Moody’s Poised for Earnings Beat Ahead of Upcoming Report

If you’re in search of a stock consistently outperforming earnings estimates, consider Moody’s Corporation (MCO). Part of the Zacks Financial – Miscellaneous Services industry, Moody’s shows potential for continuing this trend in its upcoming quarterly report.

Strong Earnings Performance

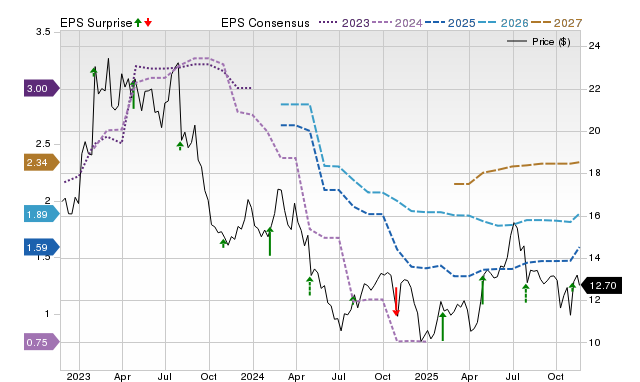

In its last two quarterly reports, Moody’s has consistently beaten earnings estimates, averaging a 5.92% surprise. In the most recent quarter, analysts expected earnings of $2.60 per share; however, Moody’s reported $2.62 per share, resulting in a surprise of 0.77%. In the quarter before that, the consensus estimate was $2.89, while the actual earnings came in at $3.21 per share, marking an impressive surprise of 11.07%.

Positive Earnings Outlook

The favorable trend in Moody’s earnings has led to positive earnings estimates recently. Currently, the Zacks Earnings ESP (Expected Surprise Prediction) stands at +0.09%. This metric suggests that analysts are bullish about the company’s future earnings prospects. Coupled with a Zacks Rank of #3 (Hold), this indicates a strong possibility of another earnings beat in the near future. The next earnings report is expected to be released on April 22, 2025.

Understanding Earnings ESP

The Earnings ESP compares the Most Accurate Estimate to the Zacks Consensus Estimate for the quarter. Analysts updating their estimates right before a release may reflect more accurate projections than those included in the consensus. Research indicates that stocks with a positive Earnings ESP and a Zacks Rank of #3 or better tend to produce positive surprises nearly 70% of the time. Thus, if you hold 10 stocks with this combination, approximately seven may exceed the consensus estimates.

Investment Considerations

While a negative Earnings ESP may suggest diminished predictive power, it does not inherently mean the stock will miss its earnings target. Numerous companies outperform consensus EPS estimates for reasons beyond just their earnings surprises. Furthermore, some stocks demonstrate stability, even when they fall short of analyst expectations. Therefore, checking a company’s Earnings ESP before a quarterly report is crucial for enhancing investment success. Utilize our Earnings ESP Filter to identify promising stocks ahead of their announcements.

Zacks Highlights New Semiconductor Stock

In another market segment, Zacks has identified a top semiconductor stock that is much smaller than NVIDIA, which has surged over 800% since its recommendation. This new pick has significant potential, given its strong earnings growth and expanding customer base, particularly in the realms of Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor manufacturing market is projected to grow dramatically, increasing from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Moody’s Corporation (MCO) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.