Badger Meter Reports Strong Q1 2025 Earnings with Notable Growth

Badger Meter, Inc. (BMI) announced an earnings per share (EPS) of $1.30 for the first quarter of 2025, surpassing the Zacks Consensus Estimate by 20.4%. This EPS also shows a significant increase from 99 cents in the same quarter last year. For ongoing updates, readers can visit the Zacks Earnings Calendar.

Quarterly net sales reached $222.2 million, reflecting a 13% increase from $196.3 million a year ago. This rise was fueled by greater utility water sales and initial contributions from the SmartCover acquisition. This performance demonstrates BMI’s ability to leverage favorable market conditions while executing effective operational strategies. The Zacks Consensus Estimate had anticipated sales of $222 million.

Strategic Acquisition Enhances Smart Water Portfolio

On January 30, 2025, Badger Meter finalized the acquisition of SmartCover, a company that provides advanced monitoring solutions for sewer and lift stations. These features have been integrated into Badger Meter’s BlueEdge water management suite. Feedback from customers regarding SmartCover’s integration has been highly positive, underscoring the strategic benefit of the acquisition.

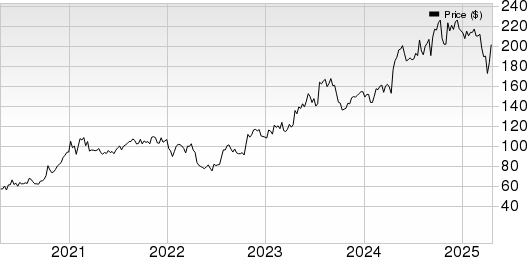

Stock Performance Following Earnings Release

Badger Meter’s stock price and performance data | Badger Meter, Inc. Quote

Following this robust performance, BMI’s shares surged by 9.64% and closed at $201.63 on April 17, 2025. Over the past year, shares have seen an 11.3% increase, contrasting with a 10.8% decrease in the Zacks Instruments-Control industry.

Image Source: Zacks Investment Research

Segment Analysis

During the reported quarter, sales from utility water increased by 16%. This growth stemmed from strong demand for mechanical and E-Series Ultrasonic meters, increased adoption of ORION Cellular radio endpoints, and the steady growth of BEACON SaaS solutions. Additionally, two months of contributions from SmartCover aided the sales figures. If excluding SmartCover, organic utility water sales still grew by 12%, highlighting the ongoing customer adoption of Badger Meter’s smart water technologies.

In contrast, flow instrumentation sales decreased by 5% year over year. Although there was slight growth in water-related sectors, reduced demand in non-prioritized market applications offset this. However, a 7% sequential growth from the fourth quarter of 2024 indicates potential for recovery and expansion.

Financial Highlights

In Q1 2025, gross profit reached $95.4 million, up from $77.2 million year over year, resulting in a gross margin of 42.9%, an increase of 360 basis points. This improvement can be attributed to a favorable product and customer mix alongside ongoing operational enhancements.

Operating earnings surged 35% year over year to $49.5 million, reflecting effective cost management and a profitable mix of products and customers. The operating margin also reached a record high of 22.2%, expanding by 360 basis points compared to last year.

However, selling, engineering, and administration (SEA) expenses rose by 13% to $46 million as the company invested in growth and acquisition initiatives, maintaining a stable percentage of sales at 20.7%. The increase includes about $1.1 million in amortization related to the SmartCover integration. Excluding the acquisition costs, SEA expenses would have only risen by 5%, or $2.2 million.

Cash Flow and Liquidity Status

For the first quarter of 2025, Badger Meter generated $33 million in net cash from operating activities, a significant increase from $21.5 million a year prior.

As of March 31, 2025, the company held $131.4 million in cash and cash equivalents against total current liabilities of $141 million. This is compared to $295.3 million and $118.2 million respectively at the end of December 2024.

Badger Meter also reported a record free cash flow of $30 million, marking a 60% increase year over year, driven by improved earnings and effective management of working capital.

Future Outlook

Looking ahead, Badger Meter anticipates a more challenging year-over-year comparison for the second quarter but remains optimistic about long-term growth. Management expects consistent high single-digit revenue growth over time and maintains its normalized gross margin expectation in the 38–40% range, while acknowledging potential tariff pressures.

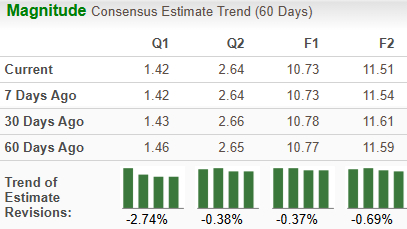

Current Zacks Rank

Badger Meter currently holds a Zacks Rank #3 (Hold). To explore the complete list of today’s Zacks #1 Rank (Strong Buy) stocks, please click here.

Recent Results from Other Companies

BlackBerry Limited (BB) posted a non-GAAP EPS of 3 cents for the fourth quarter of fiscal 2025, avoiding a loss that had been anticipated. This performance matches the non-GAAP EPS from the same quarter last year. The Zacks Consensus Estimate for this quarter was set at 2 cents per share.

Shares of BB have gained 13.3% over the past year.

Simulations Plus, Inc. (SLP) reported adjusted earnings of 31 cents per share for the second quarter of fiscal 2025, falling 3% compared to last year but surpassing the Zacks Consensus Estimate of 25 cents per share.

SLP’s shares have declined by 27.4% in the past year.

CSX Corporation (CSX) delivered disappointing first-quarter results for 2025, with earnings and revenues falling short of Zacks Consensus estimates. CSX reported EPS of 34 cents, missing the estimate of 37 cents and reflecting a 26% decrease year over year due to lower revenues.

Over the past year, CSX shares have decreased by 20%.

Zacks’ Top Stock Recommendations

Our team recently identified five stocks poised for exceptional growth, with the highest potential for doubling returns soon. Among these, Research Director Sheraz Mian highlights one stock showcasing remarkable innovation and a rapidly expanding customer base of over 50 million. This company offers a diverse range of advanced financial solutions, making it a strong candidate for significant growth.

Please note: While all our selected stocks carry potential, not all will succeed. This particular stock could surpass previous Zacks champions, such as Nano-X Imaging, which rose 129.6% in just over nine months.

Free: Discover Our Top Stock and Four Runners-Up

Want the latest recommendations from Zacks Investment Research? You can download “7 Best Stocks for the Next 30 Days.” Click here for this complimentary report.

CSX Corporation (CSX): Free Stock Analysis Report

Badger Meter, Inc. (BMI): Free Stock Analysis Report

Simulations Plus, Inc. (SLP): Free Stock Analysis Report

BlackBerry Limited (BB): Free Stock Analysis Report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.