Gold Prices Surge Amid Market Uncertainty—Is It Time to Invest?

Gold’s value dates back to humankind’s earliest years, establishing itself as a safe-haven asset that remains relevant today. Recent uncertainty in the Stock market has led to a significant increase in gold prices. Over the past year, gold, priced in U.S. dollars, has risen nearly 24%. When viewed over a longer term, gold’s value has gone up over 900% since the year 2000, outpacing the S&P 500 index’s 489% increase during the same period. Newmont Corporation (NYSE: NEM), the world’s largest gold mining company, has experienced a robust uptick of over 40% year-to-date.

Understanding Investments in Gold Mining Stocks

Investing in gold involves different approaches. When you purchase physical gold or a gold-backed ETF, you acquire a portion of the existing gold supply. Conversely, buying gold mining stocks, such as those of Newmont, gives you equity in the reserves—gold that is yet to be extracted. Beyond gold, Newmont also produces copper, silver, zinc, and lead.

Newmont’s global operations include mining projects it owns and directs, as well as those managed through partnerships and joint ventures. The company functions similarly to an oil drilling business, where financial performance relies on two main factors:

- The quantity of gold and other metals produced.

- The prevailing market prices for these metals.

The Cyclical Nature of Gold Prices and Its Investor Implications

Investors turn to gold for several reasons. Its historical value and limited supply make gold a popular hedge against inflation. Additionally, demand for gold typically rises during uncertain economic periods. Recent tariff announcements from the Trump Administration in early April have contributed to market apprehension, though some of these policies have since been retracted or paused.

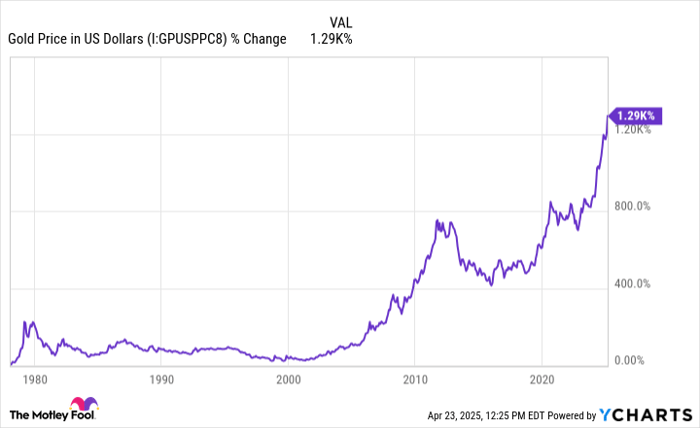

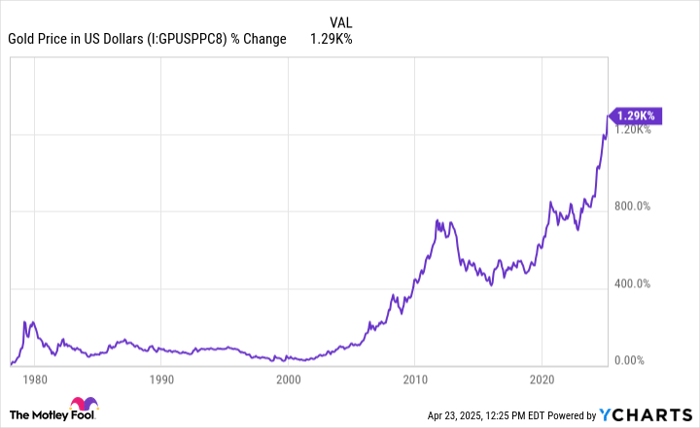

Gold prices have historically displayed boom-and-bust cycles. This pattern has been visible multiple times from the late 1970s to the present:

Gold Price in US Dollars data by YCharts

While the long-term trajectory for gold is upward, its reliability over extended periods is questionable. This explains why Newmont Corporation has returned a total of just 240% since 1989. The future remains uncertain, but past data indicate that merely buying and holding Newmont doesn’t guarantee substantial gains.

Investing timing can significantly impact potential returns.

Signs Indicate a Potential Peak in Gold Prices

Gold has surged in value over the past year, reaching unprecedented highs. However, predicting short-term asset prices is complex. There are indicators suggesting that gold may have reached or be approaching its short-term peak.

Market fear is palpable. The VIX index, which tracks expected Stock market volatility, recently hit its third-highest level on record. Simultaneously, the U.S. Index of Consumer Sentiment has dropped to nearly its lowest recorded values. Furthermore, data from Google Trends shows a spike in interest for searches related to “how to invest in gold” and “gold stocks.”

While gold is a tangible asset, it lacks an underlying business structure with earnings to support its value. Its worth is contingent on market dynamics. Therefore, moments of peak fear may align with a peak in gold demand and subsequently, gold prices.

Interestingly, Newmont Corporation appears to be undervalued. The Stock has a price-to-earnings ratio of just 15 times earnings, with the company reporting $3.48 per share last year due to rising gold prices. In contrast, it earned only $1.57 per share in 2023. This situation often indicates that cyclical stocks like Newmont are poorly timed for purchase while experiencing peak earnings. As gold prices decline, so too will the earnings.

While timing is always uncertain, current indicators suggest that Newmont Corporation might be closer to reaching its peak than its bottom. Thus, investing in the Stock may not be advisable at this moment.

Is Now the Right Time to Invest $1,000 in Newmont?

Before making a decision to invest in Stock in Newmont, consider the following:

The Motley Fool Stock Advisor analyst team identified what they consider the 10 best stocks to buy right now, and notably, Newmont is not included. The selected stocks could yield significant returns in the future.

For example, when Netflix made this list on December 17, 2004, if you invested $1,000 at our recommendation, you’d have $594,046!*

Or when Nvidia was on the list on April 15, 2005, a $1,000 investment would have grown to $680,390!*

It is also essential to note that Stock Advisor’s average return stands at 872%—an impressive outperformance compared to 160% for the S&P 500. To access the latest top 10 list, consider joining Stock Advisor.

*Stock Advisor returns as of April 21, 2025

Justin Pope has no positions in any of the stocks mentioned. The Motley Fool has no positions in any of the stocks referenced. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.