Tesla’s First-Quarter Performance Misses Expectations, Earnings Drop

Electric vehicle (EV) leader Tesla (TSLA) reported its first-quarter earnings for 2025, showing a disappointing earnings per share (EPS) of 27 cents. This figure fell short of the Zacks Consensus Estimate of 44 cents and marked a decrease from the previous year’s EPS of 45 cents. Furthermore, Tesla posted total revenues of $19.33 billion, which also missed the consensus expectation of $21 billion and represented a 9% decline year over year.

Despite these results, Tesla’s shares rose over 5% in after-hours trading. The company remains focused on initiating production of more affordable vehicles within the first half of the year and reaffirmed plans for the Cybercab to begin volume production in 2026. Additionally, Tesla is on track to pilot its Robotaxi service in Austin by June. However, global tariff issues and uncertainties related to the company’s China operations have led Tesla to reconsider its 2025 delivery volume guidance in the upcoming second-quarter update.

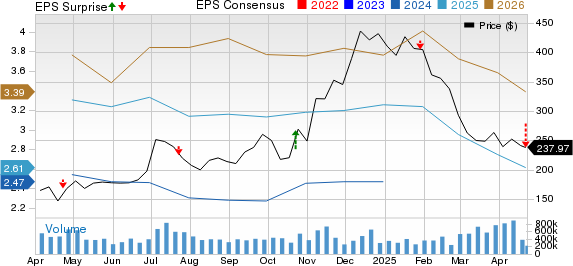

Tesla, Inc. Price, Consensus and EPS Surprise

Tesla, Inc. price-consensus-eps-surprise-chart | Tesla, Inc. Quote

Key Takeaways from Tesla’s Report

In the first quarter, Tesla produced a total of 362,615 vehicles (345,454 Model 3/Y and 17,161 from other models), which represents a 16% decrease year over year and missed our estimate of 426,407 units. The company delivered 336,681 vehicles, a 13% year-over-year decline that also fell short of our expectation of 409,584 units. Deliveries of the Model 3/Y totaled 323,800 vehicles, down 12% from the previous year and below our projected 389,255 units.

The company’s total automotive revenues were approximately $14 billion, down 19.6% year over year and below our estimate of $18.4 billion. This figure included $595 million earned from the sale of regulatory credits for electric vehicles—an increase of 34.6% year over year. Excluding leasing and regulatory credits, automotive sales amounted to $12.92 billion, missing our projection of $17.5 billion due to lower-than-expected deliveries. Automotive gross profit, after accounting for leasing and regulatory credits, was reported at $1.46 billion, with an automotive gross margin of 11.3%, down from 15.5% reported in the first quarter of 2024.

Tesla’s operating margin also decreased, dropping 343 basis points from the previous year to 2.1%, significantly missing our estimate of 7.5%. (Find the latest earnings estimates and surprises on Zacks earnings Calendar.)

Energy Generation and Storage revenues reached $2.73 billion in the first quarter of 2025, a 67% increase year over year but also falling short of our $3 billion estimate. Energy storage deployments registered at 10.4 GWh. Revenue from services and other segments was $2.64 billion, up 15% year over year, yet this figure did not meet our $3 billion estimate. By the end of the first quarter, Tesla had 67,316 Supercharger connectors installed.

Financial Overview

As of March 31, 2025, Tesla reported cash and cash equivalents totaling $37 billion, a slight increase from $36.5 billion at the end of 2024. Its long-term debt, net of the current portion, decreased to $5.3 billion from $5.7 billion as of December 31, 2024.

In terms of cash flow, net cash provided by operating activities was $2.1 billion for the first quarter, down from $4.8 billion in the same period last year. Capital expenditures were reported at $1.5 billion during the quarter. Free cash flow generated in this quarter was $664 million, a substantial decline compared to $2.8 billion generated in the fourth quarter of 2024. Tesla currently holds a Zacks Rank #5 (Strong Sell).

For further insights, you can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Updates from the Automotive Sector

Genuine Parts Company (GPC) reported adjusted earnings of $1.75 per share, beating the Zacks Consensus Estimate of $1.66 but down from last year’s figure of $2.22 per share. Net sales reached $5.87 billion, surpassing the consensus estimate of $5.82 billion with a slight year-over-year increase of 1.4%.

As of March 31, 2025, Genuine Parts had cash and cash equivalents of $420.4 million, down from $490 million at year-end 2024. Long-term debt increased to $3.78 billion from $3.74 billion as of December 31, 2024. The company projects revenue growth of 2-4% for both its automotive and industrial segments in 2025, slightly higher than the 1.6% growth reported in 2024.

Autoliv Inc. (ALV) announced adjusted earnings of $2.15 per share, exceeding the Zacks Consensus Estimate of $1.72 and marking a 37% increase year over year. The company’s net sales for the quarter were $2.58 billion, surpassing the consensus expectation of $2.47 billion despite a year-over-year decline of 1.4%. As of March 31, 2025, Autoliv reported cash and cash equivalents of $322 million and long-term debt of $1.57 billion.

Autoliv maintains its guidance for 2025, expecting organic sales growth of around 2%, up from 0.4% reported in 2024. The adjusted operating margin is projected to fall within the range of 10-10.5%, with anticipated operating cash flow of $1.2 billion for the year.

Discover the Best Stocks for the Coming Month

Experts have compiled a list of 7 top-performing stocks from the current collection of 220 Zacks Rank #1 Strong Buys, which they consider “Most Likely for Early Price Pops.”

Since 1988, these selections have outperformed the market more than twice, averaging a gain of +23.9% annually. It’s advisable to take a closer look at these carefully selected stocks.

To receive the latest recommendations from Zacks Investment Research, you can download the report on the 7 Best Stocks for the Next 30 Days. Click to access this free report.

Genuine Parts Company (GPC): Free Stock Analysis report

Autoliv, Inc. (ALV): Free Stock Analysis report

Tesla, Inc. (TSLA): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.