Intel’s Earnings Preview: Q1 2025 Revenue and Challenges Ahead

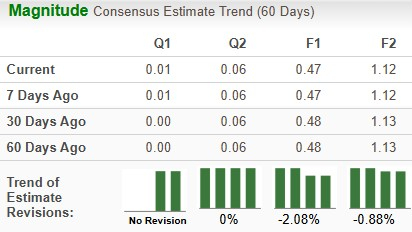

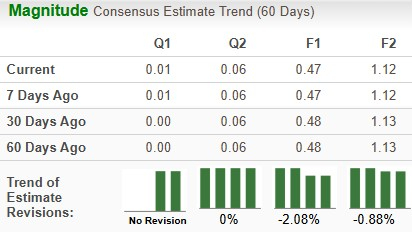

Intel Corporation (INTC) will announce its first-quarter 2025 earnings on April 24, just after trading closes. According to the Zacks Consensus Estimate, Intel’s expected sales stand at $12.32 billion, with predicted earnings of $0.01 per share. In the past two months, analysts have slightly lowered their forecasts for Intel, with 2025 estimates now at $0.47 per share, down from $0.48, and 2026 earnings expectations reduced from $1.13 per share to $1.12.

INTC Estimate Trends

Image Source: Zacks Investment Research

Recent Earnings Surprise History

Intel, a leading player in the semiconductor industry, has faced significant challenges recently. The company has reported an average earnings surprise of negative 366.64% over the past four quarters, only beating estimates twice. In the latest quarter reported, Intel’s earnings surprise was positive at 8.33%.

Image Source: Zacks Investment Research

Earnings Whispers: Predictions for Q1

Current analysis suggests that Intel is likely to exceed earnings expectations this quarter. Positive earnings surprise predictions, or ESP, combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold), enhance the likelihood of an earnings beat. Intel presently holds an ESP of +400.00% and a Zacks Rank of #3, which supports ongoing optimism in market observations.

For more financial insights, check out the Zacks earnings calendar for upcoming market news.

Factors Influencing Upcoming Results

Intel is expanding its reach in the AI sector, recently launching the Intel AI Edge Systems, Edge AI Suites, and Open Edge Platform software. These solutions aim to simplify AI integration across various industries, such as manufacturing and smart cities. Additionally, Intel introduced the Xeon 6 processors, engineered to meet the soaring demands of AI workloads while also unveiling the Intel Core Ultra processors for enhanced mobile computing performance.

Moreover, Intel has onboarded two new defense customers through the U.S. Government’s initiative, which is expected to positively affect future outcomes. However, the company still faces substantial competition from NVIDIA Corporation (NVDA), especially with its successful H100 and Blackwell GPUs, as well as Advanced Micro Devices, Inc. (AMD) in the commercial PC market.

Despite witnessing traction in AI, Intel continues to experience falling trends in its Client Computing Group (CCG) due to inventory adjustments and macroeconomic pressures. The Zacks Consensus Estimate for CCG revenues is set at $6.85 billion, while projections indicate a modest decline of about 8.5% year over year. Furthermore, the Datacenter and AI Group (DCAI) predictions mirror a slowdown with estimates around $2.96 billion, also anticipating a 2.4% decline from the previous year.

Intel faces another hurdle in China, its largest market, as the country intensifies efforts to reduce dependence on Western technology, aiming to phase out foreign semiconductors by 2027.

INTC’s Price Performance

Over the past year, Intel shares have declined by 45%, contrasting sharply with the industry average growth of 10.3%, and trailing behind competitors like NVIDIA and AMD.

Image Source: Zacks Investment Research

Valuation Insights for Investors

When examining Intel’s valuation metrics, it appears relatively inexpensive compared to industry standards. The forward price-to-sales ratio for Intel stands at 1.51, notably below the industry average of 9.78 and trailing the stock’s historical mean of 2.58.

Image Source: Zacks Investment Research

Investment Considerations for INTC

Intel is a key player in the U.S. semiconductor landscape and is a long-standing partner of the Department of Defense. With the ongoing global geopolitical uncertainties, the U.S. is stressing semiconductor self-sufficiency, which could elevate Intel’s growth potential. Recently, Intel has also initiated plans to spin off its venture capital segment, Intel Capital, to focus on core operations and enhance liquidity.

Moving forward, Intel is diversifying its portfolio, emphasizing AI to support a range of applications from IT to gaming. The introduction of Intel Core Ultra processors promises improved scalability and energy efficiency, aimed at sectors like autonomous vehicles and industrial IoT, potentially solidifying partnerships with major PC manufacturers like Microsoft.

Intel Struggles to Compete in AI Market Against AMD and NVIDIA

Intel’s position in the rapidly evolving AI market faces challenges, particularly as it navigates competition from NVIDIA and AMD. While the company is making strategic moves to strengthen its AI capabilities, it must also contend with pressure on margins driven by stiff competition in the server, storage, and networking sectors. A significant concern for Intel is its dependence on the Chinese market, which exposes it to increasing tensions in Sino-U.S. trade relations. This situation could adversely affect its financial performance.

Additionally, Intel’s considerable debt levels may restrict its ability to generate sufficient cash flow, potentially hindering its capacity for innovation. As a result, these factors combined present a complex landscape for the company.

Strategic Directions Amidst Challenges

To establish a stronger position in the AI sector, Intel is implementing various strategic initiatives. The company is in the midst of an aggressive cost-cutting plan aimed at rebuilding a sustainable growth trajectory. Its efforts to streamline operations, enhance efficiency, and expand its presence in AI PCs, software, the Internet of Things (IoT), and Advanced Driver Assistance Systems (ADAS) suggest a positive outlook for the firm.

Despite these efforts, Intel holds a Zacks Rank of #3, indicating a neutral position. Prospective investors should proceed with caution as the company faces declining earnings estimates and a decrease in share price relative to its competitors—both signs of waning investor confidence.

Investment Opportunities on the Horizon

In a broader context, five stocks have been identified as having the potential to double in value. Each stock was selected by Zacks experts as leading candidates for substantial growth in 2024. While not every recommendation turns out to be a success, previous picks have reported significant gains—ranging from +143.0% to +673.0%.

Many of the stocks featured in this report are currently under the radar of Wall Street, offering a compelling opportunity for investors to enter before they potentially soar. Interested readers can explore these five high-potential candidates.

If you want the latest recommendations from Zacks Investment Research, consider downloading their report on the 7 Best Stocks for the Next 30 Days.

For more detailed analysis, free reports are available for:

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.