AI Innovations and Tariffs Shape Medical Info Systems Industry in 2025

The Medical Info Systems industry is on a significant growth trajectory in 2025, spurred by new federal initiatives and robust regulatory support. A driving force behind this expansion is Donald Trump’s $500 billion Stargate AI project, designed to enhance AI infrastructure across various sectors, including healthcare, with initial backing from companies such as SoftBank, OpenAI, Oracle, and MGX. According to a report from the Business Research Company, the application of AI within the medical device market is projected to experience a Compound Annual Growth Rate (CAGR) of 29.9% between 2026 and 2029. This rising demand for digital healthcare solutions offers lucrative opportunities for companies like Veeva Systems (VEEV), Hims & Hers Health (HIMS), and Butterfly Network (BFLY).

However, this optimistic outlook faces challenges from another aspect of Trump’s economic policy: tariffs. The administration’s recent hikes in tariffs—up to 145% on Chinese goods, 32% on Taiwanese imports, and 46% on Vietnamese products—pose a risk to America’s AI objectives.

Understanding the Medical Info Systems Industry

The Zacks Medical Info Systems industry includes companies that develop and sell healthcare information systems. These firms provide software and hardware solutions to healthcare providers, enabling secure and efficient access to real-time clinical, administrative, and financial data. Growing emphasis on patient satisfaction, data security, and managing administrative costs has intensified the need for advancements in big data, cloud computing, blockchain, and AI technologies. Key players like Omnicell and Allscripts are benefiting financially from the booming sales of software, related hardware, professional services, and ongoing service contracts for software maintenance.

