NiSource Projected to Report Strong Q1 Earnings Amid Growth

With a market capitalization of $17.5 billion, NiSource Inc. (NI) is a regulated utility that serves almost 4 million customers across six states in the U.S. Headquartered in Merrillville, Indiana, the company focuses on upgrading its infrastructure, expanding service systems, and improving customer experience.

Upcoming Financial Results

NiSource is scheduled to release its first-quarter results before the markets open on Wednesday, May 7. Analysts anticipate the company will report an adjusted EPS of $0.89, reflecting a 4.7% increase from the $0.85 reported in the same quarter last year. NI has consistently exceeded expectations, outperforming Wall Street’s bottom-line projections for the past four quarters.

Annual Earnings Projections

For fiscal 2025, analysts forecast an adjusted EPS of $1.87, representing a 6.9% rise compared to the $1.75 reported for fiscal 2024. Looking ahead to fiscal 2026, earnings are expected to grow further, projecting an increase of 8% year-over-year to $2.02 per share.

Stock Performance Overview

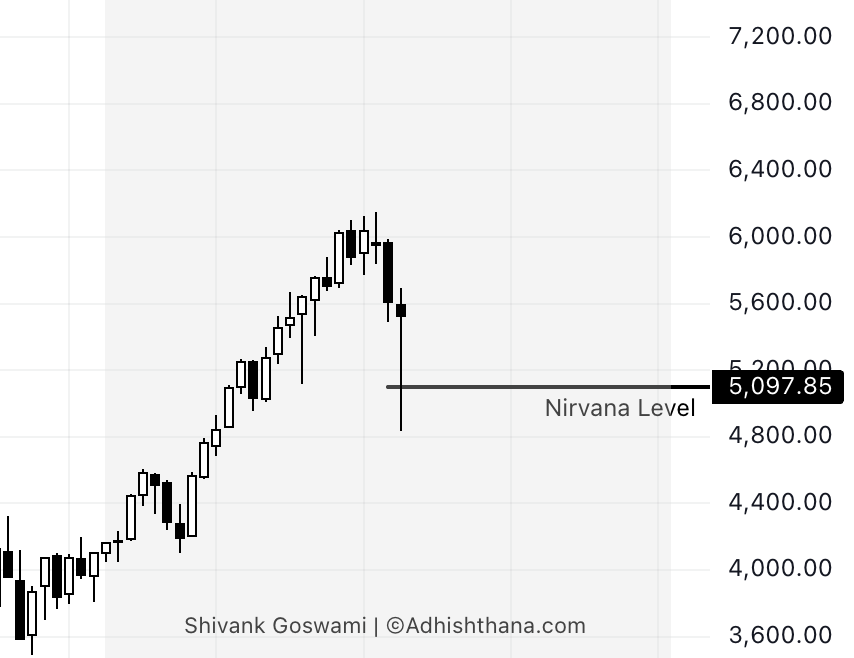

Over the past 52 weeks, NI stock prices have surged 40.4%, significantly outperforming the Utility Select Sector SPDR Fund’s (XLU) 16.9% gains and the S&P 500 Index’s ($SPX) 9.4% returns during the same period.

After announcing its better-than-expected Q4 results on February 12, NiSource’s stock price increased by nearly 1%. The company reported operating revenues of $1.6 billion for the quarter, an 11.3% year-over-year increase that exceeded analyst expectations of $1.45 billion. Moreover, its adjusted earnings reached $0.49 per share, surpassing consensus estimates by 4.3%. Following this positive news, NiSource’s stock maintained upward momentum for the next four trading sessions.

Analyst Ratings and Forecasts

Overall sentiment among analysts regarding NI stock remains highly positive, receiving a “Strong Buy” rating. Of the 15 analysts covering the stock, 14 advocate a “Strong Buy,” while one suggests a “Hold” rating. The mean price target stands at $42.64, indicating an 8.1% upside potential from current levels.

On the date of publication, the author did not have any positions in the securities mentioned. All information provided here is for informational purposes only. For more details, please refer to the Barchart Disclosure Policy here.

The views expressed in this article reflect those of the author and do not necessarily represent the opinions of any affiliated companies.