U.S. Stock Market Declines Offer Strategic Investment Opportunities

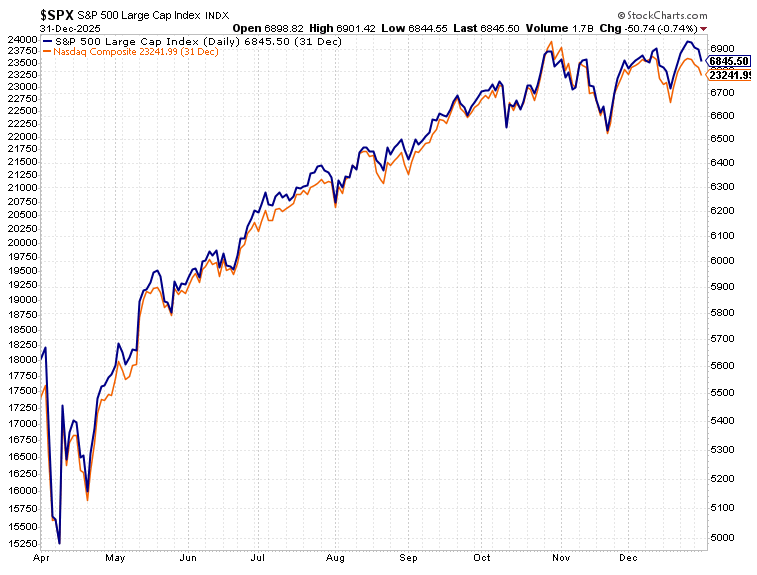

The U.S. stock market has experienced a significant downturn as trade tensions escalate under the Trump administration. The benchmark S&P 500 (SNPINDEX: ^GSPC) currently sits 16% below its record high from two months ago, and the technology-heavy Nasdaq Composite (NASDAQINDEX: ^IXIC) has fallen by 21%.

Historically, stock market downturns have been prime buying opportunities. Below, we outline two Vanguard index funds that are appealing, with neither priced above $500 per share.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to buy at this time. Learn More »

Investing in Vanguard S&P 500 ETF: A Strategic Choice for Diversification

The Vanguard S&P 500 ETF (NYSEMKT: VOO) tracks the performance of the S&P 500, which includes 500 major U.S. stocks across all 11 market sectors. This index fund enables investors to diversify their holdings among some of the most pivotal companies in the world. The five largest holdings by weight are:

- Apple: 7%

- Microsoft: 5.8%

- Nvidia: 5.5%

- Amazon: 3.7%

- Alphabet: 3.4%

As noted, the S&P 500 is presently 16% below its peak, placing the index in correction territory. This presents a solid buying opportunity for investors willing to wait, as historically the S&P 500 generates strong returns in the year following its first close in correction territory. Moreover, it has successfully rebounded from all previous downturns.

Additionally, despite experiencing seven corrections and three bear markets, the S&P 500 has delivered a remarkable 585% return over the last two decades, compounding at an annual rate of 10.1%. This impressive track record spans various economic conditions, leading investors to feel confident about similar returns in the future.

Finally, the Vanguard S&P 500 ETF boasts a competitive expense ratio of just 0.03%, which translates to an annual fee of only $3 for every $10,000 invested.

stock market indexes.” src=”https://g.foolcdn.com/image/?url=https%3A%2F%2Fg.foolcdn.com%2Feditorial%2Fimages%2F815441%2Fstock-market-1.jpg&w=700″>

Image source: Getty Images.

Vanguard Utilities ETF: Defensive Investments for Economic Uncertainty

The Vanguard Utilities ETF (NYSEMKT: VPU) reflects the performance of 69 firms within the utilities sector. Most of its assets focus on electric utilities (62%) and multi-utility companies (25%), while also investing in water and gas utilities. The five largest holdings, by weight, include:

- NextEra Energy: 10.9%

- Southern Company: 7.5%

- Duke Energy: 7%

- Constellation Energy: 4.7%

- American Electric Power: 4.3%

Utilities stocks are generally considered defensive because demand remains stable during economic fluctuations. Consequently, the utilities sector has a history of outperforming during recessions. The Vanguard Utilities ETF is thus a strategic choice for investors concerned about a potential economic downturn.

Moreover, the utilities sector has significantly less international revenue exposure compared to other market sectors, as most services are provided domestically. This characteristic indicates that utilities stocks may endure less impact from tariffs introduced by President Trump. Morgan Stanley analysts recently mentioned that “if tariffs are robust and long-lasting, defensive stocks in sectors such as healthcare and utilities may outperform.”

Notably, the Vanguard Utilities ETF also has a favorable expense ratio of 0.09%, meaning shareholders will incur just $9 annually on every $10,000 invested in the fund.

Should You Invest $1,000 in Vanguard S&P 500 ETF Right Now?

Before purchasing shares in the Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team has highlighted what they consider to be the 10 best stocks to buy at this moment, and the Vanguard S&P 500 ETF is not among them. The selected stocks could generate significant returns in the coming years.

For example, if you had invested $1,000 in Netflix when it was recommended on December 17, 2004, you would have $524,747*! Similarly, investing $1,000 in Nvidia on April 15, 2005, would result in $622,041*!

Furthermore, Stock Advisor boasts a total average return of 792%—significantly outperforming the S&P 500’s 153%.

*Stock Advisor returns as of April 21, 2025

Suzanne Frey, an executive at Alphabet, sits on The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, which is now an Amazon subsidiary, is also on the board. Trevor Jennewine has interests in Amazon, Nvidia, and the Vanguard S&P 500 ETF. The Motley Fool recommends and holds positions in Alphabet, Amazon, Apple, Constellation Energy, Microsoft, NextEra Energy, Nvidia, and the Vanguard S&P 500 ETF. The Motley Fool advises on Duke Energy and has options positions on Microsoft. The Motley Fool adheres to a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.