Netflix Q1 2025 Earnings Highlight Strong Revenue and Growth Potential

Image source: The Motley Fool.

Thursday, April 17, 2025

Call Participants

- VP of Finance, IR, and Corporate Development: Spencer Wang

- Co-CEO: Ted Sarandos

- Co-CEO: Greg Peters

- CFO: Spence Neumann

Need a quote from one of our analysts? Email [email protected]

Key Takeaways

- Revenue: Over $40 billion in Q1 2025, representing around 6% of consumer spending and ad revenues in served markets.

- Paid Households: More than 300 million paid households reaching over 700 million viewers.

- TV Engagement: Less than 10% of TV hours for connected households.

- Operating Margin: The forecast for a 29% operating margin for full-year 2025 remains unchanged despite Q1 outperformance.

- Advertising Revenue: Anticipated to nearly double in 2025 via upfronts, programmatic growth, and the scatter market.

- Ad Tech Platform: Proprietary suite introduced in Canada and the U.S., with plans to expand to 10 additional markets.

- Live Events: Upcoming Taylor/Sorento fight in July and a second NFL Christmas Day game secured for 2025.

- Free Cash Flow: Projected at $8 billion for 2025, likely used for share repurchases unless significant M&A activity occurs.

Summary

Netflix demonstrates a robust market position amid economic uncertainties, with stable retention and engagement metrics. Its ad-supported offering enhances resilience, complemented by the ongoing rollout of its proprietary ad tech platform, which offers better targeting for advertisers.

The content strategy leverages in-house animation, licensed content, and creator partnerships to tap into the approximately 80% of television viewing time not currently served by Netflix or YouTube.

AI tools are utilized to boost production efficiency and facilitate advanced visual effects for cost-effective projects.

Initiatives in gaming focus on IP-based titles, well-known franchises, children’s content, and social party games, with investment growth linked to verified member value.

“We have always said that we were in this to win,” stated Greg Peters regarding the gaming strategy. “We want to invest enough to ensure that we are playing to win. But we also come knowing that we have a lot to learn.”

Industry Glossary

Upfronts: Advertising sales events where networks promote upcoming content to secure commitments from advertisers.

Scatter Market: Ad inventory sold close to the air date, often at varying rates compared to upfront purchases.

Programmatic: Automated processes for buying and selling digital advertising inventory.

Full Conference Call Transcript

Spencer Wang: Good afternoon, and welcome to Netflix’s Q1 2025 earnings call. I am Spencer Wang, VP of Finance, IR, and Corporate Development. Joining me today are co-CEOs Ted Sarandos and Greg Peters, along with CFO Spence Neumann. Please note that we will share forward-looking statements, and actual results may vary. We will now take questions from analysts, starting with our results, outlook, and forecasts. Our first question comes from Robert Fishman of Moffett Nathanson. Robert asks about The Wall Street Journal report discussing Netflix’s internal aim to double revenue and triple operating income by 2030. What should investors anticipate regarding Netflix’s content spending trends over the next five years?

Ted Sarandos: We have a unique culture that thrives on open information. While internal discussions may occasionally be leaked, we want to clarify that while we engage in long-term aspirations, these do not equate to our forecasts. Our operating plans align with our external guidance. We don’t have traditional five-year forecasts, but we are committed to becoming the most loved and valued entertainment company for all stakeholders.

Greg Peters: I am glad to expand on this. We have ambitious long-term goals grounded in realistic growth potential. Currently, we boast over $40 billion in revenue and 300 million paid households, which represents a viewership of over 700 million individuals. Although we lead in streaming view share, we still have a minority presence in our addressable market. Less than 10% of TV hours are covered by our service among connected households. We believe there is ample room for growth in engagement, revenue, and profitability.

Spencer Wang: Thanks, Ted and Greg. The next question pertains to the economic landscape and consumer sentiment. Jason Helfstein from Oppenheimer inquires about entering a recession with your low-cost ad plan. How does this influence consumer behavior compared to past recessions?

