American Electric Power Investing $54 Billion for Future Growth

American Electric Power Company, Inc. (AEP) is actively investing in its infrastructure to enhance operational reliability and meet increasing customer demand efficiently. The company is also focused on expanding its renewable generation portfolio.

Positive Outlook for AEP

American Electric has announced plans to invest $54 billion in electricity generation, transmission, and distribution operations, including renewables, from 2025 to 2029. This investment is projected to drive long-term earnings growth between 6-8%.

The company has been consistently expanding its renewable generation assets. In 2024, AEP secured regulatory approvals to acquire approximately 2,303 MW of renewable power facilities for $5.5 billion. Between 2025 and 2029, AEP anticipates investing an additional $9.9 billion in regulated renewable expansion, which will significantly enhance the company’s renewable energy capabilities.

Geographical diversification further benefits AEP, as it generates revenue from various states, setting it apart from single-state utility competitors. AEP operates the largest electricity transmission system in the nation, with about 40,000 circuit miles of transmission lines, including nearly 2,100 circuit miles of 765 kV lines, foundational for the eastern United States’ electric grid.

Challenges Facing AEP

As of December 31, 2024, American Electric Power had a generating capacity of 23,200 MW, with 10,700 MW generated from coal. The company is assessing the impact of four new Environmental Protection Agency regulations on its fleet, which may affect its operating performance as it calculates costs to comply with these regulations while ensuring reliable, affordable electricity.

At the end of 2024, AEP reported long-term debt of $39.31 billion against cash equivalents of $0.46 billion. Its current debt stood at $5.86 billion. The significant gap between current and long-term debt levels in comparison to its cash reserves raises concerns about the company’s solvency.

AEP Stock Performance

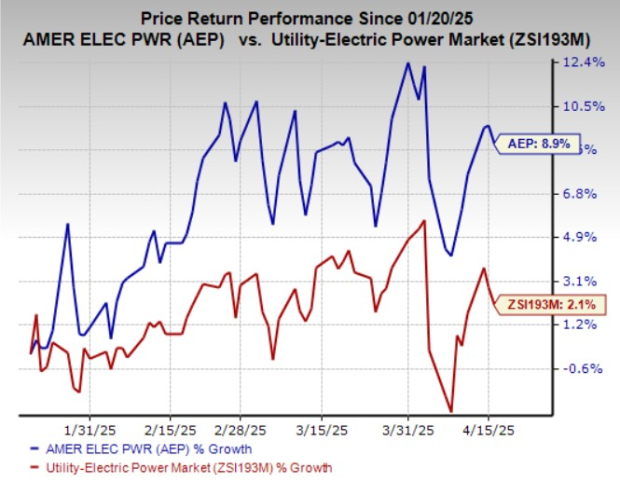

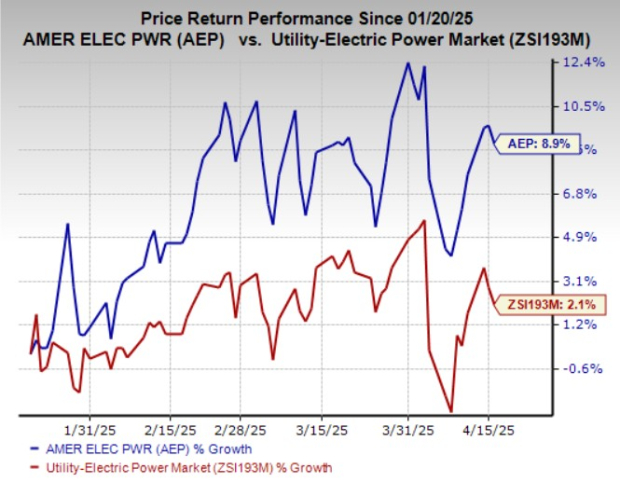

Over the past three months, AEP shares have increased by 8.9%, outperforming the industry growth of 2.1%.

Image Source: Zacks Investment Research

Alternative Stock Recommendations

Investors might consider stocks from the same industry that have higher ratings. Notable mentions include WEC Energy Group (WEC), CenterPoint Energy (CNP), and NiSource Inc. (NI), all currently rated Zacks Rank #2 (Buy). For further recommendations, you can view the list of Zacks #1 Rank (Strong Buy) stocks here.

WEC is expected to achieve a long-term earnings growth rate of 6.8%, with an average earnings surprise of 6.34% over the last four quarters.

CNP anticipates a long-term earnings growth rate of 7.5%, with a 0.76% average earnings surprise in the last four quarters.

NiSource is projecting a long-term earnings growth rate of 7.9% and reported an average earnings surprise of 23.02% over the last four quarters.

Access Exclusive Zacks Stocks for Just $1

We’re not joking.

Previously, we offered our members a chance to access all our stock picks for just $1 for 30 days, with no obligation to continue.

This opportunity has been taken by thousands of individuals. While some chose not to participate, doubting the offer, we aim to familiarize you with our portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, and more, all of which closed with double- and triple-digit gains in 2024.

Free Stock Analysis: NiSource, Inc (NI)

Free Stock Analysis: American Electric Power Company, Inc. (AEP)

Free Stock Analysis: WEC Energy Group, Inc. (WEC)

Free Stock Analysis: CenterPoint Energy, Inc. (CNP)

Originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.