ServiceNow Faces Mixed Trends Ahead of Upcoming Q1 2025 Results

ServiceNow NOW is set to announce its first-quarter 2025 results on April 23. Analysts are keen to see the company’s performance as expectations build.

Key Revenue and Earnings Estimates

The Zacks Consensus Estimate for first-quarter revenues is currently at $3.08 billion, indicating an 18.37% growth from the same quarter last year.

For earnings, the consensus is set at $3.79 per share, which reflects an 11.14% increase year over year. In the past 30 days, the earnings projection has risen by a penny.

Notably, ServiceNow has exceeded the Zacks Consensus Estimate in all of its last four quarters, with an average surprise rate of 7.02%. (See the Zacks earnings calendar for further updates.)

ServiceNow, Inc. Price and Consensus

ServiceNow, Inc. price-consensus-chart | ServiceNow, Inc. Quote

Growth in Subscription Revenue Expected

ServiceNow anticipates first-quarter 2025 subscription revenues of between $2.995 billion and $3 billion. This projection points to an 18.5-19% year-over-year growth based on GAAP. When adjusted for constant currency, subscription revenues are expected to increase in the range of 19.5-20%. However, unfavorable foreign exchange rates are projected to negatively impact revenues by approximately $40 million.

The Zacks Consensus Estimate for first-quarter 2025 subscription revenue stands at $2.997 billion, reflecting an 18.8% year-over-year increase.

Recently, ServiceNow launched the Yokohama platform, set to contribute to quarterly results. This update introduces new AI agents across various domains, such as CRM, HR, and IT, enhancing productivity and streamlining workflows.

Moreover, the company’s AI-driven offerings have consistently attracted new clients. As of the fourth quarter of 2024, ServiceNow boasted 2,109 total customers with over $1 million in annual contract value, indicating a 14% year-over-year increase in clientele. Continuation of this momentum is anticipated in the upcoming quarter.

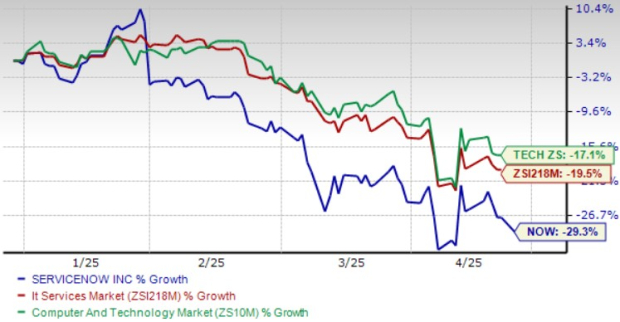

NOW Share Performance Analysis

Year to date (YTD), NOW shares have seen a decline of 27.1%, which is notably less than the 17.1% fall of the Zacks Computer & Technology sector, and the 19.5% drop observed in the Zacks Computers – IT Services industry.

NOW Stock’s YTD Performance

Image Source: Zacks Investment Research

The company’s decline can be attributed to challenges presented by the macroeconomic environment, particularly following U.S. tariff actions aimed at trading partners like China and Mexico, which are expected to adversely affect its federal business.

However, on a trailing 12-month basis, NOW shares achieved a return of 7%, outperforming the sector’s 2.8% gain and the industry’s 6% decline.

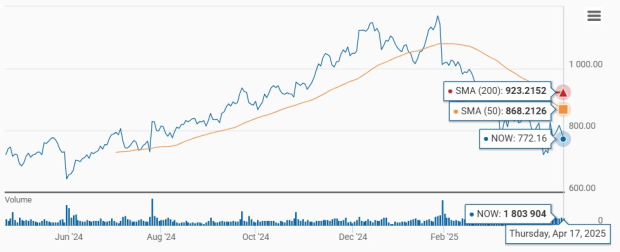

Technically, ServiceNow’s stock displays a bearish trend, trading below both the 50-day and 200-day moving averages.

ServiceNow Stock Trends

Image Source: Zacks Investment Research

Currently, ServiceNow has a Value Score of F, indicating a stretched valuation. As for the forward 12-month P/S ratio, NOW is trading at 11.65X, significantly higher than the sector’s 5.2X.

Price/Sales (F12M)

Image Source: Zacks Investment Research

Strengths from Portfolio and Partnerships

ServiceNow’s enhancement of its Yokohama platform is expected to bolster client acquisition. By heavily utilizing AI and machine learning, the company continues to improve the effectiveness of its offerings. Noteworthy partnerships with leading firms such as Alphabet GOOGL, Amazon, Microsoft, DXC Technology DXC, and NVIDIA NVDA bolster its market position.

This January, ServiceNow and Alphabet’s Google Cloud broadened their partnership, allowing ServiceNow to extend its Now Platform and a comprehensive suite of workflows to customers on the Google Cloud Marketplace. Additionally, its Customer Relationship Management and IT Service Management solutions will be available on Google Distributed Cloud.

Working with NVIDIA, ServiceNow introduced AI agents for the telecom sector, leveraging NVIDIA AI Enterprise software and the NVIDIA DGX Cloud platform. Recently, in March, ServiceNow and NVIDIA announced an expansion of their collaboration to enhance agentic AI by integrating advanced reasoning models into the ServiceNow platform for optimized business transformation.

The collaboration with DXC Technology led to the creation of DXC Assure BPM (Business Process Management). This combines DXC’s in-depth insurance expertise with ServiceNow’s unified platform and data framework.

Nevertheless, as ServiceNow prioritizes the acceleration of its Agentic AI, an expected delay in immediate revenues may affect subscription growth rates for 2025. The firm anticipates a forex impact of approximately $175 million for 2025, along with challenges from a back-end loaded federal business potentially impacting growth.

Conclusion on ServiceNow’s Trajectory

ServiceNow’s strong GenAI portfolio and extensive partner network are poised to support long-term subscription revenue growth. However, hurdles such as adverse forex conditions and tariff-related issues, combined with a stretched valuation, are significant concerns.

Currently, ServiceNow holds a Zacks Rank #3 (Hold), advising investors to wait for a more favorable opportunity to acquire shares. For a complete list of today’s Zacks #1 Rank (Strong Buy) stocks, click here.

Zacks’ Research Chief Highlights Stocks Set to Double

Our seasoned analysts have identified 5 stocks with the highest potential for gaining +100% within the next few months. Of these, the Director of Research Sheraz Mian has spotlighted one particular stock with immense upside potential.

This stock represents an innovative financial firm, boasting a rapidly expanding customer base (over 50 million) and a suite of advanced solutions. Although not every pick guarantees success, this one has the potential for significant returns, reminiscent of earlier standout Zacks stocks like Nano-X Imaging, which soared +129.6% in less than nine months.

Free: See Our Top Stock and 4 Runners Up

To receive the latest recommendations from Zacks Investment Research, download our report on the 7 Best Stocks for the Next 30 Days here.

NVIDIA Corporation (NVDA) : Free Stock Analysis report

ServiceNow, Inc. (NOW) : Free Stock Analysis report

Alphabet Inc. (GOOGL) : Free Stock Analysis report

DXC Technology Company. (DXC) : Free Stock Analysis report

This article initially appeared on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions contained in this article are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.