Greg Peters: Noting the focus on the economic environment, we are monitoring consumer sentiment closely. Based on current business operations, there aren’t significant changes to highlight. Retention metrics remain strong and consistent, with no marked shifts in plan selection or uptake. Recent price changes fit within expectations, and we observe healthy engagement levels. Thus, from our perspective, everything appears stable.

Netflix Demonstrates Resilience Amid Economic Challenges and Expanding Offerings

Historically, the entertainment sector shows resilience during economic downturns, and Netflix has displayed a similar pattern. While it’s true that Netflix’s journey is relatively recent, the company has maintained a robust presence even in tough times. Notably, their low-cost advertising plan available in primary markets contributes to this resilience. The entry-level price of just $7.99 in the U.S. and Canada positions Netflix as an excellent value in entertainment, and expectations remain high for sustained consumer demand.

Ted Sarandos: Adding to that, our focus remains on elements within our control, particularly enhancing the value Netflix provides. In challenging economic conditions, home entertainment becomes increasingly important to households. Netflix offers significant value, both in absolute and in competitive terms. Although some international risks persist—such as taxes and levies linked to local regulations—our forecasts remain unchanged. The U.S. is our biggest market for content spending, but we produce original content in 50 countries, making us a net contributor to various economies and cultures. Recently, we reaffirmed our commitment to the UK and announced a billion-dollar investment in production in Mexico. Furthermore, in 2023, we dedicated $2.5 billion to Korean content. These examples highlight our global commitment to support employment, training, and local storytelling.

Our operations aid local economies, contributing positively wherever we work. Therefore, we feel less exposed to some of the international uncertainties.

Spencer Wang: Thank you, Ted. The focus on your content slate and the increasing time viewers spend watching Netflix is noteworthy as we consider pricing decisions.

Ted Sarandos: Indeed, our approach to price changes relies heavily on member feedback. We monitor when our investments align with member perceived value before adjusting pricing. Historically, even in economically challenging environments, we have maintained growth. This speaks to the difference between perceived value and price; for many, we represent solid value, even as they are mindful of their expenditures. Additionally, the introduction of a low-priced ad model enhances our ability to cater to a diverse consumer base. We will continue on our established path while enhancing both value and accessibility.

Spencer Wang: Thanks, Ted. Let’s shift to a question from John Hudlik at UBS regarding member retention trends now that Q4 showed strong paid net additions. Have we retained the majority of these subscribers, and what do the churn numbers indicate?

Greg Peters: Absolutely, Spencer. As I mentioned earlier, we’re experiencing strong and stable acquisition and retention trends, which resulted in notable member growth in Q1. In the previous quarter, we highlighted retention for large live events in Q4—such as the Paul Tyson fight, the NFL on Christmas Day, and the global phenomenon Squid Game. While these events drove excitement, they represented only a small portion of overall net additions. Retention for new members from these events mirrors trends for those attracted by our other popular content, suggesting stability in our retention numbers, which we view positively.

Spencer Wang: Thank you, Greg. Our next inquiry is from Michael Morris at Guggenheim. Given the strong operating margins in the first half of the year, could you discuss the key incremental costs expected to lower margins in the second half? Will these costs be weighted more towards Q3 or Q4?

Greg Peters: Certainly, Michael. As outlined in our report, we’re forecasting a 29% full-year operating margin. We manage margins primarily on a yearly basis; however, margins fluctuate quarterly based on content timing—a key driver reflected in our outlook. We anticipate content expenses will increase in Q3 and Q4 relative to the previous year, given the timing of our releases. Notably, our major titles are scheduled for the latter half of the year. Traditionally, Q4 brings a heavier film slate. We also expect sales and marketing expenses to increase in the second half, which is vital for supporting our content releases as well as ad sales. This growth is associated with bolstering our sales operations and capabilities. Overall, while we expect a heavier film slate in Q4, no significant differences between Q3 and Q4 margins are anticipated.

