Equinix Set to Report Q1 Earnings Amid Optimistic Analyst Outlook

Valued at approximately $75 billion by market cap, Redwood City, California-based Equinix, Inc. (EQIX) specializes in global data center and digital infrastructure solutions. The company enables businesses to securely connect and optimize their digital operations through high-performance interconnection, colocation, and cloud services across various industries.

Upcoming Earnings Release

The tech giant is set to unveil its first-quarter results after the markets close on Wednesday, Apr. 30. Ahead of this event, analysts expect EQIX to report an adjusted funds from operations (AFFO) of $8 per share, reflecting a 9.7% decline from $8.86 per share reported in the same quarter last year. On a positive note, the company has consistently surpassed analysts’ AFFO expectations over the past four quarters.

Fiscal Outlook for 2025 and 2026

For the full fiscal 2025, EQIX is projected to deliver an AFFO of $33 per share, down 5.8% from $35.02 per share in fiscal 2024. However, analysts forecast a rebound in fiscal 2026, with AFFO expected to rise 8.2% year-over-year to $35.69 per share.

Stock Performance

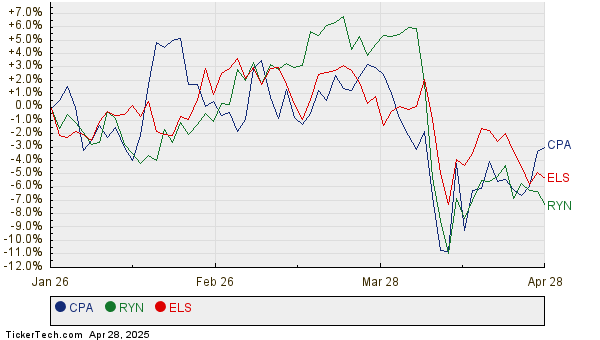

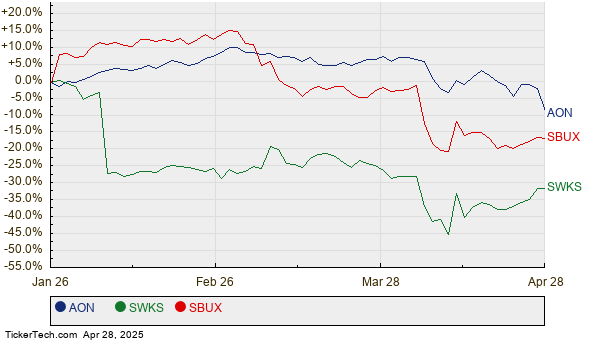

EQIX stock has soared 13.5% over the past 52 weeks, significantly outperforming the Technology Select Sector SPDR Fund’s (XLK) 5.5% gains and the S&P 500 Index’s ($SPX) 9.4% returns during the same period.

Recent Q4 Results

Following the release of its Q4 results on Feb. 12, EQIX stock prices dropped 1.3%. The company reported a 7.2% year-over-year revenue growth to $2.3 billion, slightly missing analysts’ expectations. However, it demonstrated effective cost management by reducing sales and marketing expenses while keeping general and administrative costs modest, leading to a notable expansion in EBITDA margin and an 11% increase in adjusted EBITDA to over $1 billion. Additionally, its AFFO of $7.92 per share exceeded consensus estimates by 12.5%.

Analysts’ Consensus and Price Target

The consensus view on EQIX remains strongly optimistic, with an overall “Strong Buy” rating. Among the 27 analysts covering the stock, there are 24 “Strong Buys,” one “Moderate Buy,” and two “Holds.” The mean price target of $1,021.19 suggests a 21.8% upside from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) any positions in the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.