UBS Upgrades Philip Morris International to Neutral Amid Price Target Adjustments

Fintel reports that on April 25, 2025, UBS upgraded its outlook for Philip Morris International (XTRA:4I1) from Sell to Neutral.

Analyst Price Forecast Indicates Potential Downside

As of April 24, 2025, the average one-year price target for Philip Morris International is set at 138.81 €/share. This forecast varies, with estimates ranging from a low of 89.86 € to a high of 164.85 €. The average price target signifies a potential decrease of 7.08% from its latest closing price of 149.38 € per share.

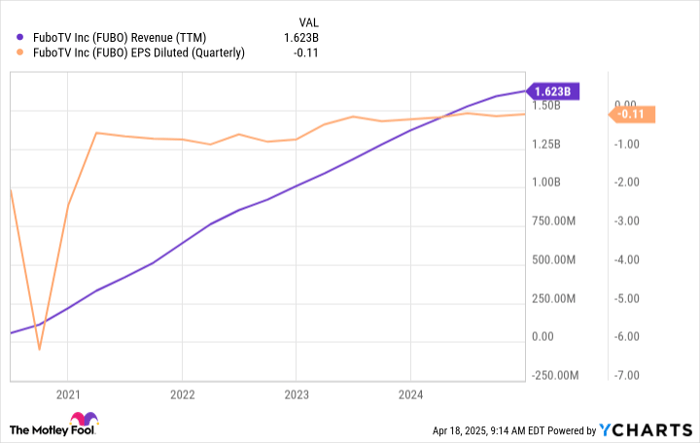

Projected Revenue and Earnings

Philip Morris International’s projected annual revenue stands at 41,241 million €, reflecting a 7.44% increase. Additionally, the expected annual non-GAAP EPS is 7.88.

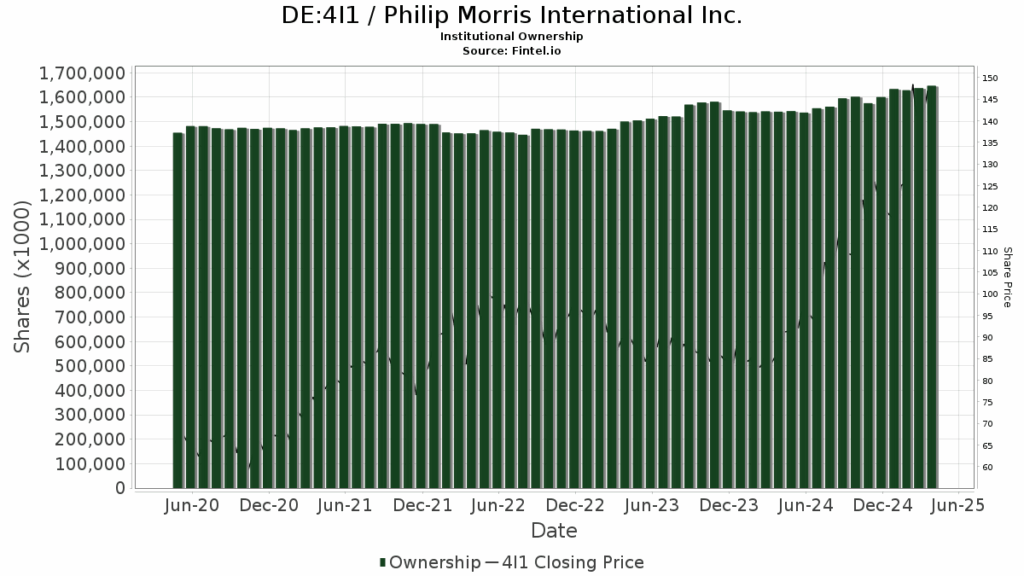

Fund Sentiment Overview

A total of 3,718 funds or institutions are currently reporting positions in Philip Morris International. This marks an increase of 272 owners, or 7.89%, over the last quarter. The average portfolio weight assigned to 4I1 by all funds has risen by 2.22% to 0.56%. As a result, total institutional shares owned have increased by 0.62% over the past three months, totaling 1,639,672K shares.

Institutional Shareholder Activity

Capital World Investors currently owns 122,584K shares, which represents 7.88% ownership of the company. In its prior filing, the firm reported 118,368K shares, reflecting an increase of 3.44%. This firm also raised its portfolio allocation in 4I1 by 0.54% over the last quarter.

In contrast, Capital International Investors holds 92,667K shares, representing 5.95% ownership. Previously, the firm reported owning 97,503K shares, indicating a decrease of 5.22%. Their portfolio allocation in 4I1 declined by 7.78% last quarter.

Capital Research Global Investors holds 50,846K shares for a 3.27% stake. Last filing, this firm owned 56,340K shares, marking a significant reduction of 10.81%. Their allocation in 4I1 decreased by 11.49% in the last quarter.

GQG Partners owns 48,747K shares, making up 3.13% of the company. They previously reported 42,654K shares, which is an increase of 12.50%. This firm has expanded its portfolio allocation in 4I1 by 7.29% over the last quarter.

Additionally, VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 48,733K shares, or 3.13% ownership. In their last filing, they owned 49,268K shares, a decrease of 1.10%. Their portfolio allocation in 4I1 also reduced by 3.37% last quarter.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.