Corteva, Inc. Set to Report Q1 Earnings—Analysts Anticipate Flat Growth

Based in Indianapolis, Indiana, Corteva, Inc. (CTVA) specializes in seed and crop protection solutions, playing a crucial role in the agriculture sector and food supply chain. The company’s current market capitalization stands at $41.4 billion. Corteva offers a range of agricultural products including seeds, crop protection solutions, and digital services. Analysts expect the company to announce its fiscal Q1 2025 earnings following the market close on Wednesday, May 7.

Earnings Expectations and Performance History

Analysts forecast that CTVA will report earnings of $0.87 per share on a diluted basis, marking a 2.3% decline from $0.89 per share in the same quarter last year. Recently, Corteva has demonstrated mixed performance: beating consensus estimates in two of the last four quarters while falling short on two occasions.

Full-Year Projections

Looking ahead, industry experts predict that CTVA’s earnings per share (EPS) will be $2.98 for the full fiscal year, reflecting a 16% increase from the $2.57 reported in fiscal 2024. Furthermore, EPS is anticipated to rise 14.4% year-over-year to reach $3.41 in fiscal 2026.

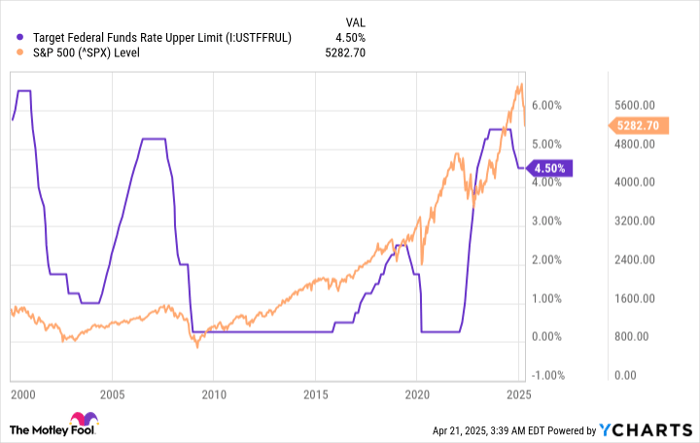

Stock Performance and Market Comparison

Corteva’s stock has outpaced the S&P 500’s gains of 6% over the past year, experiencing a 10.7% increase. In contrast, the Materials Select Sector SPDR Fund (XLB) has seen a decline of 7.7% during the same timeframe.

Recent Financial Results

On February 5, CTVA shares dropped more than 2% after the company released its Q4 results. Its adjusted EPS of $0.32 fell short of Wall Street’s expectation of $0.34. However, Corteva did report revenue of $3.98 billion, surpassing estimates that projected $3.95 billion. The company anticipates full-year adjusted EPS to fall between $2.70 and $2.95, with revenue expected to land between $17.2 billion and $17.6 billion.

Analyst Ratings and Price Targets

The consensus among analysts remains optimistic, with an overall “Strong Buy” rating for CTVA stock. Out of the 21 analysts covering the stock, 14 recommend a “Strong Buy,” two suggest a “Moderate Buy,” and five advise a “Hold.” The average analyst price target for Corteva is set at $69.10, indicating a potential upside of 13.1% from current trading levels.

On the date of publication, Neha Panjwani did not have any positions—either directly or indirectly—in any of the securities mentioned in this article. All information and data are presented solely for informational purposes. For more details, please refer to the Barchart Disclosure Policy.

More news from Barchart

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.