Eni S.p.A Reports Q1 2025 Earnings: Earnings Beat Consensus but Revenues Decline

Eni S.p.A reported adjusted earnings of 92 cents per American Depository Receipt for the first quarter of 2025, surpassing the Zacks Consensus Estimate of 91 cents. However, this marks a decline from last year’s earnings of $1.04.

Total revenues for the quarter reached $24.2 billion, exceeding the Zacks Consensus Estimate of $22.3 billion, although this figure represents a decrease from $25.2 billion recorded in the same quarter a year prior.

The stronger-than-expected quarterly performance stemmed from increased natural gas price realizations. Nonetheless, these advantages were counteracted by reduced hydrocarbon production and lower margins in refining and biofuels.

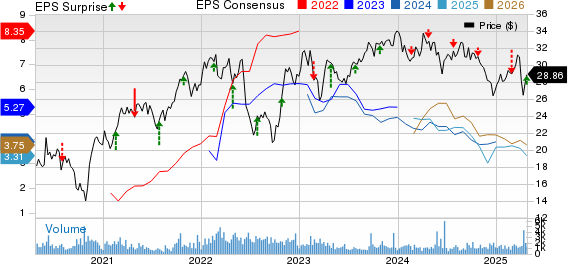

Eni SpA Price, Consensus and EPS Surprise

Eni SpA price-consensus-eps-surprise-chart | Eni SpA Quote

Operational Performance

Eni operates through four segments: Exploration & Production, Global Gas & LNG Portfolio and Power, Refining and Chemicals, and Enilive and Plenitude.

Exploration & Production

In the first quarter, Eni’s total oil and gas production was 1,647 thousand barrels of oil equivalent per day (MBoe/d), down 5% from 1,741 MBoe/d in the prior-year quarter.

Liquids production decreased to 786 MBbl/d, down 1% from 797 MBbl/d a year ago. Natural gas production fell to 4,502 million cubic feet per day (mmcf/d) compared to 4,937 mmcf/d in the previous year.

The average realized price for liquids was $69.72 per barrel, down 6% from $74.53 in the prior-year period. Conversely, the realized natural gas price increased by 8% to $7.57 per thousand cubic feet, up from $7.04.

The Exploration & Production segment faced challenges due to lower hydrocarbon production linked to asset divestitures completed in 2024, notably in Nigeria, Alaska, and Congo. However, projects ramping up in Côte d’Ivoire, Mexico, and Italy, along with reduced expenses, cushioned some negatives. The segment reported a pro-forma adjusted EBIT of €3.3 billion, down 2% from €3.4 billion in the first quarter of 2024.

Global Gas & LNG Portfolio and Power

Total worldwide natural gas sales for Eni in this quarter reached 12.12 billion cubic meters (bcm), representing a 22% decline year over year. The company attributed this drop to reduced wholesale gas sales in Italy and diminished sales in the European market, especially in Turkey.

The Global Gas & LNG Portfolio and Power segment reported a pro-forma adjusted EBIT of €473 million, marking a substantial 34% increase from €353 million a year prior.

Refining and Chemicals

In the first quarter, Eni’s total refinery throughput was 5.86 million tons (mmtons), lower than the 6.38 mmtons reported for the same period in 2024. Petrochemical product sales also saw a decline, dropping 7% year on year to 0.80 mmtons.

This segment recorded a pro-forma adjusted negative EBIT of €334 million, a decline from a negative €53 million reported a year earlier. The Refining segment was impacted by reduced throughput volumes and weaker refining margins globally. Additionally, the Chemicals segment encountered hurdles due to ongoing difficulties in the European market, driven by macroeconomic pressures and increased production costs compared to other regions.

Enilive & Plenitude

Retail gas sales managed by Plenitude fell by 7% year-over-year to 2.39 bcm. The company’s pro-forma adjusted EBIT for this segment decreased to €336 million, down from €426 million the previous year, impacted by lower margins in its biofuels business.

Financial Overview

As of March 31, Eni reported long-term debt of €20.1 billion and cash and cash equivalents amounting to €9.1 billion.

The net cash generated from operating activities in the reported quarter was €2.4 billion, whereas capital expenditures totaled €1.8 billion.

Outlook

In response to recent developments regarding trade tariffs, Eni has adjusted its 2025 capital spending guidance to below €8.5 billion, reduced from the previous estimate of approximately €9 billion. Oil and gas production for 2025 is anticipated to be around 1.7 million barrels of oil equivalent per day.

E’s Zacks Rank and Key Picks

Eni currently holds a Zacks Rank #3 (Hold).

In the energy sector, notable stocks include Archrock Inc. (AROC), Nine Energy Service (NINE), and Kinder Morgan, Inc. (KMI). Archrock has achieved a Zacks Rank #1 (Strong Buy), while both Nine Energy Service and Kinder Morgan carry a Zacks Rank #2 (Buy).

Kinder Morgan Increases Dividend Amidst Market Stability

In the first quarter of 2025, Kinder Morgan demonstrated its strong financial health by raising its quarterly cash dividend to 29.25 cents per share. This adjustment signals an approximate 2% increase compared to the same period last year, reflecting the company’s commitment to delivering reliable returns to its shareholders.

Stable Earnings and Returns

Amid ongoing price volatility in the market, Kinder Morgan has been able to achieve predictable earnings. This stability not only supports the company’s profitability but also enhances capital returns for its investors, reinforcing stakeholder confidence.

Market Outlook

The decision to increase dividends comes as Kinder Morgan continues to navigate fluctuations in industry pricing. The company’s established operational frameworks have positioned it effectively within a competitive landscape, allowing it to meet financial expectations consistently.

Shareholders and potential investors will likely keep a close eye on Kinder Morgan’s future performance and capital allocation strategies. The ongoing focus on generating stable cash flows remains a priority, which may further enhance its dividend growth going forward.

Overall, Kinder Morgan’s proactive measures and sound financial management contribute to its reputation as a reliable choice for income-driven investors.