Investors Weigh Nvidia’s Dominance Against Amazon’s Growth Potential

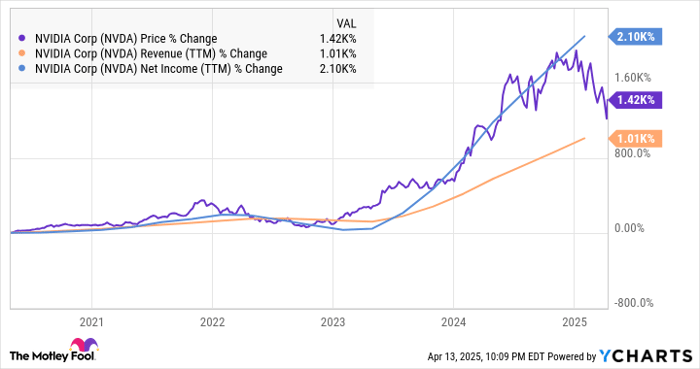

Nvidia (NASDAQ: NVDA) has emerged as a standout performer over the past five years, delivering an astounding 1,300% return to investors. This remarkable performance significantly outstrips the tech-heavy Nasdaq Composite, which saw gains of about 100% during the same timeframe.

The company’s impressive growth is primarily due to strong demand for its graphics processing units (GPUs), which are utilized in diverse applications, including artificial intelligence (AI), automotive technology, personal computing, and “digital twins.” This variety of market applications has played a key role in Nvidia’s revenue and earnings surge over the last five years.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

NVDA data by YCharts

Nvidia’s current market capitalization stands at $2.5 trillion, making it the third-largest company in the world. Analysts believe that Nvidia may continue to see gains in the future, thanks to a large addressable market that can sustain ongoing revenue and earnings growth.

Nonetheless, there is another tech company that could potentially surpass Nvidia in the long term, given its strong presence in various multibillion-dollar sectors. Let’s closely examine this competitor and its prospects over the next five years.

Amazon’s Multifaceted Approach: AI, Cloud, and E-Commerce

Amazon.com (NASDAQ: AMZN) ranks as the world’s fourth-largest company, with a market cap of $1.9 trillion, trailing Nvidia by about 30%.

Over the past five years, Amazon has lagged behind both Nvidia and the Nasdaq Composite, achieving gains of only 45%. Moreover, the company’s stock has taken a hit, losing approximately 20% of its value in 2025 due to broader market concerns related to tariffs.

NVDA data by YCharts

This downward trend, however, offers an opportunity for investors to acquire a solid tech company at an appealing value. Amazon remains a leading player in e-commerce and dominates the expanding cloud computing market, which will benefit from advancements in AI.

Last year, Amazon controlled an estimated 40% of the U.S. e-commerce market. This is significant, given that the U.S. e-commerce market is projected to grow at an annual rate of 15% through 2030, potentially surpassing $19 trillion in annual revenue.

In addition to its U.S. dominance, Amazon is making headway in international e-commerce markets, such as Germany, where it reportedly has captured 50% of the largest e-commerce market in Europe. Amazon also leads in the U.K. market, which is the second-largest in Europe and the third-largest globally.

The European e-commerce sector is anticipated to triple in size between 2024 and 2030, generating over $10 trillion in annual revenue, indicating robust growth prospects for Amazon’s e-commerce business, as well as for its cloud computing operations.

Currently, Amazon holds a 30% share of the cloud infrastructure market, surpassing second-place Microsoft at 21%. Predictions suggest that the cloud market could yield $2 trillion in annual revenue by 2030, partly driven by AI’s influence. According to Goldman Sachs, generative AI could account for 10% to 15% of total cloud spending by that time.

This expansive market opportunity could catalyze substantial growth for Amazon. The company’s Amazon Web Services (AWS) generated nearly $108 billion in revenue for 2024, marking a 19% increase from the previous year. With a solid share of the growing cloud infrastructure market, AWS is well-positioned for significant long-term gains.

Moreover, Amazon is actively working to reduce costs for running AI apps on AWS by creating in-house custom processors. These processors claim to provide a 30% to 40% advantage in price-to-performance compared to traditional cloud instances powered by GPUs. Many companies are now opting for Amazon’s cloud solutions equipped with these custom processors for their AI workloads.

Accelerated Earnings Growth Could Boost Amazon’s Stock Price

This year, Amazon plans a significant increase in capital expenditures (capex) to enhance its AI infrastructure, with a 20% rise in 2025, reaching $100 billion. While this expenditure may pressure Amazon’s earnings growth for the year, analysts forecast a 14% increase in earnings, projecting a bottom line of $6.32 per share.

Looking ahead, expectations for Amazon’s earnings growth are optimistic. Analysts predict a 19% increase in the next year, followed by a more robust 25% rise in 2027. Assuming Amazon maintains a 20% annual earnings growth rate after that, projections suggest earnings could reach $16.22 per share by 2030.

AMZN EPS Estimates for Current Fiscal Year data by YCharts

If Amazon’s stock is trading at 28 times earnings by that time, consistent with current valuations in the tech-heavy Nasdaq-100, it could push the stock price to $454. This increase would represent 1.6 times Amazon’s stock price as of April 16, potentially elevating its market cap closer to $4.75 trillion. This substantial growth could be sufficient for Amazon to surpass Nvidia if Nvidia experiences a downturn due to decreased AI hardware spending or greater competition.

As of now, Amazon is trading at 28 times forward earnings.

Investors Eye Amazon’s Future Amid “Magnificent Seven” Stocks

Is Now the Right Time to Invest $1,000 in Amazon?

Before purchasing stock in Amazon, consider this important insight:

The Motley Fool Stock Advisor analyst team has singled out what they believe to be the 10 best stocks for investors to buy right now, and notably, Amazon is not included in this selection. The stocks that made this exclusive list are poised for significant returns in the coming years.

Reflecting on past performance, when Netflix appeared on this list on December 17, 2004, a $1,000 investment would now be worth $524,747!* Similarly, when Nvidia was recommended on April 15, 2005, a $1,000 investment would have grown to $622,041!*

It’s noteworthy that Stock Advisor boasts an impressive average return of 792%, significantly outperforming the S&P 500’s return of 153%. Be sure to check out the latest top 10 recommendations available through Stock Advisor.

*Stock Advisor returns as of April 14, 2025

John Mackey, the former CEO of Whole Foods Market, which is an Amazon subsidiary, serves on The Motley Fool’s board of directors. Harsh Chauhan has no stake in any of the stocks mentioned. The Motley Fool holds positions in, and recommends, Amazon, Goldman Sachs Group, Microsoft, and Nvidia. Additionally, The Motley Fool recommends long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. Please refer to The Motley Fool’s disclosure policy for more information.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.