It’s worth mentioning, while we exceeded initial operating income expectations in Q1, this event was largely the result of timing in revenue and expenses. We anticipate this spend will balance out across the full year. With considerable macroeconomic uncertainty ahead, we maintain a cautious outlook.

Spencer Wang: Thank you, Ben. Let’s now pivot to questions around advertising. From Dan Salmon at New Street Research: Does the current macroeconomic climate affect your approach to television upfronts? What are your broad thoughts on this matter?

Netflix Discusses Ad Strategy and Tech Advancements Amid Market Dynamics

Ted Sarandos: Absolutely. As we continue to monitor the marketplace, there’s a noticeable lack of softness based on our direct interactions with buyers. In fact, we’re observing encouraging signs from clients as we approach our annual upfront event. It’s important to mention that while our advertising segment is currently modest, this small scale may provide some insulation against potential market shifts. Our proprietary ad tech suite is rolling out, having already debuted in Canada and the United States, with more markets to follow. This technology enhances capabilities that advertisers have indicated they desire. Overall, we are optimistic about roughly doubling our advertising revenue by 2025 through various channels including upfronts, programmatic expansion, and scatter.

Spencer Wang: Thank you, Ted. This nicely leads into our next question from Vikram at Baird. Can you provide an update on your first-party ad tech platform? How is the rollout performing in Canada, and what progress have you made in the U.S.?

Ted Sarandos: Certainly. The rollout of our ad suite marks a significant milestone for us, and we’ve put considerable effort into it. So far, the launches in Canada and the U.S. have gone according to expectations. We are actively learning and making improvements based on the live feedback we’ve received. In the coming months, we plan to expand across the remaining ten advertising markets in stages. One of the initial advantages of having our own ad servers is the increased flexibility for advertisers, which simplifies their buying process and enhances the overall buyer experience. This ease of transaction with Netflix fosters increased sales.

Furthermore, we anticipate that our first-party ad tech will allow us to offer more critical features to advertisers over time. These enhancements include greater programmatic availability, improved targeting capabilities, and more robust measurement and reporting tools. Such developments are already underway, with some elements delivered in specific territories while others will be rolled out gradually. Managing our own ad tech stack also gives us the power to curate a better quality ad experience for our members by increasing ad relevance, which is beneficial across the ecosystem.

Spencer Wang: Thank you for that insight. Speaking of ad relevance, Justin Patterson has a long-term query regarding advertisements. Netflix has found success in personalized content recommendations. What are the key steps to achieving similar success in ad content recommendations, and where do you see yourselves in that process?

Ted Sarandos: While I wouldn’t say we’ve completely mastered this aspect yet, we aspire to replicate the sophistication we’ve achieved with personalized content recommendations in the advertising sector. Our goal is to effectively match the right ad with the appropriate audience, the right viewer, and the specific title. Successfully integrating these elements should lead to better campaign outcomes for advertisers and an enhanced experience for our members, creating a win-win-win situation. Currently, we are in the early stages of this endeavor. Our transition to our ad platform, which we’ve recently launched in Canada and the U.S., has already expanded our targeting capabilities significantly. We are collecting unique Netflix data on various factors like life stage, interests, and viewing moods to improve targeted advertising. Recently, we’ve allowed advertisers to target on-boarded audiences and use modeled audiences as well as segments provided by select third-party vendors.

Looking forward to 2026, we aim to broaden our data targeting capabilities globally, and we’ll enhance measurement functionalities across all markets. By 2027, we plan to focus on advanced investments in machine learning optimizations and sophisticated measurement techniques. On top of that, the flexibility of our ad stack encourages the development of new ad formats and enhances targeting opportunities, paving the way for a promising future.

Spencer Wang: The innings analogy certainly provides a broader view of your progression.

Greg Peters: Exactly. It allows for more flexibility than a simple crawl, walk, run approach. There are many options ahead of us.

