Super Micro Computer Faces Decline Amid Broader Market Weakness

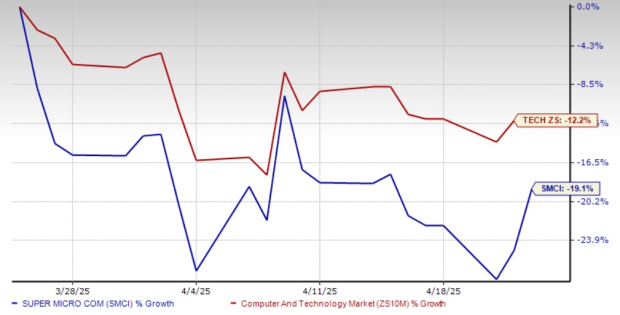

Super Micro Computer, Inc. (SMCI) has seen its shares fall 19.1% over the past month, significantly underperforming the tech sector, which declined by 12.2% during the same period.

The recent drop in Super Micro Computer’s stock is attributed to widespread market pressures. A substantial sell-off in technology stocks is largely driven by rising trade tensions and concerns about slowing economic growth, which have negatively impacted companies like Super Micro Computer.

This decline raises an important question: Should investors consider seizing the opportunity to buy SMCI shares at a lower price?

Super Micro Computer One Month Performance Chart

Image Source: Zacks Investment Research

Growth Driven by Data Center and Cloud Demand

Super Micro Computer’s growth is fueled by the increasing demand for artificial intelligence (AI) workloads. As the number of data centers rises and existing facilities expand, the need for SMCI’s high-performance, energy-efficient servers is on the rise.

The company’s liquid-cooled and modular servers have gained traction among cloud service providers, government agencies, and enterprises because they efficiently manage AI processes at scale. Recent partnerships with NVIDIA (NVDA) have enhanced SMCI’s capabilities, particularly through the integration of NVIDIA’s Blackwell GPUs, which provide high compute power.

In the emerging Direct Liquid Cooling (DLC) market, Super Micro Computer has shipped over 3,000 DLC racks in 2024, accounting for approximately 70% of the global market share. To meet growing demand, SMCI is rapidly expanding its production facilities in Malaysia, Taiwan, Europe, and the United States.

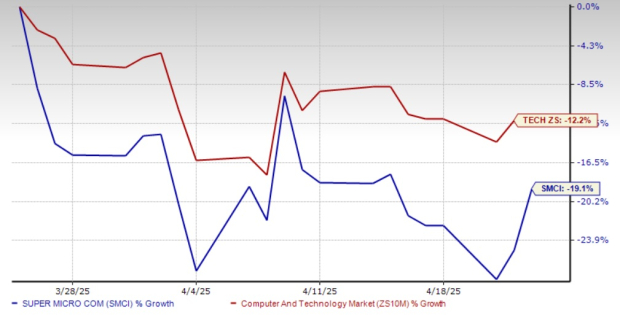

Looking ahead, Super Micro Computer expects to reach annual sales of $40 billion by fiscal 2026, projecting a 168% increase from its fiscal 2024 net sales of $14.94 billion. This indicates a robust revenue growth trajectory.

According to the Zacks Consensus Estimate, revenues for fiscal 2025 are expected to be $23.8 billion—a year-over-year increase of 59.2%. Similarly, the earnings consensus estimate for fiscal 2025 stands at $2.52, representing a 14% growth from the previous year.

Image Source: Zacks Investment Research

Leveraging Advanced Products for Continued Growth

Super Micro Computer is strategically focusing on high-performance systems tailored for AI tasks. In its product lineup, the company utilizes Intel (INTC) Gaudi 3 accelerators to facilitate scalable AI training and inference operations.

Moreover, SMCI incorporates Intel’s built-in accelerator technologies such as AMX, QAT, DSA, and IAA into its X13 Systems. The use of Advanced Micro Devices (AMD) accelerators also enhances performance for AI and data-intensive applications.

Among its offerings, Super Micro Computer’s H14 Series servers are powered by Advanced Micro Devices’ EPYC 9005 CPUs, while its GPU-Accelerated Systems feature AMD’s Instinct MI325X GPUs. This integration of products from NVIDIA, AMD, and Intel contributes to the reliability and performance of SMCI’s systems.

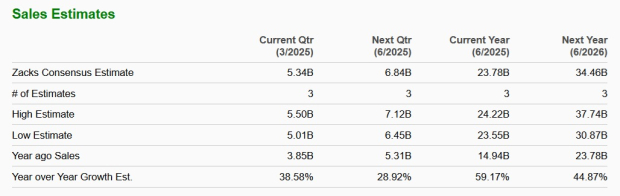

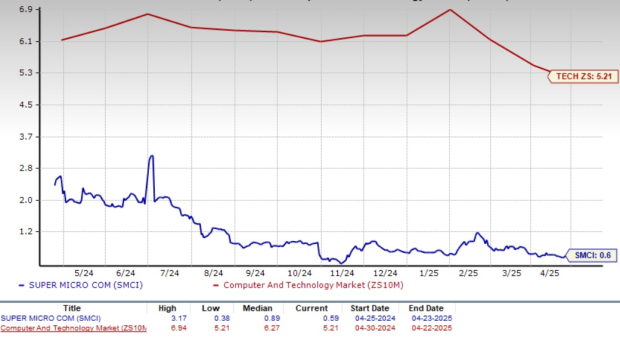

Valuation Insights: SMCI Stock Trades at a Discount

Currently, Super Micro Computer is trading at a notably low price-to-sales (P/S) ratio of 0.6X, which is significantly less than the Zacks Computer and Technology Sector’s average P/S ratio of 5.21X.

Image Source: Zacks Investment Research

Conclusion: Consider Buying Super Micro Computer Stock

Given its strong footing in the data center and cloud computing markets, Super Micro Computer stands poised to leverage its current momentum. The attractive valuation of SMCI stock presents a notable opportunity for investors seeking to enhance their portfolios amidst market fluctuations.