Apple’s $695 Billion Buyback Strategy Boosts Shareholder Value

Stock buybacks, or share repurchases, are prevalent in financial news. These occur when companies buy their own shares on the market and retire them, effectively reducing the total number of shares outstanding. This strategy is one of the most common ways for companies to utilize profits to generate value for shareholders. By lowering the share count, companies can increase per-share revenue and earnings, often leading to a higher stock price.

The Motley Fool analyzed which companies have invested the most in buybacks, revealing that several industry leaders, referred to as the “Magnificent Seven,” dominated in 2024.

Top Buyback Performer: Apple Inc.

Apple (NASDAQ: AAPL) leads the buyback charge, having allocated over $695 billion to buybacks over the past ten years—far exceeding its competitors.

Impact of Buybacks on Investor Returns

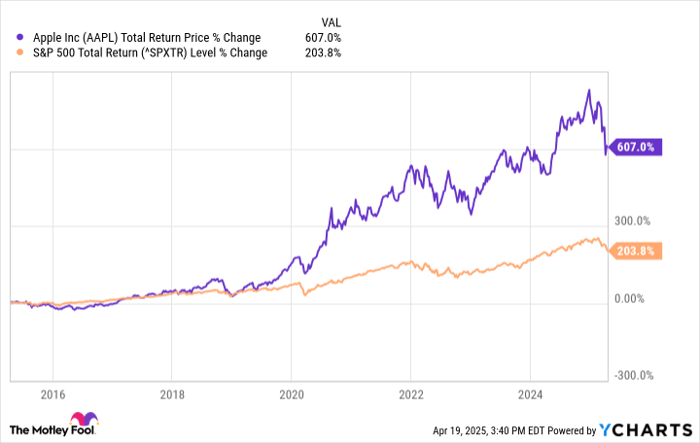

Over the past decade, Apple’s buyback strategy has significantly enhanced its performance relative to the S&P 500. This can largely be attributed to its substantial investment in buybacks.

AAPL Total Return Price data by YCharts.

At the end of fiscal year 2015, Apple’s diluted share count stood at 5.8 billion. Following a 4-for-1 stock split in 2020, this translates to about 23.2 billion shares today. By the end of fiscal year 2024, the number of shares decreased to approximately 15.4 billion. This reduction signifies that Apple’s buybacks lowered its diluted share count by 33.5% over the decade.

For 2024, Apple reported a net income of $93.7 billion, resulting in diluted earnings per share (EPS) of $6.08. Without the buybacks, the diluted EPS would have been merely $4.04, suggesting that the stock price would be significantly lower without this strategic initiative.

Why Apple’s Buyback Capacity Stands Out

Apple’s unique business model allows it to implement a substantial buyback strategy compared to many other companies. It benefits from an extensive global supply chain that facilitates cost-effective manufacturing of its products, alongside a powerful brand that enables it to sell these products at high margins. Additional high-margin revenue streams from subscription services and App Store fees further bolster its financial capabilities.

With approximately 25% of revenue converted to free cash flow and a remarkable return of more than 56% on invested capital, Apple’s financial strength is notable, particularly with nearly $400 billion in annual revenue:

AAPL Revenue (TTM) data by YCharts; TTM = trailing 12 months.

Warren Buffett, a renowned investor and CEO of Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), has expressed admiration for Apple, identifying it as the largest holding in Berkshire Hathaway’s portfolio and referring to it as the best business the company owns.

Risks of Relying Too Heavily on Buybacks

Despite Apple’s successes, investors must remain vigilant. Buybacks alone shouldn’t be the sole reason to invest in a company. Criticism directed at Apple indicates that organic growth has slowed in recent years, with management facing challenges in implementing artificial intelligence features in its products. This raises questions about whether Apple should invest more significantly in research and development to foster innovation.

While Apple possesses the potential to regain its momentum, this scenario serves as a reminder that even leading firms must continuously innovate and push their boundaries to remain competitive.

Should You Invest in Apple Now?

Potential investors should consider the following before buying Apple stock:

The Motley Fool Stock Advisor analyst team has identified their list of the 10 best stocks to buy now, with Apple not included. This list contains stocks that are anticipated to deliver substantial returns in the coming years.

For instance, consider Netflix, which was recommended on December 17, 2004: an initial investment of $1,000 would be worth $561,046 today! Or Nvidia, listed on April 15, 2005: an initial investment of $1,000 would now be worth $606,106!

Additionally, Stock Advisor’s total average return is 811%, which greatly outperforms the S&P 500’s 153%.

*Returns as of April 21, 2025

Justin Pope holds no position in the companies mentioned. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway. The Motley Fool’s disclosure policy applies.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.