Netflix Reports Strong Q1 Earnings with Impressive Subscriber Growth

Netflix (NFLX) shares surged following robust first-quarter results, closing at $973.03, a weekly increase of 2.33%. The stock is trading close to its 52-week high of $1,064.50, marking a year-to-date gain of just over 9%. Following the earnings announcement, shares climbed more than 4% in after-hours trading.

On Monday, shares rose an additional 3% in premarket trading. This uptick was driven by a positive annual revenue outlook, which reassured investors of the company’s resilience amid potential economic challenges.

Financial Performance Highlights

Netflix reported first-quarter earnings for 2025 at $6.61 per share, exceeding the Zacks Consensus Estimate by 16.17% and reflecting a 54.8% increase year over year.

Revenues reached $10.54 billion, a 12.5% year-over-year increase, or 16% when adjusted for foreign exchange (F/X) effects. This growth was primarily fueled by an increase in subscriptions and enhanced pricing strategies, partially tempered by foreign exchange fluctuations. Revenue figures modestly surpassed guidance due to stronger-than-expected subscription and ad revenues, although they were slightly below the consensus estimate by 0.04%.

Revenue from the United States and Canada (UCAN) rose 9% year over year, a decline from the 15% growth seen in the fourth quarter of 2024. This slowdown was attributed to a partial quarter impact from price changes and the lack of advertising revenue from Christmas Day NFL games.

See the Zacks earnings Calendar to stay ahead of market-making news.

Shifts in Subscriber Reporting and Engagement Metrics

In a strategic change, Netflix will no longer report specific subscriber counts starting from Q1 2025. The company aims to concentrate on financial metrics and user engagement instead. Unlike tech giants such as Apple (AAPL) and Amazon (AMZN), which do not disclose subscriber figures, other media companies like Disney (DIS) continue to report such data.

Beginning with the second quarter of 2025 results, Netflix plans to publish a bi-annual engagement report detailing viewing statistics, which covers 99% of user engagement on the platform, alongside its second and fourth-quarter earnings results.

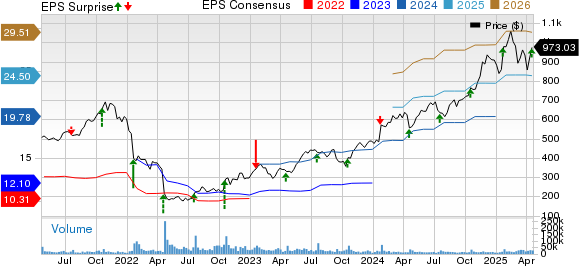

Netflix, Inc. Price, Consensus and EPS Surprise

Netflix, Inc. price-consensus-eps-surprise chart | Netflix, Inc. Quote

Content Drives Q1 Subscriber Engagement

This strong performance can be attributed to a compelling content lineup. Notable hits include Adolescence, the platform’s third most popular English-language series ever with 124 million views, and the limited series Back in Action starring Cameron Diaz and Jamie Foxx, which garnered 146 million views. Other popular titles included the French film Ad Vitam with 63 million views and the Mexican film Counterattack with 59 million views.

With a Zacks Rank of #3 (Hold), Netflix attributed its first-quarter gains to the diverse appeal of its intellectual property. Standout genres included action with The Night Agent Season 2 (50 million views), comedy with Running Point (36 million views), and true crime with American Murder: Gabby Petito (52 million views). The platform also achieved notable success with non-English titles, across various languages and formats.

Furthermore, Netflix experimented with new formats, licensing four episodes of the toddler learning series Ms. Rachel (29 million views) and launching season 2 of Inside (2 million views), a reality show featuring the Sidemen.

Operational Insights

Operational metrics displayed healthy trends, with marketing expenses increasing 5.2% year over year to $688.4 million. As a percentage of revenues, marketing expenses contracted by 50 basis points (bps) to 6.5%.

Operating income grew 27.1% year over year, reaching $3.34 billion. Operating margin expanded by 370 bps to 31.7%, slightly exceeding initial forecasts due to revenue upside and specific timing of expense spending.

Balance Sheet & Cash Flow Situation

As of March 31, 2025, Netflix held $7.19 billion in cash and cash equivalents, down from $7.8 billion at the end of the previous year. Total debt was reported at $15.01 billion, reducing from $15.57 billion as of December 31, 2024.

The company’s streaming content obligations reached $21.79 billion by the end of Q1 2025, a decrease from $23.24 billion at the close of 2024. Netflix’s free cash flow for the quarter was $2.66 billion, which represents a substantial increase from $1.37 billion in the prior quarter.

During this quarter, NFLX paid down $800 million in senior notes using resources from a 2024 refinancing and purchased back 3.7 million shares for $3.5 billion. The company has $13.6 billion of share repurchase authorization remaining.

Looking ahead to the second quarter, Netflix has $1 billion in debt maturities, which will be managed with proceeds from the prior year’s investment grade bond issuance currently held in short-term assets.