Ted Sarandos: Yes, we are preparing to step onto the field and start swinging. That’s where we currently stand.

Spencer Wang: Now, I will move forward with a series of content-related questions from analysts, starting with Rich Greenfield from Lightshed. With four major sports properties available currently, how should Netflix evaluate their strategic fit, specifically regarding the UFC, WWE premium live events, Formula 1 (F1), and Major League Baseball?

Ted Sarandos: Thanks, Rich. I would like to remind you that our live strategy encompasses more than just sports. Thus, I am not positioned to comment on any specific potential opportunities at this moment. However, I would like to direct your attention back to our overarching strategy.

Netflix’s Live Event Strategy and Future Content Plans Explained

Netflix continues to emphasize its unwavering commitment to live events, aiming to create significant experiences that resonate with audiences. Despite live content being a smaller portion of the overall content budget, the company recognizes the substantial impact it has on audience engagement. With 200 billion viewing hours logged, the live segment may seem minor; however, the outcomes in conversation and potential audience retention are compelling enough to warrant ongoing investment.

Among the upcoming highlights is the Taylor Sorento fight scheduled for July, which marks a rematch from a previous event that garnered record viewership as the most-watched women’s sporting event in U.S. history. Additionally, Netflix is set to showcase holiday football with an NFL game on December 25, 2025. The company has recently opted in for a second Christmas Day game, reinforcing its aim to broaden its live sports presence beyond just the U.S. market in the coming years.

Spencer Wang: Thanks, Ted. The next question comes from Matt Thornton of FPN Securities. Do you think video podcasts could perform well as a category on Netflix?

Ted Sarandos: Absolutely, Matt. We are continuously exploring various content formats and creators. The distinctions between podcasts and talk shows have blurred, and we aspire to collaborate with top creators across different media that audiences love. Our current efforts include producing numerous podcasts, some tied specifically to our shows like Squid Game and Diplomat, along with others that focus on various genres and talents. A recent example is our podcast You Cannot Make This Up, which follows Netflix stocks and is available wherever podcasts are hosted. As enthusiasm for video podcasts increases, we anticipate that some will find their way to Netflix sooner or later.

Spencer Wang: From Rich Greenfield again, how do you create iconic animated franchises? What does it really take to build out culturally relevant animated IP? Is the answer a different team, acquisitions, or something else entirely?

Ted Sarandos: Thanks, Rich. It’s essential to recognize that we are still relatively new in creating animated content, and it’s a wholly creative endeavor. We have seen both successes and setbacks. Notable successes include Leo, Seabees, and Guillermo del Toro’s Pinocchio, which won us an Oscar for Best Animated Feature. Demand for animated films is significant; in 2024, nine out of the ten most streamed movies were animated. Our strategy combines producing original content in-house along with licensing from partners like Universal Illumination and Sony. Currently, our animation team is developing a promising slate slated for release by 2027, including an engaging project titled In Your Dreams, expected in Q4.

Spencer Wang: Thanks, Ted. Our next question comes from Robert Fishman of MoffettNathanson. Considering the competitive landscape over the next five years, should investors expect Netflix to venture into short-form or creator-led content to compete directly with YouTube?

Ted Sarandos: I’ll begin with a broad perspective. We’ve always faced robust competition, including YouTube, as we vie for viewers’ attention. It’s crucial that we earn every viewing hour; nothing is taken for granted. The greatest opportunity lies in capturing the 80% of TV time unclaimed by either Netflix or YouTube. We also believe that Netflix offers a superior platform for certain creators and storytelling types, particularly in terms of monetization for those creators.

Ted Sarandos: We’re actively seeking the next generation of talented creators from diverse backgrounds. Today’s storytellers have access to tools that enable innovative approaches to narrative. While some content can be classified as premium, we maintain that our monetization model is one of the best available for premium projects. This allows us to assist creators in reaching wider audiences. Success stories like Miss Rachel, who has consistently ranked in the top ten since her Netflix debut, and our work with comedians like Kill Tony highlight our commitment.