Trends Influencing the Medical Information Sector

AI and Health

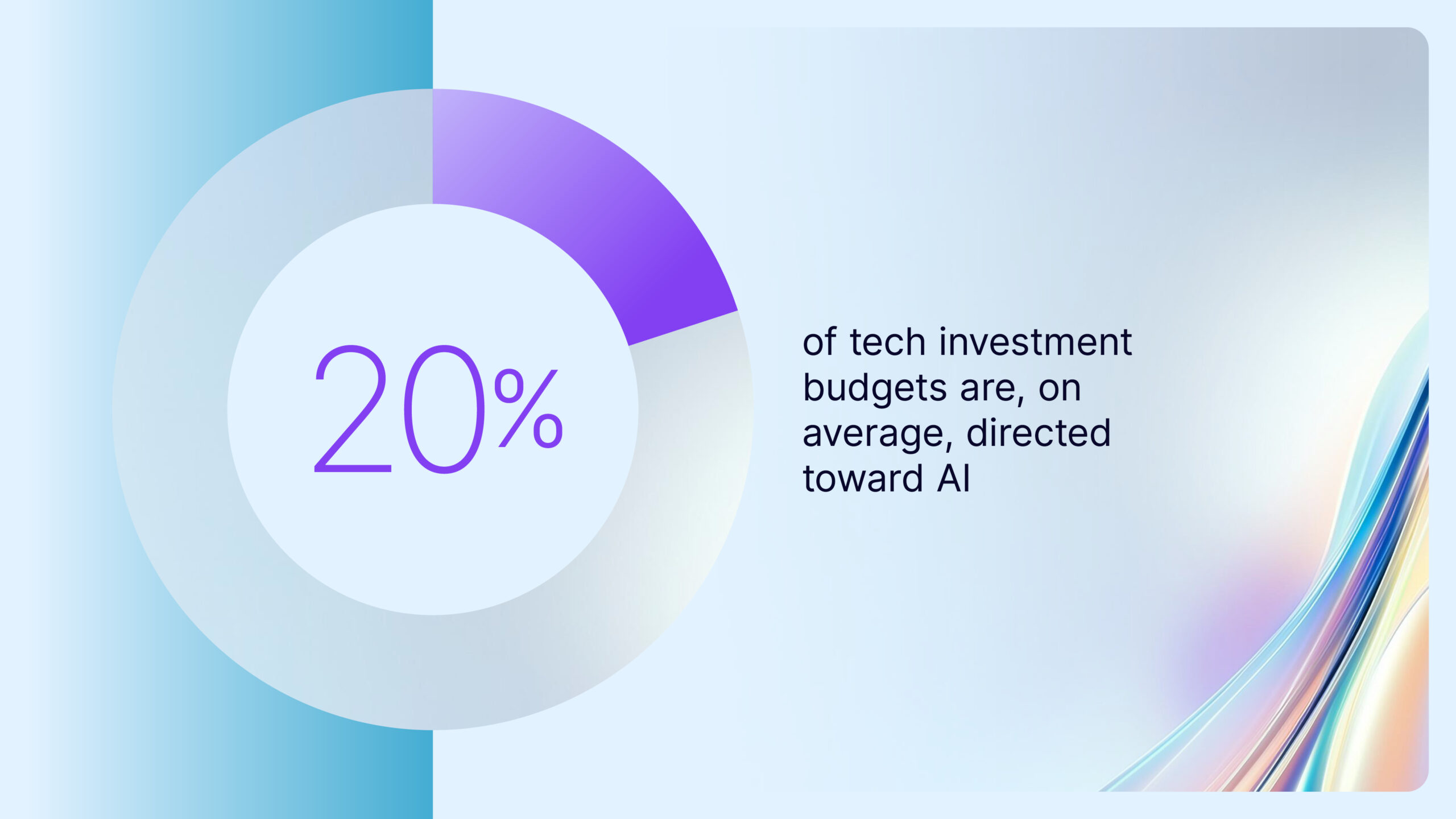

The medical field is a major adopter of AI, utilizing it for the synthesis of new drug compounds and the development of devices that enhance diagnostic precision and speed. Applications range from generative AI technologies to surgical robotics, particularly in diagnostic environments. Increasing prominence of tools like electronic health records and predictive analytics supports this trend. Trump 2.0’s $500 billion Stargate initiative aims to bolster this momentum by improving data management and interoperability. A Pragma Market Research report anticipates the global AI in healthcare market will reach $95.65 billion by 2025, with AI-powered innovations like Google’s DeepMind and Medtronic and Apple’s AI-enabled wearables driving enhanced diagnostics and continuous patient monitoring.

Rising Demand for Remote Healthcare

The remote patient monitoring segment within the medical info systems space is rapidly expanding, propelled by the increasing use of wearable devices and telehealth services. Greater awareness of the advantages of continuous patient monitoring has emerged as a key factor in enhancing the quality and efficiency of medical care. Furthermore, health tech products are transforming the diagnosis process and streamlining hospital workflows via robotics and AI-driven chatbots. According to a Custom Market Insights report, the global smart healthcare products market, valued at $145.9 billion in 2023, is expected to grow to $485.71 billion by 2032, achieving a CAGR of 12.78%.

Tariff Impacts on AI Ambitions

The sweeping tariffs imposed by the Trump administration pose significant challenges to America’s AI goals, especially in healthcare. While the $500 billion Project Stargate seeks to establish the U.S. as a global AI leader, escalating costs for imported hardware essential for AI infrastructure, such as servers and other equipment, complicate efforts to develop necessary data centers. Although semiconductor chips are exempt, many critical components for AI applications are now subject to high tariffs, adversely affecting the medical device sector that relies heavily on advanced technology for early disease detection, predictive care, and personalized treatment. This creates additional hurdles for smaller hospitals and startups as they navigate risky investment conditions amid uncertain trade relations.

Zacks Industry Rank Analysis

Currently, the Zacks Medical Info Systems industry holds a Zacks Industry Rank of #28, placing it in the top 11% of over 250 Zacks industries. This ranking, determined by averaging the Zacks Rank of its constituent stocks, indicates favorable near-term prospects for the sector. Historically, top-ranking Zacks industries outperform their lower-ranked counterparts by a ratio exceeding 2 to 1.

A closer look at several stocks with promising earnings outlooks will follow, though it’s prudent to first evaluate the industry’s historical shareholder returns and current valuations.

