La Rosa Holdings Corp. Reports Significant Revenue Growth but Wider Losses

Shares of La Rosa Holdings Corp. (LRHC) have decreased by 10.1% following the release of their financial results for 2024. This contrasts starkly with the S&P 500 index, which recorded a modest growth of 0.2% in the same period. Over the past month, La Rosa’s stock has plummeted 37%, while the S&P 500 has declined by 8.4%.

Strong Revenue Growth Amid Increased Losses

La Rosa reported for 2024 revenues of $69.4 million, marking a 119% increase from $31.8 million in 2023, and exceeding their guidance by $4.4 million. A significant driver of this growth was the 179% increase in residential real estate services revenues, which climbed to $57 million from $20.5 million the previous year.

The company’s property management revenues rose 15% to $11.1 million, while revenues from commercial real estate surged by 183%, reaching $328,000 compared to $116,000 in 2023. However, La Rosa’s net loss widened to $15.9 million, or 79 cents per share, from a loss of $9.3 million, or $1.27 per share, in the previous year. This deterioration is attributed to rising general and administrative expenses and increased interest costs.

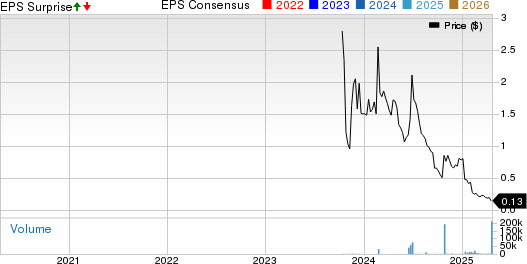

Price, Consensus, and EPS Surprise Metrics

La Rosa Holdings Corp. price-consensus-eps-surprise-chart | La Rosa Holdings Corp. Quote

Additional Business Metrics

The company’s gross profit surged by 110%, reaching $6 million up from $2.8 million a year earlier. Despite this gain, total operating expenses increased markedly to $17.2 million from $9.9 million in 2023, driven by sales and marketing, general and administrative costs, and a goodwill impairment of $787,438. Notably, general and administrative costs, excluding stock-based compensation, rose to $11.6 million from $4.8 million in the prior year.

La Rosa’s acquisitions in 2024 accounted for an additional $9.8 million in revenues, alongside full-year contributions from six acquisitions made in 2023. By March 31, 2025, the company’s agent network had expanded to over 2,500 licensed brokers and sales associates.

Management Insights

CEO Joe La Rosa highlighted that the company’s “agent-first brokerage model” has been essential for its growth. This model, featuring flexible compensation plans including 100% commission options, has attracted top talent. Management also emphasized the integration of technological solutions, such as the enhanced “My Agent Account” platform that now includes modules for property management payments.

La Rosa aims to further scale operations through additional acquisitions and geographical expansion. The company has set a revenue target of $100 million for 2025, with a pending acquisition of a brokerage firm that reported $19 million in revenues for 2023 and employed about 945 agents, which could represent a significant milestone.

Influencing Factors

The substantial revenue increase in 2024 is largely attributed to acquisitions and enhancements in service offerings across residential, property management, and commercial segments. However, the sharp rise in expenses—including stock-based compensation of $4.7 million, interest expenses, and amortization of debt discounts—contributed to the broader net loss. The company also faced a $1.3 million change in the fair value of derivative liabilities and a $778,000 loss on debt extinguishment, which further pressured its results.

Macroeconomic factors such as rising mortgage rates and limited housing affordability continue to affect the overall housing market, hindering transaction volumes and extending property marketing timelines.

Company Guidance

La Rosa reaffirmed its $100 million revenue target for 2025 and expressed confidence in achieving profitability through enhanced agent productivity and improved operational efficiencies. Furthermore, the company received a 180-day extension from Nasdaq to comply with the $1 minimum bid price rule—an outcome they believe will support their strategic initiatives.

Recent Developments

In 2024, La Rosa expanded its geographic reach, opening its first office in North Carolina and acquiring full or majority ownership in 12 brokerage firms across states including Georgia, California, Florida, and Texas. The launch of the LR Agent Advance program in April 2025 is aimed at enhancing agent retention by providing upfront access to commissions. Moreover, the company started accepting cryptocurrency payments from agents in December 2024, responding to shifting financial preferences.

As of April 8, 2025, La Rosa had not yet regained compliance with Nasdaq’s minimum bid rule but was granted an additional 180-day grace period extending to October 6, 2025. The company is currently considering options, including a potential reverse stock split, to preserve its Nasdaq listing.

Research Chief Predicts “Best Pick to Double”

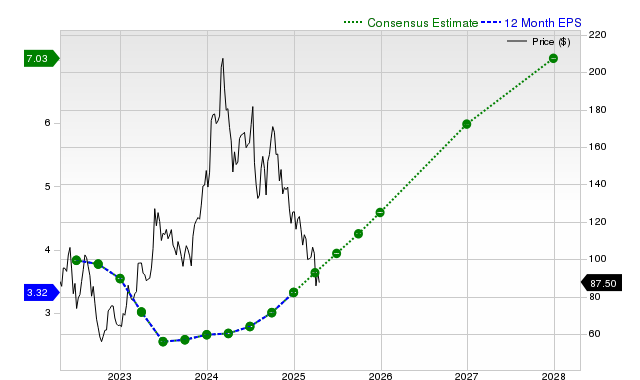

From a wide array of stocks, five Zacks experts selected their top pick projected to exceed +100% growth in the coming months. Among these, Director of Research Sheraz Mian identified one stock with the highest potential upside.

The selected company appeals to millennial and Gen Z consumers, having generated nearly $1 billion in revenue last quarter alone. A recent price dip makes it an attractive buying opportunity. While not every recommendation is guaranteed success, this stock could outperform past Zacks winners such as Nano-X Imaging, which surged by +129.6% within just over nine months.

Free: See Our Top Stock And 4 Runners Up

La Rosa Holdings Corp. (LRHC): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.