Amazon Faces Trade War Challenges Amid Strong Long-Term Prospects

The world is changing. After decades of a steady relationship—albeit occasionally testy—between China and the United States, a massive trade war has erupted. Investors are concerned about the implications for consumer spending, inflation, and stock values in their portfolios.

Amazon (NASDAQ: AMZN) finds itself at the center of this trade conflict. The online retailer, along with its millions of sellers, ships significant quantities of goods from China every year, creating uncertainty about the future of these connections. It is understandable, then, to see Amazon’s stock down 26% from its all-time highs.

Potential Impact of Tariffs on Amazon

Amazon may experience disruptions due to the tariffs on Chinese goods. However, this environment could present a favorable buying opportunity for long-term investors, especially those focused on artificial intelligence (AI). Here’s why it makes sense to consider buying Amazon stock now.

Resilient Retail Segments

Amazon’s marketplace sources products from sellers across the globe, heavily relying on Chinese vendors. The company has included disclosures about this dependency in its annual report. With the ongoing tariff war, it will be increasingly difficult for many of these sellers to operate within the North American marketplace.

However, does this mean Amazon’s retail business is doomed? The answer is likely no. While there may be challenges ahead, the core strength of Amazon’s business model lies in its ability to aggregate consumer demand and its established delivery network in the United States. If Chinese sellers exit, Amazon can gradually replace them with vendors from Vietnam, Mexico, and other locations.

A substantial portion of Amazon’s retail profit derives from third-party seller fees, which are unaffected by sellers’ origins, as well as from advertising services and Amazon Prime subscriptions. Assuming consumer spending continues to rise in the long term, these segments are likely to expand in North America.

Furthermore, Amazon is capturing increased market share in retail sales, driven by the surge in e-commerce and improved delivery times. The company achieved record delivery speeds in 2024, with many items available for same-day delivery.

In 2024, North American retail revenue reached $388 billion, with an operating income of $25 billion. Even if tariffs complicate current seller operations, Amazon’s diversified revenue streams and the persistent trend toward e-commerce adoption point to resilience and growth.

The Massive Opportunity in AI

No discussion of Amazon would be complete without mentioning Amazon Web Services (AWS) and the burgeoning field of AI. As the largest cloud computing entity globally, AWS has generated $108 billion in revenue in 2025. Its operating income surpassed that of Amazon’s entire North American and international retail divisions, nearing $40 billion last year.

AI expenditures are driving rapid revenue growth at AWS, with a year-over-year increase of 19% last quarter compared to 13% in the same period of 2023. This surge appears to be just the beginning. Recently, Nvidia announced a plan to invest $500 billion in AI supercomputers in the U.S. AWS is positioned to utilize these new computing resources, forming a crucial part of the AI ecosystem.

Startups like OpenAI and Anthropic demand considerable computing power to develop and implement their AI models, and this need is only growing. If AWS doubles its revenue over the next five years while sustaining its current operating margin, it could generate approximately $80 billion in operating income, a figure that places it among the most profitable companies worldwide.

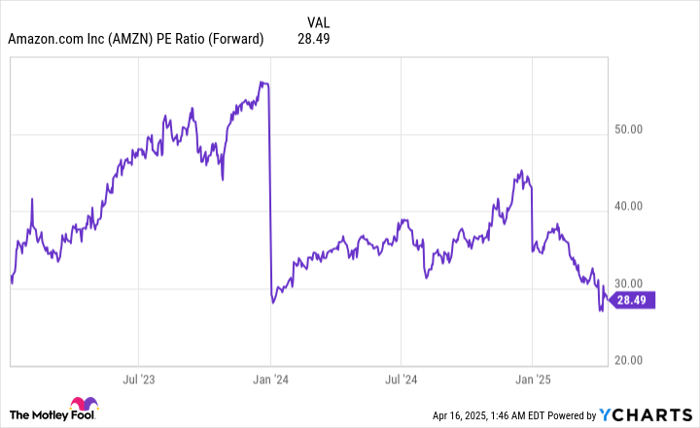

AMZN PE Ratio (Forward) data by YCharts; PE = price to earnings.

Reasons to Buy Amazon Stock Now

With the stock price declining, investors have the chance to acquire shares of Amazon just as its profits are poised to increase. This anticipated uptick is driven by rising AWS spending, operational efficiency improvements, and the rapid growth of high-margin segments like advertising.

Currently, the stock has a forward price-to-earnings (P/E) ratio of 28. Though this year may experience volatility, Amazon is expected to sustain growth, propelled by the dual trends of cloud computing and e-commerce spending. Consequently, investors with a long-term perspective should consider purchasing the stock now.

Should You Invest $1,000 in Amazon Right Now?

Before making a purchase decision regarding Amazon stock, it’s important to note:

The Motley Fool Stock Advisor analyst team has recently identified what they deem the 10 best stocks to buy now, and Amazon is not among them. The selected stocks have the potential to deliver significant returns in the coming years.

For instance, consider when Netflix was included on this list on December 17, 2004. A $1,000 investment at that time would now be worth $524,747!* Similarly, if you invested $1,000 in Nvidia when it made the cut on April 15, 2005, you would now have $622,041!*

It’s important to note that the Stock Advisor has achieved an average total return of 792% which outperforms the 153% return from the S&P 500. Don’t miss the latest top 10 list available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of April 14, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Amazon. The Motley Fool has positions in and recommends Amazon and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.