Future Outlook

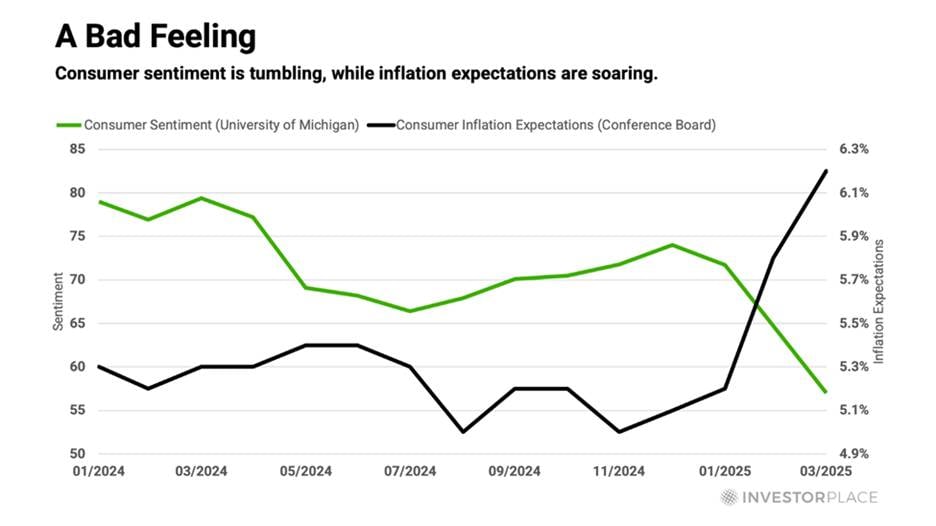

Forward guidance remains positive. Netflix anticipates a 15.4% revenue increase for the second quarter of 2025 (17% F/X neutral), targeting $11.035 billion in revenue. The company expects to benefit fully from recent pricing changes and continued membership growth.

Netflix Targets Growth and Revenue Milestones by 2030

Netflix, Inc. (NFLX) has reported a positive outlook for its upcoming financial performance, expecting increased membership and advertising revenues. The company forecasts a revenue growth reacceleration for its UCAN segment in the second quarter, with expected revenues estimated at $10.96 billion.

Projected Earnings and Operating Margins

For the second quarter, Netflix anticipates earnings of $7.03 per share, while the Zacks Consensus Estimate stands lower at $6.22 per share. The company is also projecting an operating margin improvement to 33%, reflecting approximately a 6 percentage point year-over-year increase. Management attributes this enhancement to recent price adjustments, increased subscriber numbers, and growing advertising revenues.

New Content Launches for Q2

In the second quarter, Netflix will introduce several new films. Notable releases include Nonnas, featuring Vince Vaughn, and Tyler Perry’s drama Straw, starring Taraji P. Henson. Other highlights are Bullet Train Explosion from Japan and Havoc, an action thriller featuring Tom Hardy and Forest Whitaker. In addition, new series such as Forever, inspired by Judy Blume’s classic novel, and romantic comedy The Royals based in India, will debut. Popular series like America’s Sweethearts: The Dallas Cowboys Cheerleaders, Black Mirror, and Ginny & Georgia will return for new seasons.

Advertising Business and Revenue Projections

On April 1, Netflix launched its Ad Suite in the United States, with plans for international expansion soon. Management is optimistic, expecting advertising revenue growth to double by 2025, marking confidence in this emerging business segment. Furthermore, Netflix projects 2025 revenues to fall between $43.5 billion and $44.5 billion, driven by robust member growth, increased subscription pricing, and a potential doubling of advertising revenues, even as foreign exchange fluctuations may have an offsetting effect.

Long-Term Goals and Growth Strategy

Netflix maintains its target of achieving a 29% operating margin by 2025, based on foreign exchange rates as of January 1 of that year. Despite various economic challenges, the company’s overall outlook remains consistent with its previous earnings report. Currently, the dollar’s recent weakness suggests Netflix is tracking towards the upper end of its revenue guidance.

A bold initiative announced recently includes the company’s goal to double revenues by 2030 and reach a $1 trillion market capitalization. This growth strategy emphasizes content expansion, the addition of live programming, and the enhancement of its gaming and advertising sectors, aimed at achieving substantial revenue and profit increases in future years.

Successful Ad-Supported Tier

The ad-supported subscription model has proven successful, with more than 55% of new subscribers selecting this option in available markets. As a result, Netflix projects advertising revenues could reach $9 billion annually by 2030, representing an increasingly significant share of the company’s total revenue.

Zacks Investment Research Highlights Promising Stocks

In related financial news, Zacks’ research team has identified five stocks with a high likelihood of gaining over 100% in the upcoming months. Among these, Director of Research Sheraz Mian highlights a standout stock with a fast-growing customer base and diverse solutions that may significantly outperform prior Zacks’ picks.

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.