Comparing Lumen Technologies and Cogent Communications: Investment Insights

Lumen Technologies, Inc. (LUMN) and Cogent Communications Holdings, Inc. (CCOI) are key players in the enterprise-focused fiber network market. Both companies provide high-capacity, long-haul fiber networks that support a range of applications, including cloud services, streaming, AI data transfer, and enterprise connectivity.

The surge in demand for bandwidth-intensive applications driven by AI workloads and cloud infrastructure presents significant growth opportunities for these firms as they adapt to the evolving digital landscape.

This leads to an important question: Which stock represents a better investment choice today? To answer this, we will examine the fundamentals, valuations, growth prospects, and associated risks for each company.

The Strengths of LUMN

Lumen is recognized as a global communications services provider featuring advanced fiber-optic networks that ensure high-capacity data transport, edge computing, cloud connectivity, and cybersecurity. Shifting away from traditional telecom services, LUMN is making a significant focus on AI and aims to build the infrastructure necessary for AI and cloud-driven telecommunications.

The demand for connectivity fueled by AI initiatives has led Lumen to secure $8.5 billion in PCF deals for 2024. Major global companies across different sectors are racing to enhance their fiber capacity. Key partnerships include agreements with tech giants such as Microsoft (MSFT), Amazon, Google Cloud, and Meta Platforms, where Lumen is providing the necessary network capabilities for AI innovation. Last July, Microsoft chose Lumen to increase its network capacity to support next-generation applications for its global customers. Recently, Lumen also teamed up with Google Cloud to offer advanced cloud and enterprise network solutions designed to meet the scalability, security, and performance requirements of AI-led digital transformation.

The growing interest in Lumen’s services, particularly in its large enterprise and mid-market segments for Waves and IP, demonstrates its appeal. In 2024, Lumen expanded its high-speed IP service to incorporate 400-gig ports across 14 markets, while more than 70 markets now offer 400-gig Waves. The company reported a nearly 50% rise in sales of 100 and 400-gig waves within large enterprises and mid-market sectors for 2024.

Lumen plans to boost its inter-city fiber miles from 12 million in 2022 to 47 million by 2028. They aim to enhance network capacity while maximizing utilization. The company anticipates increasing overall network utilization from 57% to 70% from 2022 to 2028, largely driven by heightened demand from hyperscalers seeking to lease previously underused conduits and finance new network projects. Lumen forecasts $1 billion in cost savings by the end of 2027, through infrastructure simplification across its network, product offerings, and IT operations, anticipating over $250 million in run-rate cost benefits in the current year.

However, LUMN faces substantial debt challenges. As of December 31, 2024, the company held $1.889 billion in cash but had a long-term debt of $17.494 billion. Additionally, secular headwinds from its legacy business and increasing competition in the AI sector, particularly from Cogent, remain pressing concerns.

The Advantages of CCOI

Cogent operates as a Tier 1 Internet Service Provider, offering affordable, high-speed internet access, private network services, and colocation center solutions characterized by ultra-low latency data transfer.

The company has focused on providing larger 100 gigabit and 400 gigabit connections in specific locations, transforming its connection mix and lowering its average price per megabit. By utilizing internet routers without additional legacy equipment, Cogent manages to maintain relatively lower operational costs compared to competitors. Its efficient network expansion and integration practices assure high-quality internet service, capitalizing on its cost-effective metro and intercity network infrastructure. Consequently, Cogent achieves high throughput and minimizes dropped data packets during transmission, establishing a more stable network environment than traditional circuit-switched networks.

The acquisition of Sprint’s network assets has enhanced Cogent’s wavelength and optical transport capabilities, allowing it to directly compete with Lumen. During its latest earnings call, CCOI revealed that the acquisition has significantly boosted its wavelength sales capability and connectivity, reaching 808 locations across North America, surpassing its initial target of 800 sites by 2024. This acquisition also expanded Cogent’s data center presence by incorporating 115 newly reconfigured Sprint facilities into its existing network of 1,646 carrier-neutral data centers. The growing infrastructure scale positions Cogent to capture a larger share of enterprise, cloud, and carrier demand, driving top-line growth. Cogent reported its wavelength revenues at $7 million for the last quarter, a 124% increase from the same quarter last year, with customer connections rising to 1,118 from 661 a year prior.