Spencer Wang: Thank you. From Ben Swinburne of Morgan Stanley, we’re starting to see some of the fear around AI and content creation wane as major directors like the Russo brothers and Jim Cameron embrace the technology. What initiatives is Netflix pursuing to leverage AI for its creators? How impactful do you foresee this technology being, and can you share any examples?

Ted Sarandos: There’s a palpable excitement surrounding AI’s potential for content creation. Jim Cameron recently highlighted its ability to reduce movie production costs significantly, and I believe even a minor enhancement in quality could lead to massive opportunities. Currently, our talent is implementing AI tools for tasks such as set references, previs, VFX sequence preparation, and shot planning, which improve the overall production process. Traditionally, advanced visual effects were reserved for high-budget films, but today, AI tools make them more accessible to projects with smaller budgets, thus expanding creative possibilities.

Netflix Advances VFX and Game Offerings with AI and Interactive Experiences

Ted Sarandos: A recent example of technological innovation in filmmaking has me excited. Rodrigo Prieto, the director of photography on *The Irishman* just five years ago, faced the challenges of de-aging technology. Although it represented a considerable advancement, it still fell short of perfection and created hurdles on set for actors. Fast forward to today, Rodrigo is directing his first feature film, *Pedro Perrimore*, in Mexico. Utilizing AI-powered tools, he has effectively delivered de-aging visual effects at a fraction of the cost incurred for *The Irishman*. In fact, the entire budget of this new film was comparable to the VFX costs for *The Irishman*. This development showcases how creators can leverage new technologies to achieve what was once considered impossible, and it is an exciting time for our industry. Our focus remains on finding ways for AI to enhance both the member and creator experience.

Spencer Wang: Thank you, Ted. Our next question comes from David Joyce of Seaport Research Partners. With an extensive library of content, what strategies are you considering for improved discovery and engagement on the platform? Will it require structural changes to the recommendation engine or more marketing efforts?

Greg Peters: A surprising fact for many is that even our most popular titles contribute to less than 1% of total viewing time. Therefore, improving discovery and recommendation capabilities is crucial to unlock the value of Bella’s team’s investments worldwide. We consistently see improvements through our test results, indicating significant potential for enhancing our members’ experiences. To illustrate, last year, we started testing a more intuitive TV homepage, which had not seen major changes in over a decade. We believe this update will significantly enhance content discovery on Netflix and plan to roll it out later this year. Moreover, we are developing new capabilities like interactive search based on generative technologies, expected to further improve discovery. Our commitment to enhancing the user experience in this area is ongoing and will continue indefinitely.

Spencer Wang: Thanks, Greg. Up next, Michael Morris from Guggenheim would like to know about the adoption trends regarding extra member accounts since their launch. How have these accounts contributed to revenue growth, and do you see them as a source of future growth?

Ted Sarandos: We view extra member accounts as a valuable addition to our pricing model, providing members with flexibility to customize their Netflix experience. These accounts allow members to share the service with family or friends at a lower cost. So far, retention and engagement levels have been strong, indicating this option’s health within our offerings. However, while we appreciate the convenience it provides, extra member accounts have not been a significant growth driver, and we expect their impact to remain modest in the near future.

Greg Peters: I concur with Ted’s sentiments. While the extra member accounts have shown healthy growth, they do not substantially drive our business at this time.

Spencer Wang: Thanks for that clarification. Our next question comes from Justin Patterson from KeyBanc. Recently, Alon, who leads our Netflix games initiative, discussed making gaming more accessible to achieve mass market appeal. What types of games have resonated with Netflix users so far, and where do you see opportunities for enhancing the user experience to drive higher engagement with games?

