Leidos Stock: Key Factors Influencing Future Performance

Leidos (LDOS) has recently ranked among the top stocks searched on Zacks.com. Investors should consider several factors that might influence the stock‘s performance in the near term.

In the past month, shares of this security and engineering firm experienced a +3.4% return, while the Zacks S&P 500 composite declined by -6.9%. The Zacks Aerospace – Defense industry, which includes Leidos, saw a decrease of 3.1%. The critical question is: What could be the stock‘s future trajectory?

The Impact of Earnings Estimate Revisions

At Zacks, we focus on the shifts in a company’s future earnings projections. We believe that the present value of future earnings largely dictates the fair value of a stock.

Our analysis focuses on how sell-side analysts adjust their earnings estimates based on current business trends. When a company’s earnings estimates rise, its fair value increases. Consequently, if a stock is deemed undervalued based on these estimates, investor interest generally drives the price up. Studies demonstrate a strong correlation between revisions in earnings estimates and short-term stock price movements.

For the current quarter, Leidos is expected to deliver earnings of $2.47 per share, reflecting an increase of +7.9% from the same quarter last year, though the Zacks Consensus Estimate has decreased by -0.6% in the last 30 days.

The consensus earnings estimate for the full fiscal year is $10.51, indicating a +2.9% change from 2022. This estimate has increased by +0.2% over the past month.

Next fiscal year’s consensus earnings estimate of $11.38 signals an +8.3% rise from expectations a year prior, with a similar +0.2% increase in the last 30 days.

With a well-documented track record, our proprietary stock rating tool, the Zacks Rank, effectively assesses a stock‘s near-term price potential using earnings estimate revisions. Leidos currently holds a Zacks Rank #3 (Hold), reflecting the company’s status in the market.

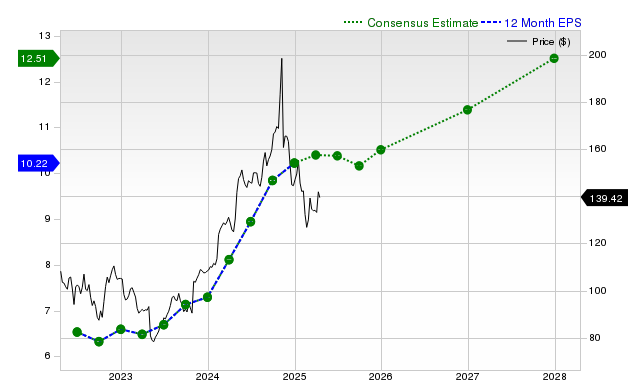

The chart below illustrates the progression of the company’s forward 12-month consensus EPS estimate:

12-Month EPS

Projected Revenue Growth

While a company’s earnings growth is a vital aspect of financial health, sustained earnings growth is challenging without accompanying revenue increases. Understanding a company’s revenue potential is therefore essential.

Leidos holds a consensus sales estimate of $4.08 billion for the current quarter, reflecting a +2.7% increase year-over-year. Estimates for the current and next fiscal years of $17.09 billion and $17.66 billion represent changes of +2.6% and +3.4%, respectively.

Last Reported Results and Surprise History

In the last quarter, Leidos reported revenues of $4.37 billion, marking a +9.7% year-over-year change. The earnings per share (EPS) for this period was $2.37, compared to $1.99 a year earlier.

When compared to the Zacks Consensus Estimate of $4.12 billion, the reported revenues demonstrated a surprise of +5.89%. Similarly, the EPS surprise was +8.72%.

Leidos has exceeded consensus EPS estimates in every one of the last four quarters, consistently outperforming revenue expectations during this period.

Valuation Insights

Considering a stock‘s valuation is crucial for informed investment decisions. Whether a stock‘s current price reflects its intrinsic value and growth prospects significantly influences future price performance.

By comparing a company’s valuation multiples, such as price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF), with historical benchmarks can indicate if a stock is fairly valued, overvalued, or undervalued. Relative comparisons with peers also provide valuable context.

The Zacks Value Style Score, which evaluates stocks based on traditional and non-traditional valuation metrics, grades stocks from A to F, with a B rating indicating that Leidos is trading at a discount relative to its peers. Click here to explore the values behind this grade.

Bottom Line

The considerations discussed above, alongside other insights from Zacks.com, can help gauge whether the market buzz surrounding Leidos warrants attention. However, its current Zacks Rank #3 suggests that it may perform in alignment with the broader market in the near future.

Zacks Identifies Top Semiconductor Stock

This stock is just 1/9,000th the size of NVIDIA, which has surged over +800% since our recommendation. While NVIDIA remains strong, our new top chip stock holds significant potential for future growth.

With robust earnings growth and an expanding consumer base, it’s ideally situated to meet the increasing demand for Artificial Intelligence, Machine Learning, and Internet of Things technologies. The global semiconductor market is anticipated to grow from $452 billion in 2021 to $803 billion by 2028.

Explore this emerging stock now for free >>

Want the latest recommendations from Zacks Investment Research? Download “7 Best Stocks for the Next 30 Days” today. Click for this free report.

Leidos Holdings, Inc. (LDOS): Free stock analysis report.

This article originally appeared on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.