Understanding Analyst Recommendations for Bit Digital, Inc. (BTBT)

When it comes to making decisions about buying, selling, or holding stocks, investors often look to analyst recommendations. These ratings, particularly those from brokerage firms, can heavily influence stock prices. But how reliable are these recommendations? Let’s explore what analysts say about Bit Digital, Inc. (BTBT) and how investors can use this information effectively.

Current Brokerage Outlook on BTBT

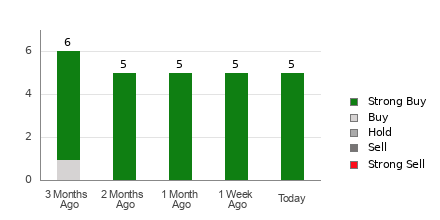

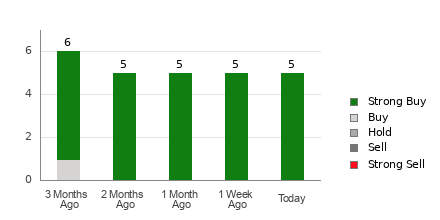

Bit Digital currently boasts an average brokerage recommendation (ABR) of 1.00 on a scale from 1 to 5, where 1 signifies a Strong Buy and 5 indicates a Strong Sell. This average is derived from the recommendations made by five brokerage firms. An ABR of 1.00 suggests a Strong Buy.

All five recommendations contributing to this ABR are classified as Strong Buy, meaning that 100% of the analysts surveyed favor buying the stock.

Check price target & stock forecast for Bit Digital here>>>

Evaluating Broker Recommendations

The ABR indicates a strong buy case for Bit Digital, yet making investment decisions purely on this measure may not be wise. Studies suggest that brokerage recommendations often fail to lead investors to stocks poised for significant price increases.

The reason for this is primarily due to the conflicting interests of brokerage firms. Analysts from these firms typically rate stocks with a positive bias, often providing five “Strong Buy” ratings for each “Strong Sell.” Consequently, the insights provided do not necessarily reflect the true potential of a stock’s future price movements. It is best for investors to use this information in conjunction with their own analyses.

Combining Zacks Rank with Broker Recommendations

Our proprietary stock rating tool, the Zacks Rank, offers a reliable assessment of a stock’s near-term price potential. This tool categorizes stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell) based on earnings estimate revisions, which have a proven correlation with stock price movements.

It is important to differentiate between the Zacks Rank and the ABR, as they measure different factors. While the ABR calculates an average based on brokerage recommendations and is often shown in decimal format, the Zacks Rank is a numeric model based on earnings revisions and is displayed in whole numbers.

Broker analysts frequently maintain overly optimistic ratings, driven by their firms’ interests. As a result, their recommendations may mislead rather than guide investors. In contrast, the Zacks Rank relies on actual earnings estimate revisions, offering a more accurate reflection of near-term price trends.

The Zacks Rank applies its ratings consistently across stocks for which analysts provide earnings estimates. It also reacts quickly to changes in those estimates, making it a timely tool in forecasting future price movements.

Investment Consideration for BTBT

Currently, the Zacks Consensus Estimate for Bit Digital’s earnings has remained steady at -$0.02 for the year. This constant outlook from analysts may signal that the stock is likely to perform similarly to the overall market in the near future.

This lack of significant changes in analyst earnings estimates, alongside other factors, has positioned Bit Digital with a Zacks Rank of #3 (Hold). For a complete list of Zacks Rank #1 stocks, you can check here>>>>.

In light of this analysis, it may be prudent to exercise caution despite the strong Buy recommendation from brokers.

Exciting Opportunities in the Semiconductor Sector

One emerging opportunity is in the semiconductor space, which is significantly smaller than giants like NVIDIA. With growth expected from artificial intelligence, machine learning, and the Internet of Things, the semiconductor market is projected to expand from $452 billion in 2021 to $803 billion by 2028.

Discover This Stock Now for Free >>

Bit Digital, Inc. (BTBT): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.