Cogent has achieved over 90% of its target for $220 million in annual savings from the integration of Sprint’s assets, and it expects cost reductions to continue through 2026, likely exceeding its initial $220 million goal.

Despite these advantages, Cogent, like other competitors in the field, faces challenges from a highly competitive environment and broader macroeconomic issues. Weakness in its net-centric business and a heavily indebted balance sheet also raise red flags.

Price Performance and Valuation Analysis for LUMN & CCOI

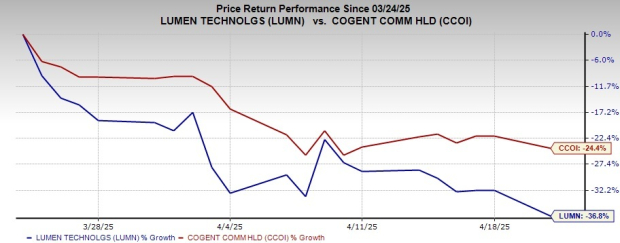

In the past month, LUMN’s stock has decreased by 36.8%, while CCOI has seen a decline of 24.4% during the same timeframe.

Image Source: Zacks Investment Research

From a valuation standpoint, Cogent is currently assessed as overvalued, with a Value Score of F, whereas LUMN boasts a Value Score of A.

Examining Price-to-Book ratios, LUMN is trading at 6.78X, which is lower than CCOI’s 11.41X.

Image Source: Zacks Investment Research

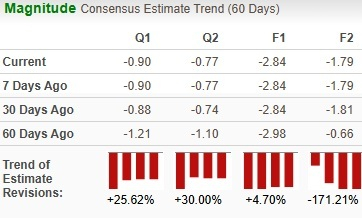

Analyst Estimates for LUMN & CCOI

Recent analyst revisions indicate a positive outlook for CCOI, with earnings estimates significantly increased for the company’s bottom line.

Image Source: Zacks Investment Research

Conversely, there have been no changes to LUMN’s earnings estimates.

Lumen Technologies vs. Cogent Communications: Investment Insights

Both Lumen Technologies, Inc. (LUMN) and Cogent Communications Holdings, Inc. (CCOI) hold a Zacks Rank #3 (Hold). For a detailed view of today’s Zacks #1 Rank (Strong Buy) stocks, you can see here.

Investment Opportunities Evaluated

While both companies are working to expand their presence in the enterprise fiber market, Lumen currently presents a stronger investment case. Lumen’s strategic shift towards AI infrastructure, combined with partnerships with major technology firms, positions it favorably despite ongoing debt concerns. In contrast, Cogent has been facing hurdles, including a declining net-centric segment and a lack of diverse product offerings, making it more susceptible to competitive pressures.

Despite its attractive valuation, Lumen (LUMN) stands out as the preferable option over Cogent (CCOI) at this time. Both companies share a similar Zacks Rank; however, the underlying fundamentals favor Lumen’s prospects more significantly.

Stock Recommendations for Future Gains

Investors might want to consider five stocks that have been identified by Zacks experts as having the potential to double in value. These selections have previously yielded impressive returns, with variations as high as +143.0%, +175.9%, +498.3%, and +673.0%.

Many of the stocks highlighted in this report are currently overlooked by Wall Street, offering an opportunity for early investment. To learn more about these five potential high performers, click here.

For the latest stock recommendations from Zacks Investment Research, you can download the report on the 7 Best Stocks for the Next 30 Days. To access this free report, click here.

Check out free stock analysis reports for:

- Microsoft Corporation (MSFT): Free Stock Analysis report

- Cogent Communications Holdings, Inc. (CCOI): Free Stock Analysis report

- Lumen Technologies, Inc. (LUMN): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.