Three Undervalued Stocks to Consider Amid Long-Term AI Growth

Identifying strong investments in the stock market is essential for success, particularly during volatile times. Many investors show concern regarding short-term tariff impacts, but several stocks exhibit promising long-term potential. By focusing on future growth rather than immediate fluctuations, discerning investors can pinpoint lucrative opportunities.

Three Promising Stocks Down Over 30%

Currently, three companies—Nvidia (NASDAQ: NVDA), Taiwan Semiconductor (NYSE: TSM), and ASML (NASDAQ: ASML)—have declined more than 30% from their all-time highs and present solid buying opportunities. These firms illustrate a key segment of the AI chip value chain. As long as businesses continue to invest in AI technology, these stocks are likely to thrive.

Understanding the AI Chip Value Chain

Nvidia integrates chips from Taiwan Semiconductor into its GPUs (graphics processing units), which serve as primary computational units for AI hyperscalers. To manufacture these chips, Taiwan Semiconductor relies on specialized machines from ASML, specifically extreme ultraviolet (EUV) lithography machines. ASML holds a monopoly on EUV technology, reinforcing its engineering dominance.

As demand for Nvidia’s GPUs grows, so does the requirement for chips from Taiwan Semiconductor. This increased demand will necessitate more ASML EUV machines. Sustained growth in AI investment appears likely, indicating a favorable long-term trend.

At the 2025 GTC event, Nvidia CEO Jensen Huang predicted that data center buildouts will rise from approximately $400 billion in 2024 to $1 trillion by 2028. With Nvidia reporting $115 billion in total data center revenue over the past 12 months, the company currently captures nearly a third of this spending. Maintaining this market share could drive significant growth in the coming years.

Similarly, Taiwan Semiconductor’s CEO C.C. Wei forecasts a doubling of revenue from their AI-related chips by 2025. Over the next five years, they anticipate a compounded annual growth rate of 45% in AI-related revenue, which would be a remarkable feat.

Current Valuations of Key Stocks

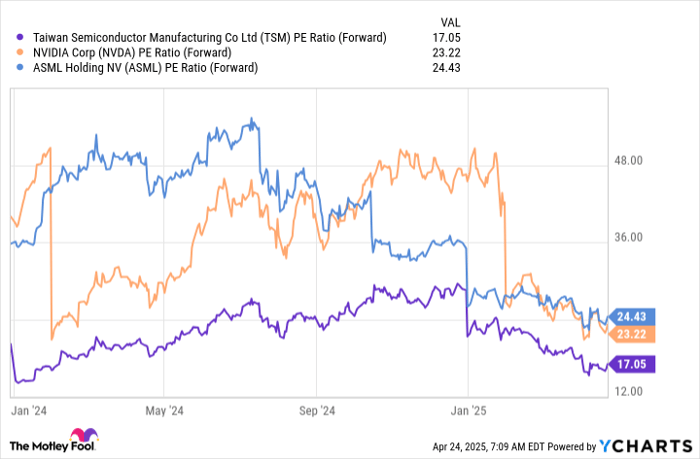

Despite their previous high valuations, these stocks have become more affordable following recent sell-offs.

TSM PE Ratio (Forward) data by YCharts

ASML, priced at 24.4 times forward earnings, stands as the priciest stock among the three. However, recent plans for ASML to repurchase up to 10% of its shares may enhance its attractiveness.

Nvidia, with a forward earnings ratio of 23, appears to be an excellent investment, given its growth trajectory.

Lastly, Taiwan Semiconductor presents a compelling value at current price levels, especially as the broader market trades around 19.8 times forward earnings. TSMC is expected to outperform the market, making this investment opportunity particularly appealing.

Long-Term Growth Remains Strong

While these stocks may currently face challenges, their long-term outlooks remain optimistic. Investors should consider capitalizing on these attractive valuations before they rebound.

Keithen Drury holds positions in ASML, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool also has positions in and recommends ASML, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily align with those of Nasdaq, Inc.