Assessing AGNC Investment: A Cautionary Note for Dividend Seekers

For dividend investors, it can sometimes be difficult to look beyond a high yield and assess the underlying business. This challenge is particularly evident with AGNC Investment (NASDAQ: AGNC), which boasts a notable dividend yield of 17%. However, if you rely on consistent income to cover your expenses, AGNC may not be the right choice for you. Here’s why.

What are the best investment options for $1,000 now? Our analysts have uncovered the 10 best stocks for potential growth at this time. Learn More »

Understanding AGNC Investment’s Operations

To evaluate AGNC Investment, it’s important to recognize its operational goals. Overall, the company has performed well over time, but its focus is on total returns rather than merely delivering dividends. Although dividends create a component of total returns, reinvestment of those dividends is essential. AGNC states its aim is to provide “favorable long-term stockholder returns with a substantial yield component.”

While this focus is intriguing, it does not guarantee a growing and dependable dividend. AGNC’s strategy involves purchasing mortgages pooled into bond-like securities. The company profits from the difference between the interest it collects on these securities and its associated costs, primarily because it employs leverage to enhance returns. This model resembles that of a mutual fund more than an operating company.

Dividend Trends Indicate Caution

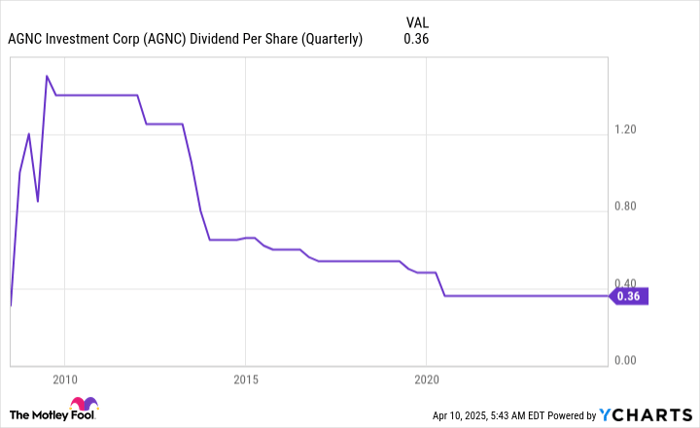

Examining AGNC’s dividend history reveals why it may not be suitable for income-focused investors despite its attractive yield. A quick look back since the company’s initial public offering shows noteworthy trends.

AGNC Dividend Per Share (Quarterly) data by YCharts.

Initially, the dividend rose sharply, a common pattern for a new REIT. However, following its peak, the dividend trend has consistently declined over the past decade. To be fair, management has maintained its current dividend level since the last cut in 2020. However, a deeper look into the history shows a clear downward trend.

Investors should take note that AGNC’s dividend track record does not inspire confidence in its reliability. Unfortunately, dividend cuts occur frequently in the mortgage REIT sector, and AGNC is no exception. Its substantial yield may tempt those seeking to maximize portfolio income.

AGNC data by YCharts.

Another significant concern is that AGNC’s stock price has declined alongside its dividend. While this correlation is logical, it signifies that investors seeking a reliable dividend have faced reduced income and devalued capital—a contrast to the expectations of most dividend investors.

Exercise Caution if Seeking Income with AGNC Investment

The chief issue here is that AGNC’s objective likely does not align with the goals of typical dividend-focused investors. This misalignment does not reflect poorly on the company in general but indicates it may not be suitable for average dividend seekers.

Beware of the allure of an impressive yield and the recent stability of the payout; focus on the company’s primary aim of total return instead. Those who depend on the dividends from AGNC may find historical evidence suggests they won’t achieve satisfaction as dividend investors.

Should You Invest $1,000 in AGNC Investment Corp. Today?

Before purchasing shares in AGNC Investment Corp., consider this:

The Motley Fool Stock Advisor analyst team recently identified the 10 best stocks for current opportunities. Notably, AGNC Investment Corp. did not make this list. The companies that did could generate exceptional returns in the coming years.

For context, if you had invested $1,000 in Netflix when it was recommended on December 17, 2004, it would have grown to $518,599!* Similarly, an investment of $1,000 in Nvidia when recommended on April 15, 2005, could now be worth $640,429!*

It’s essential to note that the average total return of Stock Advisor is 791%, significantly surpassing the 152% return of the S&P 500. Stay informed about the latest top 10 list by joining Stock Advisor.

*Stock Advisor returns as of April 14, 2025

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool holds no positions in any mentioned stocks. For more details, please refer to The Motley Fool disclosure policy.

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.