Vertiv Prepares for First-Quarter 2025 Earnings Announcement

Vertiv VRT is set to report its first-quarter 2025 results on April 23.

Projected Financial Performance

For the upcoming quarter, Vertiv anticipates net sales in the range of $1.9 billion to $1.95 billion, representing an organic growth rate between 17% and 21% year over year. The company expects non-GAAP earnings between 57 cents and 63 cents per share.

The Zacks Consensus Estimate for first-quarter revenues stands at $1.92 billion, reflecting a year-over-year growth of 16.92%. Consensus estimates for earnings are also unchanged at 62 cents per share, indicating a significant year-over-year growth of 44.19%.

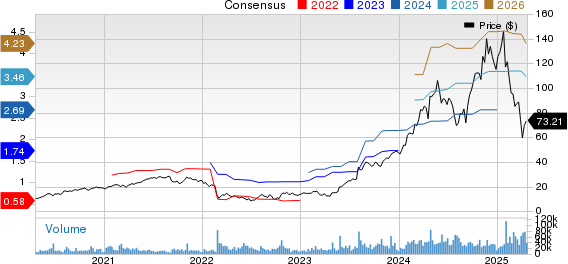

Vertiv Holdings Co. Price and Consensus

Vertiv Holdings Co. price-consensus-chart | Vertiv Holdings Co. Quote

Historical Earnings Performance

Vertiv has consistently surpassed the Zacks Consensus Estimate in the last four quarters, achieving an average earnings surprise of 13.67%. (Find the latest EPS estimates and surprises on Zacks earnings Calendar.)

Let’s review the key factors leading up to this announcement.

Key Factors Influencing VRT’s Q1 Results

As a supplier of cooling and power management infrastructure, Vertiv primarily serves data centers and is benefiting from a surge in AI-driven orders. Operators’ heightened emphasis on thermal management aligns well with Vertiv’s competencies, positioning the company to address the rising demand with innovative and efficient solutions.

Additionally, VRT’s recent product launches in March, including Vertiv Unify software and Vertiv SmartRun, enhance its capabilities in infrastructure management and advanced thermal solutions.

The rich partnerships with companies such as Ballard Power Systems, Compass Datacenters, NVIDIA NVDA, Intel, and ZincFive serve as a significant advantage for Vertiv.

Stock Performance Compared to Industry

Year-to-date (YTD), Vertiv shares have fallen 35.6%, outperforming the Zacks Computer & Technology sector’s decline of 17.1% and the Zacks Computer IT Services industry’s drop of 19.6%. Comparative peers, Eaton ETN and Schneider Electric SBGSY, also experienced losses of 19.1% and 5.9%, respectively.

Factors contributing to VRT’s struggles include heightened tariffs from U.S. trade policies, particularly affecting China, alongside sluggish near-term order trends. Vertiv faces stiff competition from Eaton, which has invested over $8 billion into portfolio transformation.

Current Stock Trajectory

Vertiv shares are currently in a bearish trend, trading below their 50-day and 200-day moving averages.

Valuation Concerns

Despite its growth potential, Vertiv carries a Value Score of D, indicating a potentially stretched valuation. The company’s 12-month price/book ratio is 11.45, substantially higher than the sector average of 8.16, Eaton’s 5.67, and Schneider Electric’s 3.97.

Price/Book Ratio Comparison

Image Source: Zacks Investment Research

Pursuing Growth Amid Challenges

Vertiv is increasing its capacity in various solutions, including liquid cooling and thermal management, in response to AI-driven demand growth. The company operates 23 manufacturing facilities worldwide and has expanded its North American operations with a new 215,000-square-foot facility in Pelzer, SC.

Additionally, Vertiv launched a 7MW reference architecture for NVIDIA’s GB200 NVL72 platform, aimed at enhancing AI data center infrastructure. The collaboration with Ballard Power focuses on developing backup power solutions for data centers, and the integration of ZincFive BC Series UPS battery cabinets has enriched its backup power product line.

Conclusion: A Cautious Approach Recommended

Although Vertiv is seeing rapid expansion within the liquid cooling market, fierce competition poses significant challenges. Concerns surrounding order growth, tariff impacts, and pricey valuations create potential risks for investors. Presently, VRT holds a Zacks Rank #4 (Sell), suggesting it may be prudent for investors to refrain from investing in the stock for now.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks’ Research Chief Identifies “Stock Most Likely to Double”

Our team has released information on five stocks positioned for potential gains of 100% or more in the coming months. Director of Research Sheraz Mian highlights one exceptional stock with significant growth potential.

This top pick is from an innovative financial firm, boasting a fast-growing customer base of over 50 million and a diverse range of solutions. While not all picks guarantee success, this stock shows prospects for remarkable gains, akin to past Zacks selections such as Nano-X Imaging, which surged 129.6% in just over nine months.

Free: see Our Top Stock and 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to access this free report.

Eaton Corporation, PLC (ETN): Free Stock Analysis report

NVIDIA Corporation (NVDA): Free Stock Analysis report

Schneider Electric SE (SBGSY): Free Stock Analysis report

Vertiv Holdings Co. (VRT): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.