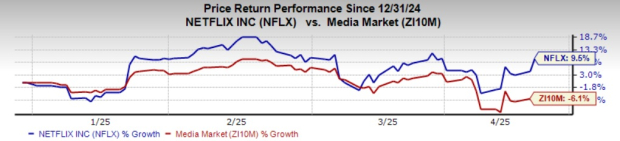

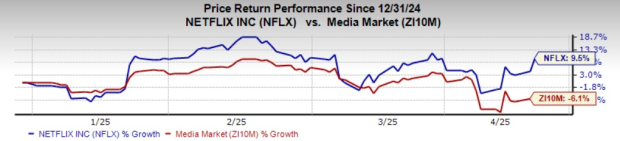

This year, Netflix shares have appreciated approximately 10%, outperforming both the broader industry and the S&P 500, which saw declines of 6.1% and 8.4%, respectively. If the company surpasses earnings expectations, this upward trend may continue.

Image Source: Zacks Investment Research

Major ETFs Watching Netflix

Multiple exchange-traded funds (ETFs) that allocate significantly to Netflix are gaining attention. These include the MicroSectors FANG+ ETN (FNGS), Invesco Next Gen Media and Gaming ETF (GGME), First Trust Dow Jones Internet Index Fund (FDN), FT Vest Dow Jones Internet & Target Income ETF (FDND), and Communication Services Select Sector SPDR Fund (XLC).

Earnings Preview

Currently, Netflix has an earnings surprise prediction (ESP) of -2.23% and holds a Zacks Rank of #3 (Hold). Historically, a positive earnings ESP along with a Zacks Rank of #1 (Strong Buy), 2 (Buy), or 3 increases the likelihood of beating earnings expectations. The company experienced no estimate revisions for the upcoming quarter over the past 30 days and is projected to report earnings growth of 8.7% alongside revenue growth of 12.5% in this period. Netflix’s prior performance is noteworthy, averaging an earnings surprise of 7.17% across the past four quarters. Furthermore, it is positioned in a high-ranking Zacks industry that falls within the top 28% of over 250 industries.

Netflix’s Price and Consensus Chart

Netflix, Inc. price-consensus-eps-surprise-chart | Netflix, Inc. Quote

Analyst Sentiments

Among analysts, bullish sentiment towards Netflix prevails. The average brokerage recommendation is recorded at 1.66 from 43 firms, with 28 issuing Strong Buy and two labeling it as Buy. Strong Buy and Buy recommendations constitute 65.12% and 4.65% of all recommendations, respectively. The consensus price target for Netflix is $1,074.53, with estimates ranging from $800.00 to $1,494.00.

Many analysts view Netflix as a strong competitor in the streaming sector despite ongoing economic uncertainties. JP Morgan characterized Netflix as the “most resilient” company due to its robust subscriber base, indicating that users watch an average of two hours of content daily. Morgan Stanley highlighted Netflix as a “top pick,” showcasing confidence in its business strategy and ability to contend in a competitive marketplace.

Oppenheimer reasserted its Outperform rating on Netflix with a target price of $1,150, noted as one of the highest on Wall Street before its Q1 earnings release. Both Bank of America and Evercore ISI share a positive outlook on the streaming company.

Quarterly Expectations

For the first quarter, Netflix anticipates year-over-year revenue growth of 11.2%, reaching $10.42 billion, while earnings per share are expected to climb by 5.7% to $5.58. The company’s ad-supported subscription tier greatly contributes to growth, with nearly half of new subscribers choosing this affordable option, even as Netflix has ceased reporting quarterly subscriber numbers. Notably, Netflix has confirmed exceeding 300 million global users in the first quarter, marking a 16% increase compared to last year.

Future Outlook

The Wall Street Journal reports that Netflix aims for a market capitalization of $1 trillion by the decade’s end, a significant increase from its current valuation of around $419.2 billion. The firm plans to double its annual revenues from $39 billion to $80 billion, driven by subscriber growth, content monetization, and international expansion. Netflix also projects an increase in its global advertising revenues to $9 billion by 2030.

To support its growth strategy, Netflix targets raising its subscriber count to 410 million by 2030, focusing heavily on international markets such as India and Brazil.

