Applied Digital Faces Challenges but Offers Long-Term Growth Potential

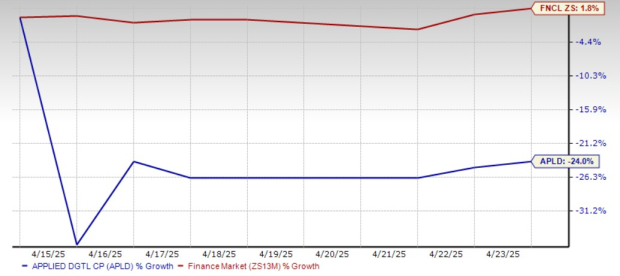

Applied Digital Corporation’s (APLD) shares have dropped 27.4% following the announcement of its third-quarter fiscal 2025 results on April 14, significantly underperforming the broader Finance sector, which declined by 4.1%. The company recorded a loss of 16 cents per share, exceeding the Zacks Consensus Estimate of an 11 cent loss. In contrast, APLD had earnings of 52 cents per share in the same quarter last year. Its revenues amounted to $52.9 million, falling short of the Zacks Consensus Estimate by 16.75%, largely due to a sequential decline in the Cloud Services segment.

This significant decline prompts investors to assess whether to sell or hold their positions in APLD stock. While immediate challenges persist, the company’s long-term growth narrative remains intact, suggesting it may be more beneficial to maintain holdings.

Reasons for APLD’s Stock Decline

The prolonged drop in its stock price following the earnings report can be attributed to poorer quarterly performance than anticipated. Additionally, increasing costs associated with sales and higher depreciation expenses from new facilities could keep pressure on the bottom line for the foreseeable future. Increased power costs have also negatively impacted the margins of its Data Center Hosting business during the fiscal third quarter.

The revenue shortfall is primarily linked to a 35.7% sequential decrease in sales from the Cloud Services division. This downturn stems from technical difficulties related to transitioning from single-tenant reserve contracts to a multi-tenant on-demand approach. Currently, APLD operates six GPU clusters, of which four remain under reserve contracts, while the other two have transitioned to the on-demand model. The company anticipates resolving these issues, leading to a stabilization in revenues in upcoming quarters.

Furthermore, the anticipated depreciation costs are likely to remain elevated as APLD enhances its infrastructure to support its High-Performance Computing (HPC) Data Center Hosting operations. Over the past year, the company has invested nearly $1 billion in assets, the majority allocated to building data centers. APLD currently maintains 286 megawatts of fully contracted data center hosting capacity, mainly serving Bitcoin miners, with additional construction underway for three new facilities, expected to increase total capacity by 700 megawatts by 2027.

While these new buildings could boost revenue growth in the next two years, APLD has yet to secure tenants for its expanded capacity. The first facility scheduled to be operational is the 400-megawatt Ellendale campus, projected to launch by 2025. Until lease agreements for new data centers materialize, the company’s near-term financial performance could remain under duress. However, a rebound in the Cloud Service segment may help alleviate some short-term pressures.

Financial Projections and Valuation

APLD’s revenue estimates for fiscal 2025 are pegged at $223.1 million, reflecting a 34.7% increase year-over-year. The Zacks Consensus Estimate suggests a loss of 99 cents per share, indicating a 24.4% year-over-year improvement.

The current market valuation indicates that APLD stock is priced at a premium, receiving a Value Score of F. Despite its recent plummet, APLD’s shares trade at a high forward 12-month price-to-sales (P/S) ratio in comparison to industry standards.

Long-Term Outlook for APLD

Even though APLD’s stock has faced significant declines this year, its current price may present a viable opportunity for investors. The company is venturing into a high-growth sector of high-performance computing, with ambitions to establish a capacity of 1.4 gigawatts over the coming years. The global high-performance computing market was valued at $48.51 billion in 2022, with projections suggesting a compound annual growth rate (CAGR) of 7.5% until it reaches $87.31 billion by 2030. The ability of HPC systems to process extensive data rapidly is prompting widespread adoption in sectors like academia, defense, energy, government, and utilities. Additionally, rising Bitcoin values and the growing integration of artificial intelligence may bolster APLD’s growth trajectory.

Also, Applied Digital plans to divest its Cloud Service business to concentrate on the HPC sector. This sale is expected to generate significant funds for further investments in its data center operations.

Consequently, APLD stands as a speculative investment with potential long-term rewards. The company could benefit from lower energy costs in North Dakota, although it must secure key lease agreements and attract high-profile hyperscaler clients to maximize its growth potential. For investors with a tolerance for risk, APLD’s early-stage growth and potential for large-scale expansion in HPC hosting may yield substantial gains.

The company’s strong partner network, encompassing Super Micro Computer (SMCI), Hewlett Packard Enterprise (HPE), Dell Technologies, and NVIDIA (NVDA), also positions it well for future collaborations. NVIDIA recently disclosed ownership of 7,716,050 shares in APLD, valued at $58.95 million as of December 31, 2024.

Conclusion: Hold APLD Stock for Now

In summary, while APLD’s share price has experienced volatility, the company’s long-term growth prospects suggest that holding onto shares may be a prudent strategy for investors willing to navigate the current challenges.

Company Faces Cloud Service Challenges With Outlook for Recovery

After experiencing a significant decline, the company may rebound as it resolves ongoing technical issues in its Cloud Service business. Nevertheless, margins are expected to remain under pressure. Given these factors, we recommend that investors maintain a Zacks Rank #3 (Hold) rating on this stock for now.

Zacks Identifies Top Semiconductor Stock

In the semiconductor industry, one stock stands out despite being only 1/9,000th the size of NVIDIA, which has surged more than +800% since we first recommended it. While NVIDIA continues to perform well, our newly identified top chip stock possesses considerable potential for growth.

This emerging semiconductor company demonstrates robust earnings growth and a broadening customer base. It is well-positioned to capitalize on the increasing demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Industry experts project that global semiconductor manufacturing will expand from $452 billion in 2021 to $803 billion by 2028.

For more insights and recommendations, explore our latest findings in the semiconductor market.

Latest Stock Analysis Reports

Investors can access free analysis reports on notable companies, including:

- NVIDIA Corporation (NVDA)

- Super Micro Computer, Inc. (SMCI)

- Hewlett Packard Enterprise Company (HPE)

- Applied Digital Corporation (APLD)

The insights presented in this article are derived from Zacks Investment Research.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.