Analyzing Wall Street’s Perspective on Intuitive Surgical’s Stock

Investors often turn to Wall Street analysts for guidance on whether to buy, sell, or hold stocks. Changes in their ratings can significantly influence a stock’s price. But how reliable are these recommendations?

To explore this, let’s examine the consensus from analysts regarding Intuitive Surgical, Inc. (ISRG).

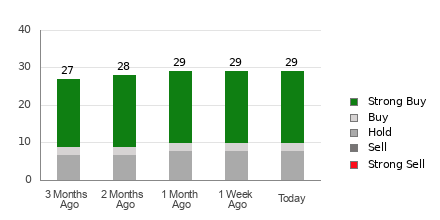

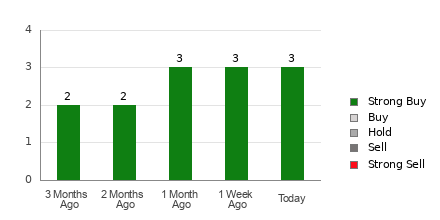

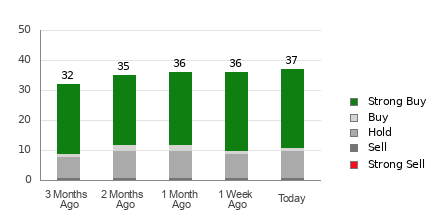

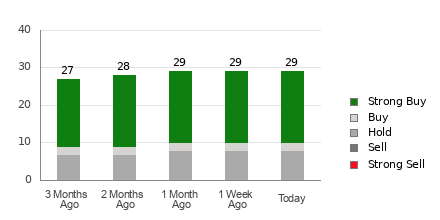

Intuitive Surgical has an average brokerage recommendation (ABR) of 1.62, based on inputs from 29 brokerage firms. This ABR rating falls between Strong Buy and Buy on a scale of 1 to 5. Specifically, of the 29 recommendations, 19 are categorized as Strong Buy and two as Buy, which together represent 65.5% and 6.9% of all recommendations, respectively.

Trends in Brokerage Recommendations for ISRG

Explore the price targets & stock forecast for Intuitive Surgical here>>>

Although the ABR suggests a buying opportunity for Intuitive Surgical, it’s prudent not to base investment decisions solely on these ratings. Research indicates that brokerage recommendations may not successfully lead investors to select stocks with the most potential for price increases.

This discrepancy often stems from the inherent bias in brokerage firms. Analysts affiliated with these firms tend to offer overly positive ratings, with a significant disparity in their recommendations where five “Strong Buy” ratings are given for every “Strong Sell.” This misalignment means their insights might not accurately reflect a stock’s true price trajectory.

Ultimately, utilizing this information might be beneficial for validating your independent research or confirming insights from trusted indicators that have a proven record of accuracy.

Our proprietary stock rating tool, the Zacks Rank, may provide more reliable guidance. This tool classifies stocks into five groups, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), based on an externally audited track record that effectively predicts near-term price movements.

Distinguishing Between Zacks Rank and ABR

Although Zacks Rank and ABR share a numerical range of 1-5, they are fundamentally different metrics. The ABR is a composite of brokerage recommendations, often displayed with decimals (e.g., 1.28), while the Zacks Rank relies on quantitative analysis from earnings estimate revisions, represented in whole numbers from 1 to 5.

Brokerage analysts often exhibit excessive optimism in their ratings due to conflicts of interest within their firms. This bias results in more favorable ratings than justified by their own research, potentially misleading investors.

Conversely, the Zacks Rank correlates closely with trends in earnings estimate revisions. Numerous studies support the idea that near-term stock price movements align with these earnings estimates.

The Zacks Rank also maintains proportionality across all stocks covered by analysts’ earnings estimates, ensuring a balanced approach within the five rankings it assigns.

Freshness is another critical distinction. The ABR may not always be current, whereas the Zacks Rank is routinely updated to reflect recent earnings estimate revisions, thereby providing timely insights into potential price movements.

Is Investing in ISRG a Good Move?

Currently, the Zacks Consensus Estimate for Intuitive Surgical has remained stable over the past month at $7.97. This consistent view among analysts regarding earnings prospects implies that the stock is likely to perform in alignment with market trends in the near future.

Taking into account the unchanged consensus estimate, along with several other relevant earnings estimate factors, Intuitive Surgical has earned a Zacks Rank #3 (Hold). You can view the complete list of today’s Zacks Rank #1 stocks here >>>>

Thus, it might be wise to approach the Buy-equivalent ABR for Intuitive Surgical with a degree of caution.

Zacks Identifies Top Semiconductor Stock

This stock is a fraction of the size of NVIDIA, which has soared over 800% since our initial recommendation. While NVIDIA remains strong, our top semiconductor pick has substantial growth potential ahead.

With robust earnings growth and an expanding customer base, this company is well-positioned to meet the surging demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is anticipated to grow from $452 billion in 2021 to $803 billion by 2028.

Discover This Stock for Free >>

Get your free stock analysis report for Intuitive Surgical, Inc. (ISRG)

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.