PayPal Prepares for Q1 Earnings Amid Mixed Market Performance

PayPal Holdings, Inc. (PYPL), valued at $61.3 billion, has been a key player in the fintech sector for over 20 years. Based in San Jose, PayPal offers various payment solutions that cater to a wide range of demographics. Notably, its mobile payment platform, Venmo, has become increasingly popular among younger consumers in recent years.

Anticipated Earnings Ahead of Market Opening

The company will release its first-quarter earnings on Tuesday, April 29, before the markets open. Analysts project that PayPal will report an adjusted earnings per share (EPS) of $1.15, reflecting a modest increase of 5.5% compared to the $1.09 EPS from the same quarter last year. Notably, PayPal has exceeded analysts’ earnings expectations in the last four quarters.

Long-Term Earnings Outlook

Looking ahead to fiscal 2025, PayPal is expected to deliver an adjusted EPS of $5.01, representing a 7.7% increase from the $4.65 reported in fiscal 2024. Additionally, analysts forecast an impressive 12.2% growth year-over-year in fiscal 2026, projecting an EPS of $5.62.

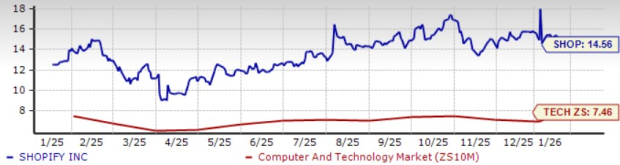

Recent Stock Performance

Over the past 52 weeks, PayPal’s stock price has decreased nearly 5%, which contrasts with the S&P 500 Index’s gain of 4.4% and the S&P 500 Financials Sector SPDR’s 17.5% increase during the same period.

Challenges and Competition

Even after surpassing revenue and earnings expectations for Q4 on February 4, PayPal’s stock fell by 13.2%. The company recorded a 4.2% year-over-year increase in net revenues, totaling $8.4 billion, and an adjusted EPS growth of 4.4% to $1.19, both exceeding analyst estimates. However, free cash flow decreased by 11.3% year-over-year to $2.2 billion. The growing competition from Apple Pay has also hindered expected growth in PayPal’s branded checkout segment, leading to investor disappointment.

Analysts’ Ratings and Price Target

The overall sentiment regarding PayPal is cautiously optimistic, with a consensus “Moderate Buy” rating. Among the 42 analysts covering the stock, the recommendations include 17 “Strong Buys,” two “Moderate Buys,” 23 “Holds,” and one “Strong Sell.” Currently, PayPal’s stock trades significantly below its average price target of $86.69.

On the date of publication, Aditya Sarawgi held no positions in any of the securities mentioned in this article. All information and data in this article are for informational purposes only. For further details, please refer to the Barchart Disclosure Policy here.

The views expressed herein are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.