Three Strong Buy Stocks for Investors to Consider

For investors looking for promising opportunities, here are three stocks with strong buy ranks and solid growth potential to consider as of April 21:

M-tron Industries, Inc. (MPTI)

M-tron Industries, Inc. specializes in manufacturing frequency and spectrum control products. Currently, it holds a Zacks Rank #1, with the Zacks Consensus Estimate for its current year earnings increasing by 13.8% over the past 60 days.

M-tron Industries, Inc. Price and Consensus

M-tron Industries, Inc. price-consensus-chart | M-tron Industries, Inc. Quote

M-tron Industries has a PEG ratio of 0.68, significantly lower than the industry average of 1.31. Additionally, the company possesses a Growth Score of B.

M-tron Industries, Inc. PEG Ratio (TTM)

M-tron Industries, Inc. peg-ratio-ttm | M-tron Industries, Inc. Quote

Sterling Infrastructure, Inc. (STRL)

Sterling Infrastructure, Inc. operates in the e-infrastructure, transportation, and building solutions sectors. It also holds a Zacks Rank #1, with its current year earnings estimate rising by 29.3% over the last two months.

Sterling Infrastructure, Inc. Price and Consensus

Sterling Infrastructure, Inc. price-consensus-chart | Sterling Infrastructure, Inc. Quote

Sterling Infrastructure has a PEG ratio of 1.14, which is on par with the industry average of 1.31. The company holds a strong Growth Score of A.

Sterling Infrastructure, Inc. PEG Ratio (TTM)

Sterling Infrastructure, Inc. peg-ratio-ttm | Sterling Infrastructure, Inc. Quote

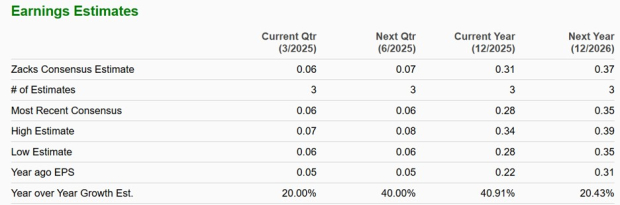

BGC Group, Inc. (BGC)

BGC Group, Inc. is a financial brokerage and technology firm. It too carries a Zacks Rank #1, with its earnings estimates increasing by 15.1% over the previous 60 days.

BGC Group, Inc. Price and Consensus

BGC Group, Inc. price-consensus-chart | BGC Group, Inc. Quote

BGC Group boasts a PEG ratio of 0.28, well below the industry average of 1.05, and it possesses a Growth Score of B.

BGC Group, Inc. PEG Ratio (TTM)

BGC Group, Inc. peg-ratio-ttm | BGC Group, Inc. Quote

For a broader view, see the full list of top-ranked stocks here.

To understand more about the Growth Score and its calculation, click here.

Zacks Expert Highlights Top Doubling Stock

Zacks’ team has identified five stocks that hold the potential for gains of +100% or more in the coming months. Among these, Director of Research Sheraz Mian highlights one stock poised for significant upward movement.

This leading pick is among the most innovative firms in the financial sector, featuring a rapidly growing customer base exceeding 50 million and a comprehensive set of advanced solutions. While successes are never guaranteed, this stock is set to outperform past Zacks picks, such as Nano-X Imaging, which rose by +129.6% within just over nine months.

Free: See Our Top Stock And 4 Runners Up

BGC Group, Inc. (BGC): Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL): Free Stock Analysis Report

M-tron Industries, Inc. (MPTI): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.