Understanding Market Competition Through an Easter Egg Hunt Analogy

Editor’s Note: Yesterday, I shared part one of Senior Analyst Brian Hunt’s two-part Easter Egg hunt series. If you missed it, you can check out the first part here.

In today’s part two, Hunt contrasts a quiet egg hunt with one crowded by hundreds. Most people would likely prefer the less crowded hunt where the chances of success are higher.

As Brian elaborates, this same concept is prevalent in the Stock market every day… I’ll let Brian take it from here…

**************

The Egg Hunt Scenario

Imagine it’s Easter, and you’re excited for the neighborhood Easter egg hunt.

Over 100 eggs are hidden in a small local park, and each egg contains a treat. Among them, one special egg holds a cash prize.

You have a choice between two hunting scenarios:

- You are hunting alongside 1,000 other people. It’s chaotic.

- You are hunting alongside just 10 other people.

Like most reasonable individuals, you’d choose the second option and prefer hunting with only 10 competitors.

This scenario illustrates your desire to have less competition:

Instead of this:

In the second scenario, with fewer competitors, your opportunity to succeed is significantly increased.

Connecting the Dots to Investing

This dynamic closely parallels the behavior of the Stock market.

In financial markets, millions of participants seek to uncover valuable opportunities, whether in stocks, commodities, bonds, or real estate.

Market players aim to buy assets for a lower price than their actual value and to sell assets for a higher price than their worth.

Essentially, everybody is searching for those hidden “eggs.”

While markets typically price assets accurately, they do experience moments of inefficiency.

These windows of opportunity—where you can potentially buy assets undervalued or sell overvalued assets—are termed “market inefficiencies.”

These inefficiencies can lead to profitable outcomes.

However, an influx of participants increases competition, making it more challenging to identify these advantageous opportunities.

As more people engage with the market, opportunities become scarcer and the potential for significant profits diminishes.

The Role of Institutional Investors

In the competitive landscape of finance, institutional investors represent the most formidable players.

Institutional investors include mutual funds, pension funds, large hedge funds, and insurance companies. They also encompass sovereign wealth funds that manage national savings.

Some institutional investors manage over $10 billion in assets, making individual investors appear minor in comparison — a $5 million asset holder is effectively a mouse next to these investment elephants.

Additionally, large institutional investors can manage much larger sums. As an example, Norway’s sovereign wealth fund exceeded $1 trillion in value in 2017, towering over many private funds.

This level of investment power influences market dynamics significantly and impacts the accessibility of profitable opportunities.

How Institutional Investors Navigate Competitive Financial Markets

Large institutional investors worldwide have vast sums of money to invest in various assets like stocks and bonds.

These institutions usually employ teams of analysts who dedicate hundreds of thousands of hours annually to uncover investment opportunities. Their work resembles traditional “financial detective” work, which involves visiting public companies and interviewing industry experts.

In addition, these analysts utilize advanced computer algorithms and Big Data programs to analyze market data. These systems operate around the clock, sifting through global financial data at high speed to identify both small and significant pricing inefficiencies.

Consider those Easter egg hunts once again and realize—the stock market is an incredibly competitive Easter egg hunt.

This presents a challenge. The good news is that the financial market encompasses a wide range of areas where larger investors often do not participate.

The Challenge of Size in Investing

In the investment arena, professional investors often focus heavily on “liquidity.” Liquidity refers to the ease or difficulty of buying and selling a security. For instance, take Amazon Stock. As one of the largest companies, valued at over $983 billion in 2022, Amazon stock is considered “very liquid.”

A robust market exists for Amazon Stock, with over 70 million shares frequently traded daily in 2022.

Conversely, consider a small-cap firm with a market cap of merely $50 million, which is less than one-tenth of one percent of Amazon’s value. Due to its small size and low public awareness, this firm’s Stock lacks significant liquidity.

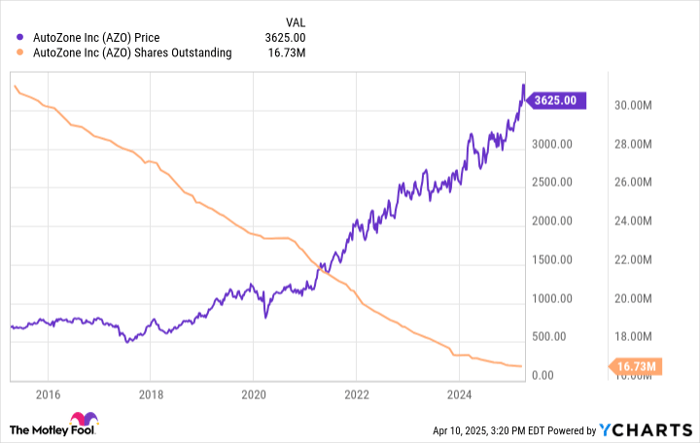

Market capitalization, determined by the number of outstanding shares multiplied by the share price, means small-cap stocks typically have fewer shares available on the market. Consequently, purchasing large amounts of these shares can be challenging due to a limited number of sellers.

Now, let’s explore a scenario where you manage a $10 billion Stock portfolio.

To make a favorable impact on your fund’s performance, you would need to invest at least 3% of your fund’s assets. Many skilled managers prefer to allocate 4% to 8% of their funds into a truly exceptional Stock.

If you aim to deploy 3% of $10 billion, that means looking to invest $300 million in a particular stock. This amount is six times larger than the market cap of a $50 million small-cap stock. Even with a modest goal of 1%, you would need to invest $100 million—placing you significantly outside the small-cap hunt.

Consequently, large money managers often miss out on the small-cap Stock opportunities.

Additionally, they face constraints in other small markets with limited liquidity, such as certain options markets, smaller investment funds (including closed-end funds and ETFs), individual bonds, small-cap foreign stocks, and penny stocks.

In these less liquid markets, the competition might be far less daunting than dealing with larger institutions equipped with extensive analyst teams and powerful technology.

Just like house hunting, you might prefer to buy in a neighborhood with fewer buyers, instead of competing with throngs of others lining up for real estate. In investment, less competition can offer a significant advantage.

Another analogy is useful: imagine fishing. You would prefer a quiet stream to a crowded lake full of anglers.

The key to successful investing and trading is to tilt the odds in your favor.

The greater your advantage, the more successful your investment journey will be. Focusing on smaller, less liquid markets, like the small-cap space, is one effective way to achieve that advantage.

Regards,

Brian Hunt

InvestorPlace Senior Market Analyst

P.S. It’s Louis again. For years, investors have been working to predict future Stock prices. Our partners at TradeSmith appear to have made a major breakthrough.

Utilizing advanced AI and machine learning, they created a tool that is transforming the financial sector and assisting individuals in thriving despite market challenges.