Spotify Expects Strong Q1 2025 Earnings Growth Ahead of Report

Spotify Technology S.A. (SPOT) will report its first-quarter 2025 results on April 29, before the market opens.

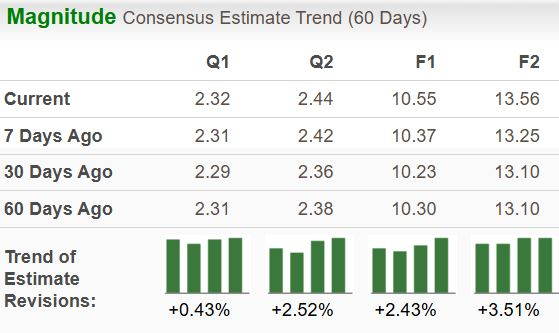

The Zacks Consensus Estimate for earnings in the upcoming quarter is $2.32 per share, reflecting an impressive 121% year-over-year growth. Expected revenues are pegged at $4.5 billion, a 13.3% increase compared to last year.

In the last 30 days, two earnings estimates have risen while one has declined. Additionally, the Zacks Consensus Estimate for 2024 earnings has increased by 1.3% during the same period.

< Image Source: Zacks Investment Research

< Image Source: Zacks Investment Research

Spotify’s earnings surprise history shows that it has exceeded the Zacks Consensus Estimate in two of the last four quarters, with an average positive surprise of 22%.

< Image Source: Zacks Investment Research

< Image Source: Zacks Investment Research

Earnings Predictions

Currently, our model does not ensure an earnings beat for Spotify this time. A combination of a positive earnings ESP (Earnings Surprise Prediction) and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) typically increases the chances of an earnings beat, but that is not the case for SPOT. Spotify’s earnings ESP currently stands at -8.61%, and it holds a Zacks Rank #3.

Factors Influencing Upcoming Results

The company’s growth in subscribers and monthly active users (MAU) is likely to boost revenue this quarter, positively impacting earnings. The consensus estimate for total MAUs is 678.3 million, which reflects a year-over-year growth of 10.3%. For ad-supported MAUs, the consensus stands at 426.4 million, also indicating a 10% increase. In addition, premium subscribers are expected to reach 265.41 million, marking an 11% year-over-year growth.

Stock Price Trends

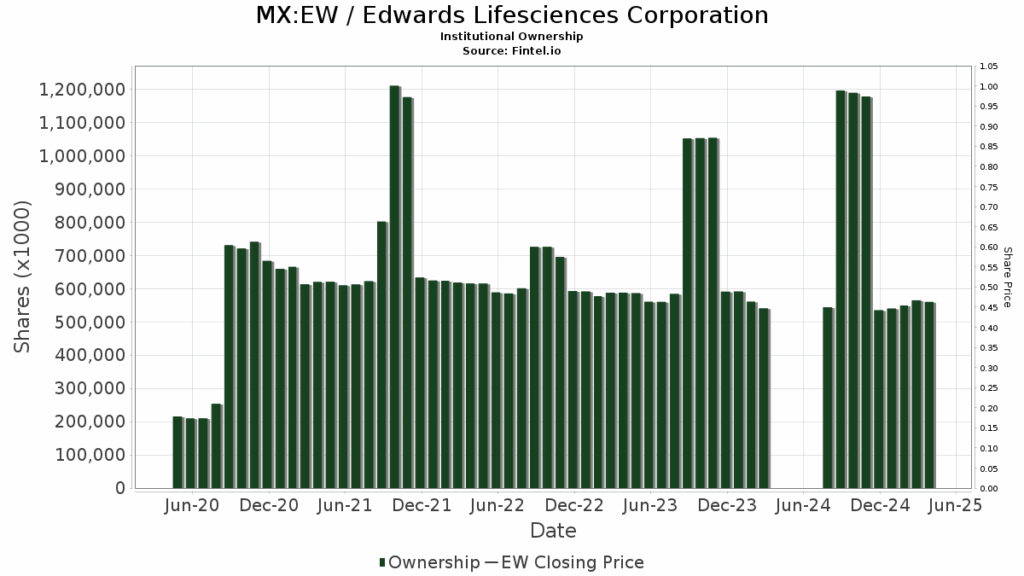

Year-to-date, SPOT has surged by 35%, with a 58% increase over the last six months and an impressive 109% rise over the past year. This positive price trend suggests that the stock is in a rally phase.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Investment Insights

Spotify continues to showcase strong performance metrics. This success is largely due to steady price increases, a loyal customer base, and significant cost reductions. These price adjustments have fueled both top-line and bottom-line growth, aided by the platform’s loyal user community and rising user adoption as shown by the uptick in MAUs and premium subscribers.

As a result, it is anticipated that Spotify will report another solid quarterly performance, driven by subscriber gains and increased Average Revenue Per User (ARPU), which would positively influence its bottom line and enhance the company’s balance sheet.

Similarly, various competitors in the music streaming space, such as Alphabet‘s GOOGL YouTube Premium, Apple’s AAPL Music/TV, and Amazon‘s AMZN Music Unlimited, have also raised their prices recently.

Conclusion

While Spotify’s current growth outlook appears strong, potential investors might consider a more cautious approach. The stock may experience corrections as signs indicate that an earnings beat is not likely. Despite this, the company’s long-term growth potential remains solid, making it an attractive stock to monitor for investment opportunities.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.