Ted Sarandos: We’ve learned a great deal since launching our games, but consider this a multi-year journey—similar to our approach when launching new content categories or entering new markets. To answer your question about successful games, we are focusing on immersive narrative games anchored in our intellectual property. *Squid Game Unleashed* exemplifies this approach, with an upcoming update tied to new content from the series. Additionally, we have recently released a *Black Mirror*-themed Tamagotchi-style game, reflecting the series’ dark themes. Another successful category has been mainstream established titles, such as *Grand Theft Auto*, with plans to introduce more games of this nature.

We also aim to serve children with ad-free, safe gaming experiences, evident in our forthcoming *Peppa Pig* game announcement. A final category we’re exploring involves socially engaging party games, merging family board games with interactive digital experiences. Improving user experience, discovery, and the quality of our offerings remains a top priority. In terms of investment and growth in this gaming space, we are dedicated to winning and continue to learn and adapt as we move forward.

Streaming Giant Netflix Discusses Strategic Investments and Future Growth

Executives from Netflix recently emphasized a cautious approach to expanding their investments until they can ensure a strong conversion of spending into member value. Spence Neumann mentioned that the company’s current investments are still modest relative to their overall content budget. Ted Sarandos expressed confidence in their strategy, stating that as they gather more evidence supporting their plans, they will gradually increase their investments. Sarandos noted the long-term market opportunity is significant, with consumer spending projected at approximately $140 billion, excluding ad revenue. The firm remains committed to its strategic framework, enabling it to unlock potential value over time.

Revenue Growth Projections and Key Drivers

Spencer Wang redirected the conversation to inquire about the expected reacceleration of YouCan revenue growth in the second quarter, following a report of 9% year-over-year growth in Q1. Greg Peters clarified that much of the revenue deceleration stemmed from pricing timing, compounded by a challenging quarter due to comparisons with the prior year’s NFL advertising successes. However, he expects accelerated growth in Q2, benefiting fully from year-over-year pricing adjustments. While advertising remains a smaller segment compared to subscriptions, it continues to grow steadily.

Future Free Cash Flow and Share Buyback Plans

In a follow-up inquiry from Alan Gould of Loop Capital about the company’s forecast of $8 billion in free cash flow by 2025, Peters reaffirmed their consistent capital allocation policy. He stated the company’s focus is on profitable growth through reinvestment while also maintaining liquidity. Any excess cash would likely be used for share repurchases rather than large acquisitions, assuming no significant mergers or acquisitions arise.

Acknowledgment of Long-time Board Member

Before concluding, Ted Sarandos took a moment to recognize Tim Haley’s invaluable contributions after 27 years on the board of directors. His guidance and support have played a crucial role in shaping Netflix into what it is today. Sarandos expressed gratitude for Haley’s service, noting that his wisdom has been instrumental through periods of significant change and growth.

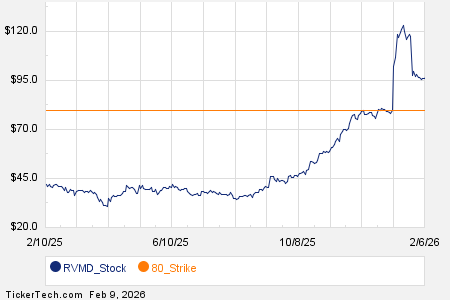

Investment Opportunities

For those looking to invest, our analyst team has identified current opportunities worth consideration. Stock Advisor boasts an average return of 792%, outperforming the S&P 500’s 153%. They’ve recently highlighted the 10 best stocks for investors to consider now, details provided upon joining Stock Advisor.

Disclaimer

This article is a transcript of the conference call produced for The Motley Fool. While striving for accuracy, there may be errors or omissions. Parts of this article were generated with AI based on The Motley Fool’s insights, but have been reviewed by quality control systems. The Motley Fool does not assume responsibility for your use of this content and encourages independent research, including reviewing the SEC filings of discussed companies.

The Motley Fool has positions in and recommends Netflix and follows a specific disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.