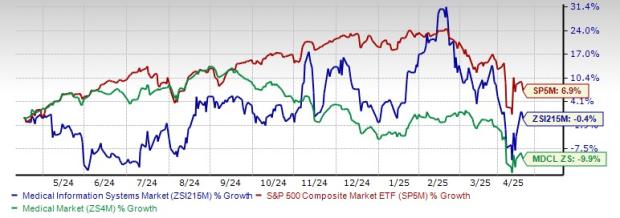

Industry Performance and Valuation Insights

Over the past year, the Medical Info Systems industry has trailed both the Zacks S&P 500 composite and its own sector. The industry has experienced a 6.6% decline over the past year, while the Zacks Medical sector saw a decrease of 4.4%, contrasting with the S&P 500’s impressive gain of 25.3% during the same period.

One Year Price Performance

Current Industry Valuation

Currently, the industry is trading at 3.95X based on its forward 12-month price-to-sales (P/S) ratio, compared to 4.56X for the S&P 500 and 2.50X for the sector. Over the last five years, the industry has fluctuated from a high of 15.78X to a low of 3.29X, with a median of 5.50X, illustrating the volatility within this segment.

Price-to-Sales Forward Twelve Months (F12M)

Price-to-Sales Forward Twelve Months (F12M)

Promising Stocks in Medical Info Systems

Veeva Systems provides cloud-based software applications and data solutions specifically designed for the life sciences sector.

Veeva Systems and Hims & Hers: Strong Growth Prospects in Life Sciences

The company’s Veeva Vault stands as the first cloud-based content management system tailored specifically for the life sciences segment. Vault CRM, a next-generation customer relationship management tool, is part of Veeva Commercial Cloud. This software suite includes data and services aimed at enhancing commercial excellence in the life sciences industry.

Veeva Systems Financial Outlook

Veeva Systems currently holds a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for fiscal 2026 earnings suggests a 10.8% improvement from the previous year. Moreover, analysts expect the company to report earnings growth of 11% for the same fiscal year.

Price and Consensus: VEEV

Hims & Hers Health Market Potential

Hims & Hers Health is tapping into a substantial unmet healthcare market, with a total addressable market of $360 million across various specialties, including mental health, weight loss, and dermatology. Its personalized offerings are driving subscriber growth, with over 2 million subscribers contributing to increased recurring revenues. The company aims to generate $100 million from new categories by 2025 and is investing in GLP-1 weight-loss solutions, advanced technologies, and compounding pharmacies to enhance its scaling capabilities.

Hims & Hers Health currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for 2025 earnings indicates a significant 58% increase from the 2024 level, with expected revenue growth of 166.7% for the same period.

Price and Consensus: HIMS

Butterfly Network’s Innovations

Butterfly Network is a digital imaging company that is quickly gaining traction with its proprietary Ultrasound-on-Chip semiconductor technology and ultrasound software solutions. In 2018, it introduced the world’s first handheld, single-probe, whole-body ultrasound system, the Butterfly iQ. This was followed in 2020 by the iQ+ and the anticipated iQ3 in 2024. Butterfly Network combines innovative hardware, intelligent software, AI, and support services to promote the adoption of economical and accessible imaging.

Currently, BFLY holds a Zacks Rank #2. The Zacks Consensus Estimate for 2025 earnings indicates a 5.9% improvement from the 2024 level, with sales growth expected at 18.9% for the same period.

Price and Consensus: BFLY

Stock Recommendations from Zacks Research

Zacks’ Research Chief has named a “Stock Most Likely to Double.” Their experts have identified five stocks that show the highest potential for a +100% gain in the coming months. Director of Research Sheraz Mian spotlights one particular stock poised for significant growth.

This top pick is part of an innovative financial firm with a rapidly growing customer base of over 50 million and a broad range of cutting-edge solutions. While not all elite selections will succeed, this stock is expected to outperform previous Zacks picks, such as Nano-X Imaging, which surged by +129.6% in just over nine months.

For more insights, you can access our report on the top stock, along with four runners-up. Interested in the latest stock recommendations from Zacks Investment Research? Download the “7 Best Stocks for the Next 30 Days” report for free. Click here to get it.

Veeva Systems Inc. (VEEV): Free Stock Analysis report.

Hims & Hers Health, Inc. (HIMS): Free Stock Analysis report.

Butterfly Network, Inc. (BFLY): Free Stock Analysis report.

This article was first published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.