Broad Market Sheds 2.25%; SPDR Gold Trust (GLD) Shows Strong Power Inflow

SPDR Gold Trust (GLD) attracted significant attention today due to a Power Inflow, an important indicator for traders focused on where institutional money is directed. This update comes in the context of a broader market decline of 2.25%.

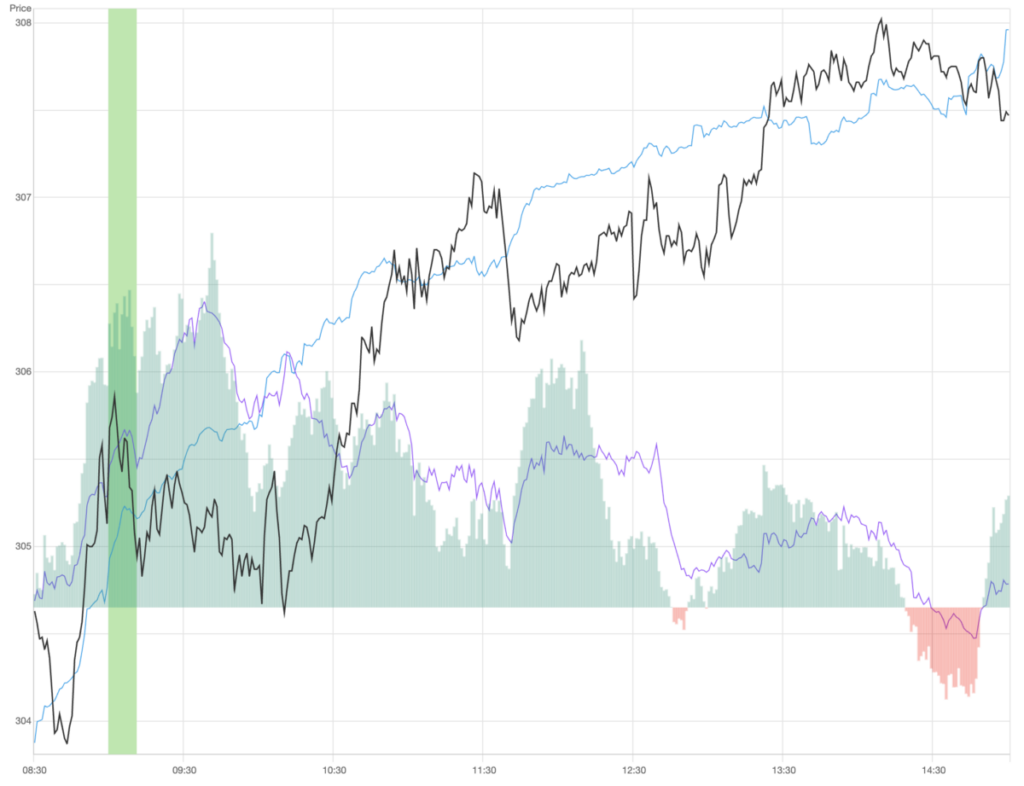

At 10:09 AM on April 16th, GLD recorded a Power Inflow at a price of $305.32. Such movements are vital for traders looking to understand the direction of institutional investment, commonly referred to as “smart money.” This analytical approach is instrumental for informed trading decisions, particularly as the Power Inflow suggests a potential upward trend in GLD’s stock, creating a possible entry point for proactive traders.

Understanding Power Inflow Signals

Order flow analytics, sometimes called transaction or market flow analysis, allows traders to differentiate and analyze both retail and institutional buy and sell order volumes. This method involves a close examination of the size and timing of these orders to derive insights that can inform trading strategies. Active traders often interpret the Power Inflow as a bullish signal.

Typically, a Power Inflow occurs within the initial two hours after the market opens, indicating potential trends driven by institutional trading activity. This insight can guide market participants in forecasting the stock’s direction for the rest of the trading day.

By employing order flow analytics, traders may gain a deeper understanding of market conditions and identify lucrative trading opportunities. Nonetheless, it is crucial to integrate effective risk management strategies into trading plans. Successfully managing risk is essential for capital preservation and to mitigate potential losses, enhancing the likelihood of sustained success in trading.

For those keen to stay revised on the latest options trades for GLD, Benzinga Pro offers real-time alerts on options trading.

Market News and Data provided by Benzinga APIs include contributions from various firms. For further details, visit TradePulse.

© 2024 Benzinga.com. Please note that Benzinga does not offer investment advice. All rights reserved.

Post-Market Analysis

After the Power Inflow, the price stood at $305.32. The returns from the high price of $308.06 and the close price of $307.47 post-signal were 0.9% and 0.7%, respectively. These figures underscore the need for a comprehensive trading strategy that includes profit targets and stop-loss parameters tailored to an individual’s risk tolerance.

Results are not indicative of future performance.

Market News and Data sponsored by Benzinga APIs