Trump Media’s Stock Surges Following New ETF Partnership

Trump Media & Technology Group Corp. DJT has experienced a significant rally, gaining over 25% in just five days. This surge follows a highly publicized partnership with Crypto.com and Yorkville America Digital. The Stock also saw a pre-market increase of more than 5.30% on Wednesday.

The collaboration aims to launch a suite of “America-First” ETFs, generating renewed interest from investors.

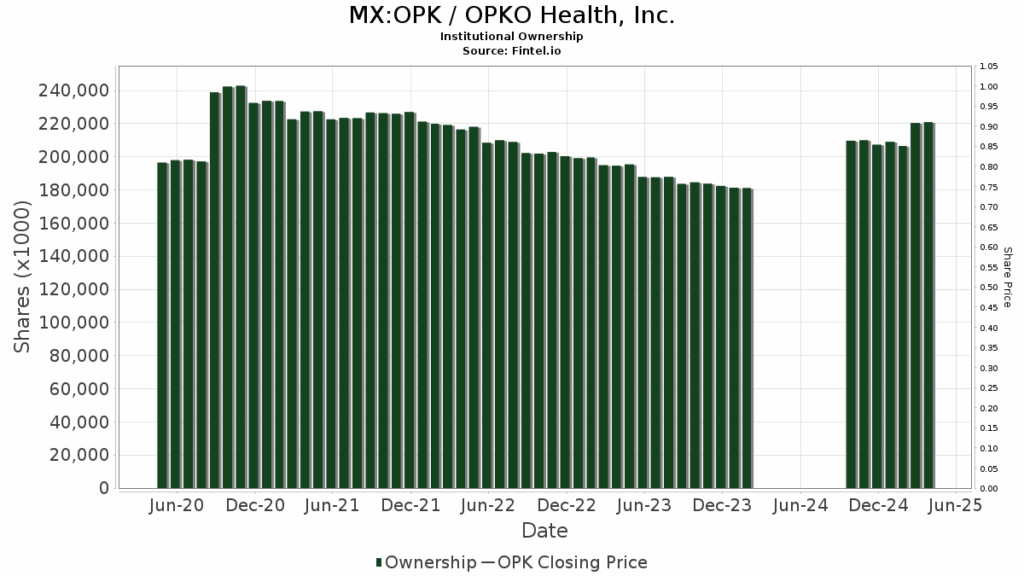

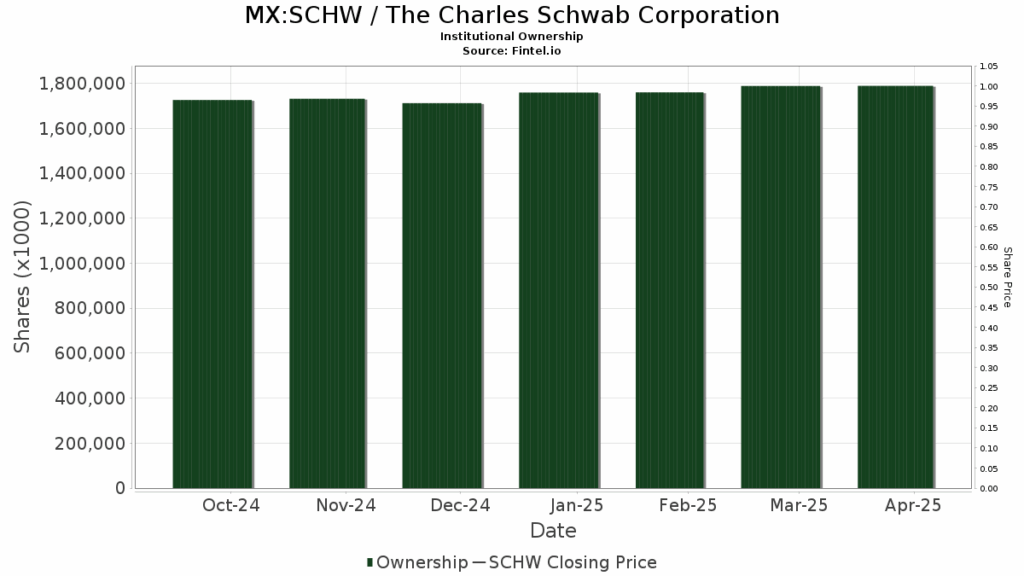

Now that the deal is finalized, the company, owned by President Donald Trump, is pushing the Truth.Fi brand into the FinTech sector. The ETFs will be diversified across digital assets and traditional American industries. This initiative forms part of a considerable $250 million investment, with assets to be held by Charles Schwab and distributed globally through Crypto.com’s broker-dealer, Foris Capital.

While the America-first narrative appeals to Make America Great Again (MAGA) traders, a deeper analysis reveals a more complex picture.

Read also: As MAGA, YALL ETFs Gain Traction, Trump Media Unveils ‘Values-Based’ Investment Accounts

Chart created using Benzinga Pro

Short-Term Outlook Shows Strength

Currently, DJT’s price action indicates a bullish trend. The Stock is performing well above its five, 20, and 50-day exponential moving averages, reflecting strong short-term buying pressure.

Its eight-day simple moving average stands at $21.31, notably lower than DJT’s current price of $24.80. Similar trends appear in the 20-day ($19.93) and 50-day ($22.24) simple moving averages, suggesting robust bullish signals.

Technical Indicators Signal Caution

However, a closer examination reveals potential vulnerabilities. The Moving Average Convergence Divergence (MACD) sits at 0.23 due to recent gains. Additionally, the 200-day simple moving average, positioned at $27.32, remains above DJT’s current price, indicating that it hasn’t fully escaped a broader downtrend.

Moreover, the Relative Strength Index (RSI) is at 64.78, nearing the overbought territory—indicating heat but not overwhelming demand. This suggests that while there may still be upward movement, the momentum could slow without additional catalysts.

Transitioning to Financial Products

The entry into ETFs represents a notable strategic pivot for Trump Media. CEO Devin Nunes indicated this is the beginning of a broader transformation into fintech, with Truth.Fi also launching separately managed accounts (SMAs) alongside the ETF offerings.

If successful, this transition could shift the company from a landscape of political volatility to one of financial credibility, although this remains speculative for the time being.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs