Booking Holdings Prepares for First-Quarter Earnings Report

Founded in 1997 and headquartered in Norwalk, Connecticut, Booking Holdings Inc. (BKNG) stands as a global leader in online travel and related services. With a market capitalization of $150.1 billion, the company manages a diverse array of well-known brands including Booking.com, Priceline, Agoda, and Kayak. These brands serve travelers across more than 220 countries and territories, offering a range of services such as accommodations, travel reservations, and rental cars. The company is scheduled to report its first-quarter earnings after market close on Tuesday, April 29.

Analysts Anticipate Profits to Decline

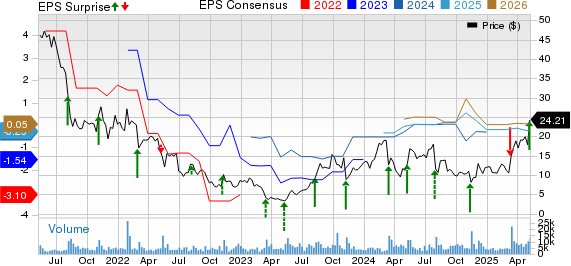

Ahead of this earnings release, analysts project BKNG will report a profit of $17 per share, reflecting a decline of 16.6% from last year’s $20.39 in the same quarter. Notably, the company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports. In the most recent quarter, its adjusted earnings reached $41.55 per share, exceeding consensus estimates by 16.6%, largely thanks to resilient travel demand, increased average daily rates, and effective cost management.

Forward-Looking Estimates and Growth Projections

For the entirety of the current year, analysts expect Booking Holdings to report an EPS of $205.05, which is a 9.6% increase from last year’s $187.10 for fiscal 2024. Looking ahead, its EPS is projected to rise by 16.9% year-over-year to $239.76 in fiscal 2026.

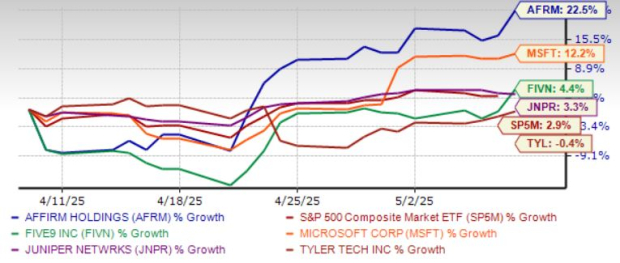

Strong Market Performance

Over the past year, Booking Holdings’ shares have surged by 32.8%, significantly outpacing the S&P 500 Index’s gains of 5.4% and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 7.6% returns during the same timeframe.

This robust performance has been driven by strong financial results, a rebound in international travel, and solid demand from affluent travelers. Additionally, the company bolstered investor confidence with a $20 billion buyback plan and dividend increase. Continued investments in technology and its extensive brand portfolio have further fortified its growth and market leadership.

Market Challenges and Analyst Sentiment

On March 28, BKNG shares dipped by more than 2% during a broader sell-off in travel and hospitality stocks. This decline was fueled by rising economic concerns, prompting caution among investors in the sector. Fears regarding a potential slowdown in consumer spending and discretionary travel weighed on market sentiment, affecting not only online travel platforms like BKNG but also airlines, cruise operators, and hotel chains.

The consensus opinion on BKNG is cautiously optimistic, holding an overall “Moderate Buy” rating. Out of 36 analysts following the stock, 21 recommend a “Strong Buy,” two suggest a “Moderate Buy,” and 13 propose a “Hold.”

The average target price for BKNG stands at $5,524.67, indicating a potential upside of 20.8% from current price levels.

On the date of publication,

Kritika Sarmah

did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For further details, please view the Barchart Disclosure Policy

here.

More news from Barchart

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.