Valuation Insights

Currently, Netflix’s shares appear overvalued with a price-to-earnings (P/E) ratio of 38.00, compared to the industry average of 11.41. However, the company’s solid Growth Score of B suggests it is poised for growth, which justifies its elevated valuation. Additionally, Netflix has gained traction as a viable defensive investment in a volatile market.

Noteworthy ETFs

MicroSectors FANG+ ETN (FNGS)

MicroSectors FANG+ ETN is tied to the performance of the NYSE FANG+ Index, an equal-dollar-weighted index providing exposure to highly traded growth stocks within technology and tech-enabled companies. It encompasses 10 stocks in equal proportions, with Netflix accounting for 10% of the index. The fund has gathered $372.8 million in assets and charges an annual fee of 58 basis points. It experiences a moderate trading volume of approximately 151,000 shares per day and has a Zacks ETF Rank of #3.

Invesco Next Gen Media and Gaming ETF (GGME)

This ETF offers exposure to companies significantly influenced by technologies and products that propel future media through direct revenue channels. It tracks the STOXX World AC NexGen Media Index, holding a portfolio of 85 stocks, with Netflix as the top holding at 8.7% of assets. The fund has garnered $117.2 million in assets and charges 61 basis points in annual fees, trading around 16,000 shares per day on average, and holds a Zacks ETF Rank of #3.

First Trust Dow Jones Internet Index Fund (FDN)

This index fund follows the Dow Jones Internet Composite Index, providing comprehensive exposure to the Internet sector. With approximately 41 stocks in its portfolio, Netflix occupies the second position at 9.5% of holdings.

Top Technology ETFs: Performance Insights and Key Metrics

First Trust Dow Jones Internet ETF (FDN)

The First Trust Dow Jones Internet ETF (FDN) stands out as one of the most popular and liquid exchange-traded funds (ETFs) in the technology sector. Currently, it boasts an impressive $5.8 billion in assets under management (AUM) and an average daily trading volume of approximately 507,000 shares. Investors should be aware that FDN charges an annual fee of 51 basis points (bps) and holds a Zacks ETF Rank #1 (Strong Buy) alongside a high-risk outlook.

FT Vest Dow Jones Internet & Target Income ETF (FDND)

Next, the FT Vest Dow Jones Internet & Target Income ETF (FDND) employs an active management strategy focused on U.S. exchange-traded equity securities, aiming to track the Dow Jones Internet Composite Index. This fund incorporates an option strategy that involves writing U.S. exchange-traded call options linked to the Nasdaq-100 Index or its ETFs. FDND maintains a portfolio of 42 stocks, with Netflix (NFLX) notably holding the third-largest share at 9.5%.

As of now, FDND has gathered $4.9 million in assets and experiences an average daily trading volume of about 6,000 shares. The fund charges higher annual fees at 75 bps.

Communication Services Select Sector SPDR Fund (XLC)

The Communication Services Select Sector SPDR Fund (XLC) provides exposure to companies across telecommunications, media, entertainment, and interactive media sectors. With an asset base of $19.2 billion, this fund follows the Communication Services Select Sector Index. It consists of 23 stocks, placing Netflix in the fourth position with a 6.5% share. Approximately one-third of the portfolio is dedicated to interactive media and services, with entertainment and media sectors making up the balance.

XLC benefits from low fees, charging just 8 bps annually, and enjoys a robust average daily trading volume of 7.5 million shares. Like FDN, it also holds a Zacks ETF Rank #1.

Want key ETF info delivered straight to your inbox?

Zacks’ free Fund Newsletter offers timely summaries and analysis, highlighting top-performing ETFs each week. Sign up now to stay informed.

If you’re seeking the latest investment recommendations, consider downloading Zacks Investment Research’s report on the 7 Best Stocks for the Next 30 Days. You can click here to access this free report.

Discover further insights into stocks such as Netflix, Inc. (NFLX) and more by reviewing the ETF research reports available: First Trust Dow Jones Internet ETF (FDN), Communication Services Select Sector SPDR ETF (XLC), MicroSectors FANG+ ETN (FNGS), and Invesco Next Gen Media and Gaming ETF (GGME).

This article originally published on Zacks Investment Research (zacks.com).

The views expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.