Two Stocks to Consider for Strong Momentum on April 23

Today, April 23, investors may want to consider two stocks exhibiting a buy rank and notable momentum:

Casella Waste Systems, Inc. (CWST)

Casella Waste Systems, Inc.: This integrated solid waste services firm holds a Zacks Rank of #1. Over the last 60 days, the Zacks Consensus Estimate for its current year earnings rose by 4.3%.

Casella Waste Systems, Inc. Price and Consensus

Price-Consensus Chart for Casella Waste Systems, Inc. | Company Quote

Over the last three months, Casella Waste Systems’ shares increased by 8.3%, in contrast to the S&P 500’s decline of 13.3%. The company’s Momentum Score stands at A.

Casella Waste Systems, Inc. Current Price

Current Price of Casella Waste Systems, Inc. | Company Quote

Phio Pharmaceuticals Corp. (PHIO)

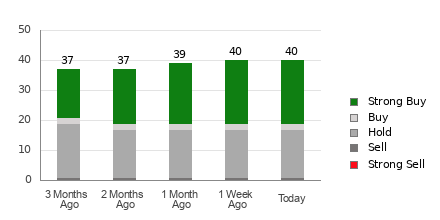

Phio Pharmaceuticals Corp.: This immuno-oncology biotech company also features a Zacks Rank of #1. Its Zacks Consensus Estimate for current year earnings climbed 14.4% in the past 60 days.

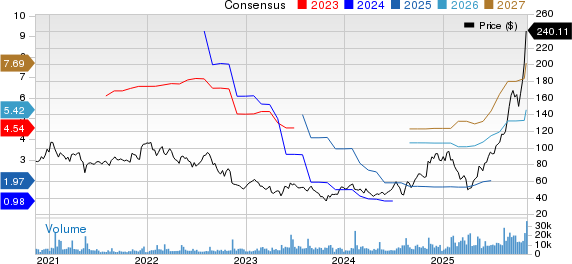

Phio Pharmaceuticals Corp. Price and Consensus

Price-Consensus Chart for Phio Pharmaceuticals Corp. | Company Quote

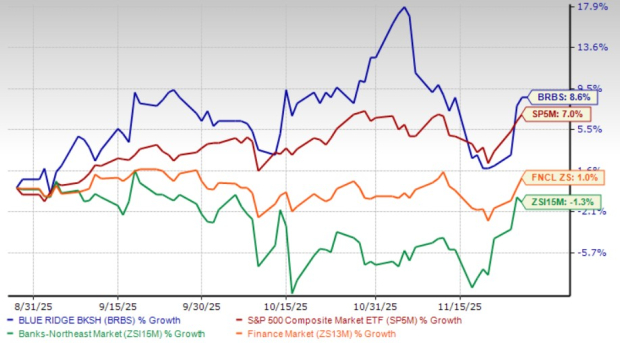

The shares of Phio Pharmaceuticals appreciated by 13.6% over the past three months, contrasting with the S&P 500’s decrease of 13.3%. It also has a Momentum Score of A.

Phio Pharmaceuticals Corp. Current Price

Current Price of Phio Pharmaceuticals Corp. | Company Quote

For a broader view, check the complete list of top-ranked stocks here.

Find out more about the Momentum Score and its calculations.

7 Best Stocks for the Next 30 Days

Expert analysts have identified seven elite stocks from the current pool of 220 Zacks Rank #1 Strong Buys. They consider these stocks as “Most Likely for Early Price Pops.”

Since 1988, this selection has outperformed the market by more than double with an average yearly gain of +23.9%. It is advisable to focus on these handpicked stocks.

View the recommendations now >>

Casella Waste Systems, Inc. (CWST): Free Stock Analysis Report

Phio Pharmaceuticals Corp. (PHIO): Free Stock Analysis Report

This article originally appeared on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.